How Does Cryptocurrency Work? A Beginner’s Guide Blockchain Technology

6 December 2024

6 December 2024🔊 Listen to the Summary of this article in Audio

On October 31, 2008, Satoshi Nakamoto shared a document called Bitcoin: A Peer-to-Peer Electronic Cash System on a cryptography mailing list. In January 2009, Nakamoto launched the Bitcoin software as open-source, making it available for everyone to use and develop.

This development started a new discussion such as what cryptocurrency is, how it works, and why it’s such a big deal.

This article is here to help you understand everything. You’ll learn what cryptocurrency is, how it works, and why it’s changing the way people think about money. We’ll also explore how you can buy, store, and use cryptocurrencies, and whether they could be the right investment for you. So let’s begin.

What Is Cryptocurrency?

Cryptocurrency is a digital currency that exists only online. Unlike traditional currency, it isn’t controlled by a central bank. Instead, it runs on a technology called blockchain, which is managed by a community of users. This means you can use it directly without needing a bank or middleman.

Understand it like this; imagine you want to send money to a friend. With traditional currency, you might use a bank or a service like PayPal, and they act as the middleman to process the transaction. With crypto, you don’t need any middleman, it’s like handing cash directly to your friend, but digitally. The community verifies it through blockchain, not a bank. This makes it faster, more direct, and often cheaper.

As of November 2024, the global crypto market capitalization has reached approximately $3.2 trillion (Source), marking a significant milestone in the digital money landscape. Bitcoin has surged to an all-time high of over $93,000, contributing to its dominant position in the market. This growth underscores the increasing influence of cryptocurrencies in the global financial system. (Source)

What is Blockchain?

Imagine a group of friends who want to keep track of all the times they lend and borrow books from each other. Instead of trusting one person to record everything, they decide to use a special notebook. Every time someone lends a book, they write down the details in this notebook, and everyone gets a copy of the new entry. Once a page (or “block”) is full of entries, they seal it off in a way that can’t be changed and start a new page. Each new page references the one before it, forming a “chain” of pages. Because everyone has the same up-to-date notebook and old pages can’t be altered without everyone knowing, no one can cheat or change past records. This shared, secure notebook is like a blockchain — it allows everyone to have a trustworthy record of transactions without needing a central authority.

