How to Choose a Payment Solution for Marketplace Website

10 May 2022

10 May 2022Are you developing an e-marketplace in crowdfunding, B2B, B2C, or P2P? The success of your mobile app development or website development hinges on having a reliable payment system to process online transactions.

The right solution should support multiple payment methods. Customers can pay with credit cards, bank transfers, or mobile— ensuring that you don’t miss out on any opportunity to generate revenue.

A good platform makes collecting fees by the platform owner a convenient and rewarding experience.

Managing payouts to vendors, suppliers, and sellers should be similarly intuitive with automated transfers and balance tracking.

Several solutions help marketplaces with payment processing. You probably heard of Stripe, PayPal, and Braintree. Naturally, you may ask: Which is the best solution?

Get the answer in our guide on how to choose the right payment gateway for a marketplace. We’ll review the leading payments solutions, focusing on their features, pros, and cons.

Let’s get started!

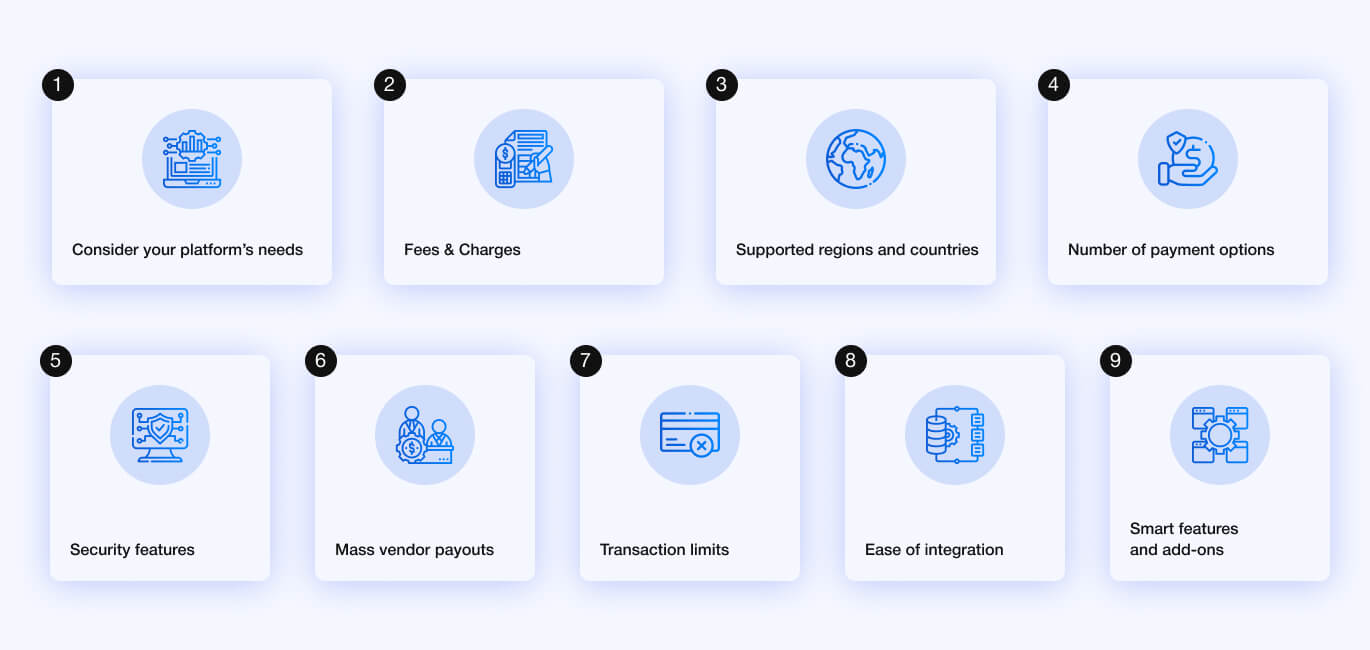

Things to consider when choosing a marketplace payment system

What is a payment service provider (also known as a payment gateway or processor)?

It’s simply a service that provides the technology, tools, and compliance required for your marketplace to receive direct payments and charge credit cards.

You can do without a marketplace payment system. But you will be delegated to doing things in an archaic way: sending invoices manually and asking customers to pay with bank transfers.