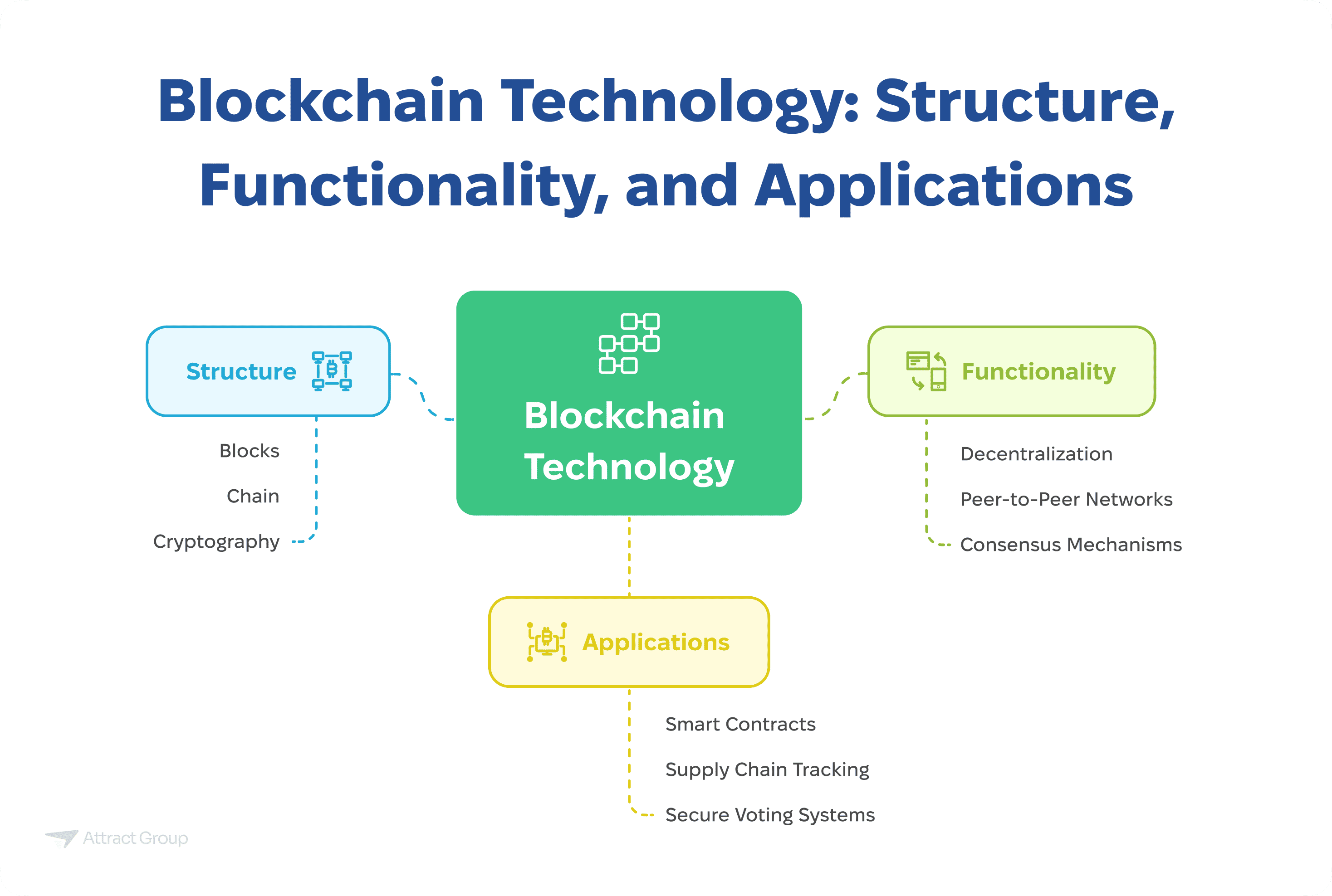

Blockchain is a digital ledger technology that allows information to be recorded securely and transparently across a network of computers without the need for a central authority. It works by grouping data into “blocks” that are linked together in a chronological “chain” using cryptographic techniques, making the data tamper-resistant. This decentralized system relies on peer-to-peer networks and consensus mechanisms like Proof of Work or Proof of Stake to validate transactions.

Programming languages such as C++, Solidity, Python, and JavaScript are commonly used to develop blockchain platforms and applications, enabling uses beyond cryptocurrencies, like smart contracts, supply chain tracking, and secure voting systems.

Our expert team specializes in custom blockchain solutions tailored to your unique business needs.

How Does Cryptocurrency Work?

Step 1: Initiating a Transaction

When you want to send a cryptocurrency like Bitcoin, you begin by entering the recipient’s public address and the amount into your digital wallet or D-Wallet. This address works like an email address but is specific to cryptocurrency. Once you confirm the details, your request is broadcast to the network.

Step 2: Broadcasting the Transaction to the Network

Your transaction is sent to a network of computers, known as nodes. These nodes operate in a decentralized system, meaning no single financial institution oversees or controls the network. This ensures transparency and removes the need for intermediaries like banks.

Step 3: Verification of Transactions

Nodes in the network work together to verify transactions using cryptographic algorithms. They check if:

- You actually own the digital asset you’re trying to send.

- The funds haven’t been spent already.

This is possible because every transaction is recorded on a ledger, known as the blockchain.

Step 4: Grouping Transactions into Blocks

Once verified, your transaction is bundled with others into a block. This block is like a page in the blockchain, containing the details of all recent transfers.

Step 5: Mining and Securing the Block

Miners are computers that solve complex mathematical puzzles to confirm the block’s validity. This process is called mining, and it ensures that no one can tamper with the transactions inside the block. Miners compete to solve the puzzle, and the first to succeed gets rewarded with new crypto tokens.

Step 6: Adding the Block to the Blockchain

After mining, the block is added to the blockchain. The blockchain is a secure, immutable ledger that records every transaction ever made. This provides transparency and ensures that everyone on the network can trust the data.

Step 7: Completion of the Transaction

Once the block is added to the blockchain, your transfer is complete. The recipient’s D-Wallet updates to reflect the new balance. Because of the blockchain’s design, this process is extremely secure, relying on encryption and cryptographic proof.

Step 8: Storing Your Cryptocurrency

Your cryptocurrency remains in your D-Wallet. It’s now ready to be used as a payment method, held as an investment, or transferred again. Wallets can be online, offline, or hardware-based, providing varying levels of security.

Types of Cryptocurrencies

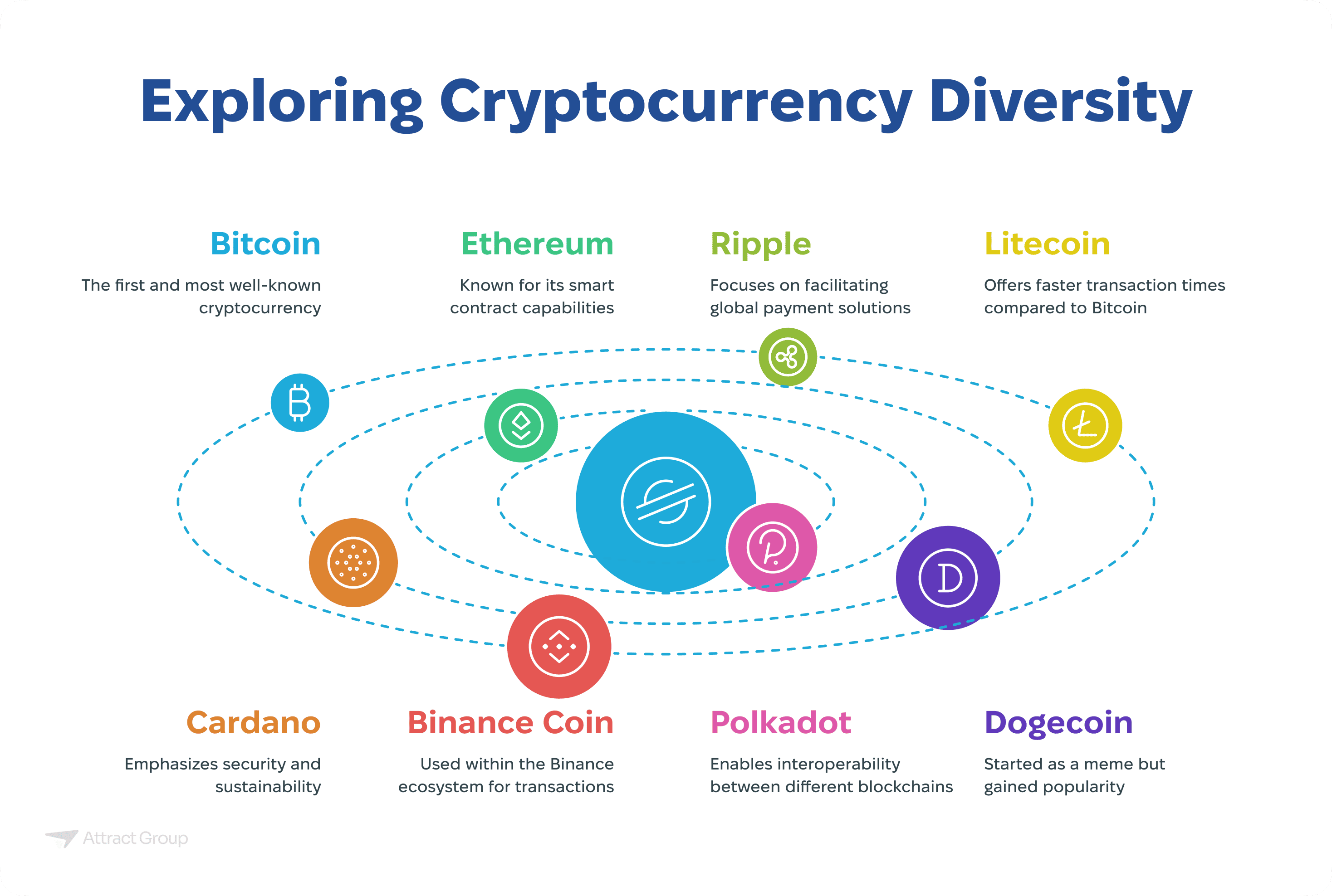

There are thousands of cryptocurrencies available today, each with unique features. Let’s explore some of the most popular ones and what makes them stand out.

1. Bitcoin (BTC)

Bitcoin, launched in 2009, is the first digital coin. It is often called “digital gold.” Many people see Bitcoin as a store of value because of its limited supply and widespread acceptance.

2. Ethereum (ETH)

Ethereum is not just a cryptocurrency — it’s a platform for creating smart contracts and decentralized applications. It introduced innovations like programmable money, which makes it different from Bitcoin. You can buy and sell Ethereum on any major exchange.

3. Ripple (XRP)

Ripple focuses on fast, low-cost cross-border payments. It’s popular with banks and financial services companies. Unlike Bitcoin or Ethereum, Ripple doesn’t rely on mining, making its transactions quicker and more energy-efficient.

4. Litecoin (LTC)

Litecoin is often referred to as the “silver” to Bitcoin’s gold. It was created in 2011 as a faster, cheaper alternative to Bitcoin. Litecoin is great for smaller transactions.

5. Cardano (ADA)

Cardano is known for its focus on security and sustainability. It uses a unique proof-of-stake system to validate transactions, making it more energy-efficient compared to Bitcoin’s proof of work.

6. Binance Coin (BNB)

Binance Coin is the native cryptocurrency of the Binance exchange. You can use it to pay fees, trade on Binance, or even book travel. It’s a utility token with various uses.

7. Polkadot (DOT)

Polkadot aims to connect multiple blockchains, allowing them to work together. It’s an ambitious project focused on improving blockchain.

8. Dogecoin (DOGE)

Dogecoin started as a joke but gained massive popularity, especially in 2021. It’s often used for tipping and small transactions online.

9. Central Bank Digital Currencies (CBDCs)

Unlike these decentralized cryptocurrencies, CBDCs are issued and controlled by governments. They are digital forms of traditional money and offer more stability. A CBDC doesn’t require a third party like a crypto exchange. It’s fully regulated by central authorities.

Buying and Storing Cryptocurrency

To start, you’ll need to choose an exchange where you can buy & sell. Popular exchanges like Binance, Coinbase, or Kraken make it easy for beginners. First, create an account and verify your identity. Then, deposit money using your bank account or credit card. Once your account is funded, you can select from many options like BTC or ETH. After purchasing, your coins are stored temporarily in the exchange. Make sure the platform is secure and reliable before using it.

Once you’ve bought cryptocurrency, it’s crucial to move it to a secure cryptocurrency wallet. Wallets can be online (hot wallets) or offline (cold wallets). Offline wallets, like hardware wallets, are the safest because they aren’t connected to the internet. Your wallet uses private keys to access your funds, so keeping them safe is essential. Losing your private key means losing your money. Wallets work by storing your access to a new block of transactions, all verified using blockchain. Always prioritize security to protect your digital assets.

Is Cryptocurrency a Good Investment?

Cryptocurrencies have emerged as a notable asset class in recent years, attracting both individual and institutional investors. Whether cryptocurrency is good or not depends on various factors, including your financial goals, risk tolerance, and understanding of the market.

Potential Benefits

High Return Potential: Some cryptocurrencies have experienced substantial price appreciation. Early investors in assets like BTC and ETH have seen significant gains.

Diversification: Cryptocurrencies can diversify a portfolio of assets since they often have a low correlation with traditional assets like stocks and bonds.

Innovation and Technology: Investing in cryptocurrencies supports blockchain, which has the potential to revolutionize various industries, including finance, supply chain, and healthcare.

Potential Risks

Volatility: Cryptocurrency markets are highly volatile. Prices can fluctuate dramatically in short periods, leading to significant gains or losses.

Regulatory Uncertainty: The regulatory environment for cryptocurrencies is still evolving. Changes in laws or regulations can impact the value and legality of certain digital assets.

Security Concerns: Risks such as hacking, fraud, and cyberattacks are prevalent. Securing D-Wallet and understanding cybersecurity is crucial.

Lack of Intrinsic Value: Unlike stocks or real estate, many cryptocurrencies do not have underlying assets or cash flow, making their valuation speculative.

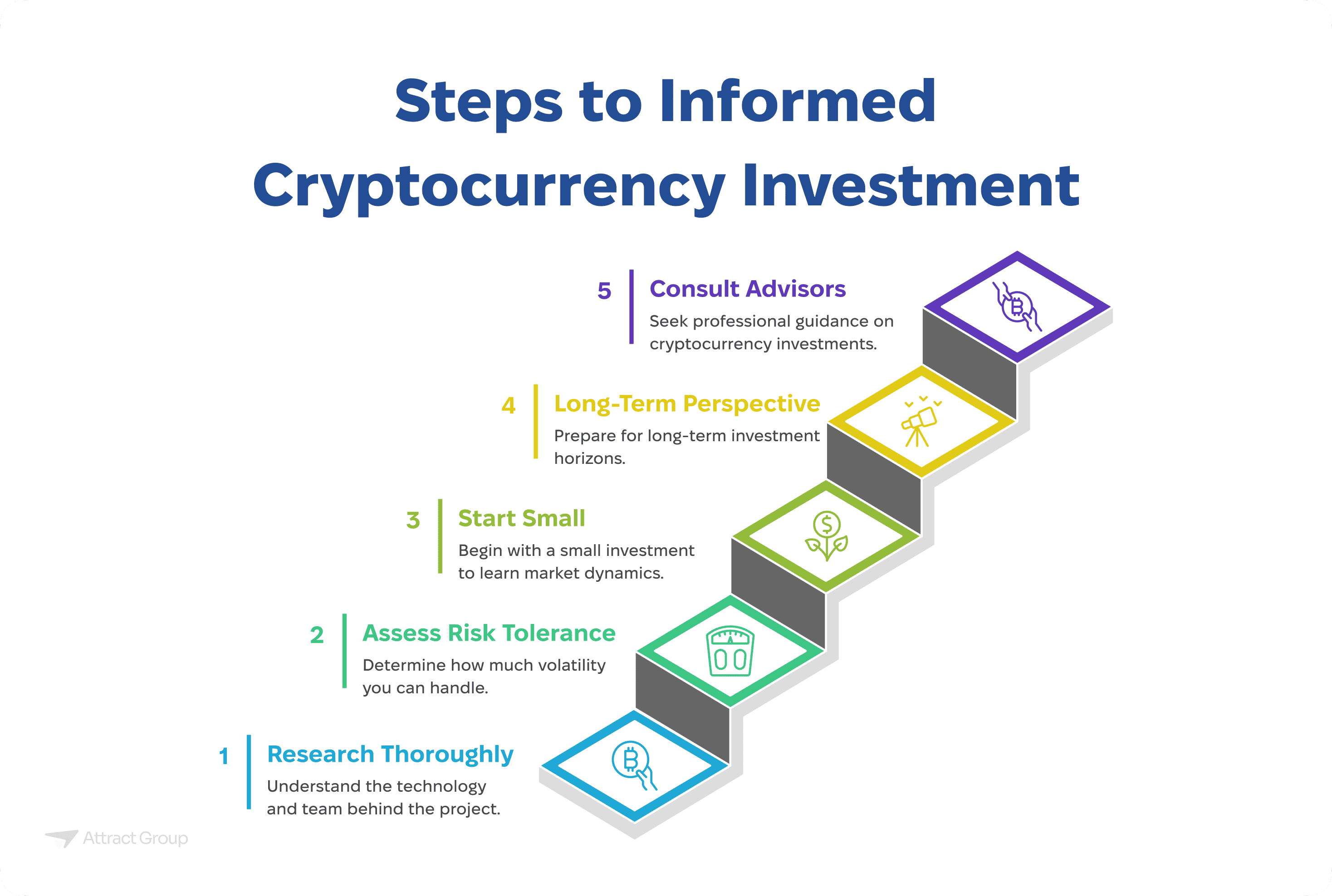

Considerations Before Investing

Research Thoroughly: Understand the technology, purpose, and team behind a cryptocurrency project.

Assess Risk Tolerance: Determine how much volatility you can handle without it affecting your financial well-being.

Start Small: Consider starting with a small investment to familiarize yourself with the market dynamics.

Long-Term Perspective: Be prepared for long-term investment horizons, as the market can be unpredictable in the short term.

Consult Financial Advisors: Seek advice from professionals who are knowledgeable about cryptocurrencies and can provide personalized guidance.

How to Invest in Cryptocurrency?

Investing in cryptocurrency can be exciting, but it requires careful planning and understanding. This guide will walk you through the key steps, from learning the basics to securing your investments, so you can make informed decisions and avoid common pitfalls.

1. Educate Yourself

Before you invest, it’s important to understand what cryptocurrencies and blockchain technology are all about. Learn how blockchain works and why it’s considered revolutionary. Reliable resources like CoinDesk and Investopedia can help you get started.

Research different cryptocurrencies beyond BTC, such as ETH, Cardano, or Solana, to see their unique use cases and growth potential. Stay updated by following crypto news, joining forums like Reddit’s r/CryptoCurrency, and reading whitepapers for coins you’re interested in.

2. Assess Your Risk Tolerance

Cryptocurrencies are highly volatile, with prices often swinging dramatically in short periods. Be prepared for this unpredictability and only invest money you can afford to lose. Avoid putting your financial stability at risk.

Understanding your risk tolerance will help you stay calm during market ups and downs. This way, you’ll make better decisions and avoid panic buying or selling.

3. Choose a Cryptocurrency Exchange

To buy & sell cryptocurrency, you’ll need a reputable exchange like Coinbase, Binance, or Kraken. Compare fees, security measures, available cryptocurrencies, and usability before deciding. Ensure the platform complies with local regulations to protect your funds and personal data.

4. Set Up a Digital Wallet

A cryptocurrency wallet is essential for storing your coins securely. Choose between:

- Hot Wallets: Online wallets connected to the internet, ideal for frequent transactions but more vulnerable to cyber threats.

- Cold Wallets: Offline wallets, like hardware wallets (Ledger, Trezor), offering better security for long-term storage.

5. Fund Your Account

Once you’ve chosen an exchange, link a payment method such as a bank account, debit card, or other options supported by the platform. Deposit the amount you want to invest, keeping fees and minimum deposit requirements in mind.

6. Purchase Cryptocurrency

With funds in your account, select the cryptocurrency you want to buy. You can place a market order to buy at the current price or a limit order to buy when the price hits a specific target. Always double-check transaction details before confirming.

7. Secure Your Investment

After buying, transfer your cryptocurrencies from the exchange to your personal wallet. Keeping funds on an exchange can expose you to hacking risks. Backup your wallet’s private keys and store them safely to prevent loss due to hardware failure or loss of access.

8. Monitor Your Investment

Keep track of your investments using portfolio trackers like Blockfolio or Delta. Stay informed about market trends, news, and updates on your chosen cryptocurrencies to make timely decisions.

9. Understand Legal and Tax Obligations

Cryptocurrency laws and tax requirements vary by country. Research local regulations to ensure compliance. Many crypto transactions are taxable events, so consult a tax professional or use crypto tax software like CoinTracker to manage your taxes properly.

10. Be Cautious of Risks

Cryptocurrency is not without risks. Beware of scams, phishing attempts, and fake investment schemes. Use trusted platforms and tools, keep your software updated, and never share your private keys. Staying vigilant will help you protect your investments from fraud.

Our blockchain experts can provide comprehensive guidance on investment strategies, security protocols, and technological implementation.

The Future of Cryptocurrency

Cryptocurrency & blockchain technology are evolving rapidly. New innovations are making it easier to use virtual currencies in everyday life. For example, you can now see cryptocurrency as payment for goods and services at major retailers. These developments reduce the need for a central authority like a bank and give you more control over your money.

There is also potential for new types of cryptocurrencies to emerge. Some focus on specific industries, while others aim to improve speed, security, or energy efficiency. You store cryptocurrencies in a D-Wallet, which is becoming safer and more user-friendly with new advancements. However, navigating this space has challenges.

Security concerns, like fraud and hacking, remain a major issue for many cryptocurrency exchanges. Governments worldwide are working to establish cryptocurrency legal frameworks to protect investors. But differences in laws can make it tricky to know what’s considered legal tender in each country.

There is also the risk of market manipulation, where prices are artificially influenced. Staying informed and cautious is essential. The cryptocurrency explained here shows both its opportunities and risks. It’s an exciting space, but always do your research and stay aware of potential pitfalls.

Our team can help you develop innovative digital financial technologies that transform your business model.

Conclusion

Blockchain is transforming the way we think about money, security, and innovation. From understanding the basics to exploring emerging trends and overcoming challenges, this guide equips you with the foundation to navigate the exciting world of crypto. As the potential of virtual currencies continues to grow, staying informed and proactive is essential to make the most of these opportunities.

At Attract Group, we are dedicated to helping you harness the power of cryptocurrency and blockchain. Our expert team specializes in delivering cutting-edge solutions tailored to your needs. Whether you’re looking to develop blockchain-based systems, integrate cryptocurrency into your business, or explore innovative applications, we’ve got you covered. With years of experience and a passion for excellence, we ensure your projects are built with precision, security, and the latest technology.

Let us help you unlock the endless possibilities of cryptocurrency and blockchain. When you work with Attract Group, you’re choosing a partner who is as invested in your success as you are. Reach out today and let’s create something extraordinary together!