Use the following tips to find the best payment solutions:

1. Consider your platform’s needs

Don’t make the mistake of choosing an online payment solution that doesn’t offer the most critical features for your business. Consider if:

- Your marketplace hosts buyers and sellers (multi-vendor marketplace) or if it’s a single-vendor store.

- You need a mass payout system for fast payouts to creators, freelances, merchants, etc.

- Your platform collects a percentage of fees from every transaction.

- Your marketplace requires a point of sales integration for in-person sales.

- You require a way to handle recurring subscriptions.

2. Fees & Charges

Fees charged by the platform can significantly impact user satisfaction and revenues. It’s essential to know all the fees to expect and plan well ahead of time to avoid surprises.

Most solutions adopt pay-as-you-pricing; for instance, Stripe charges 2.9% + 30 cents for every successful card charge.

So, before selecting a processor, it’s essential to check for:

- Transaction charges (which may vary based on business location)

- Monthly packages

- Discount pricing on volumes

- Additional charges for international cards, and currency conversions (e.g., + 1%)

- Cheaper pricing models

- Charges for alternative payment methods —you can recommend cheaper options to clients and boost satisfaction.

3. Supported regions and countries

Geo-restrictions limit businesses from certain locations from signing up as clients. Still, the businesses can accept payments from anywhere, as long as customers use internationally support payment methods such as Mastercard and Visa.

A workaround may allow you to use payment systems not available to businesses in your domicile country. For instance, businesses in unsupported jurisdictions may incorporate a U.S company and set up a U.S bank account.

So to recap:

- Check the geo-restrictions and supported list countries as you evaluate the solutions;

- You can incorporate a company overseas to access a payment gateway.

4. Number of payment options

Customers may fail to complete a transaction if a third-party website doesn’t accept their preferred payment method. It’s always better to have more methods than fewer options.

Over 200 payment methods are used online. While a platform can’t offer all methods, it’s essential to have support for popular methods such as:

- Paypal, PayPal Credit

- Venmo

- Google Pay

- Apple Pay

- Samsung Pay

- Alipay

- Amex Express

- Visa

- ACH

- E-wallets

- Direct banking

Popular cards to support include:

- Visa

- Mastercard

- American Express

- Discover

- JCB

- Union Pay

- Maestro

- Carte Bancaire

- Diners club

Check for support for region-specific solutions such as iDEAL used by 60% of shoppers in the Netherlands or OXXO which has over 13,000 stores in Mexico.

*As the popularity of cryptocurrencies grows, you may expand revenue opportunities by using a payment gateway with cryptocurrency support.

Few of the major payment processors facilitate crypto payments. For instance, Stripe ended its Bitcoin support in 2018.

In Q1, 2021, PayPal rolled out its Pay with Crypto feature to U.S customers. Upon checkout, users can pay with cryptocurrencies that are automatically covered to fiat currency.

5. Security features

Businesses that process, store, or transmit credit card data must adhere to PCI DSS compliance (Payment Card Industry Data Security Standard). It’s a rigorous process.

Fortunately, payment processors simplify compliance by providing pre-built integrations for checkout pages. Your website doesn’t collect and store sensitive card data. Instead, the data goes straight to their servers. So, check for the integrations and how reliably they work.

Another security feature to look out for is 3D-secure. It may ask users to authenticate their cards by entering a special code.

Platforms that implement Know Your Customer (KYC) further help your marketplace combat money laundering and fraud.

6. Mass vendor payouts

A marketplace working with multiple vendors requires a way to distribute payments from customers. Think of platforms such as Uber – which needs to pay drivers or StyleSeat – which remits payments to its beauty professionals.

It’s ideal to choose a platform with programmatic payouts. You can pay service providers and reconcile balances automatically, saving time and reducing errors.

7. Transaction limits

While the maximum transaction limit matters, don’t forget to review the minimum limits. Ask for further clarification from support if the platform doesn’t mention its transaction limits.

8. Ease of integration

Gateways must take the initiative to simply onboard integrations. They should offer no-code integrations and ready-to-use plugins that integrate with existing eCommerce solutions.

If you need to build a custom integration, the platform should provide extensive documentation and development support. Working with a popular platform is always advisable as it unlocks access to a large network of experts, consultants, and agencies.

9. Smart features and add-ons

Look for smart productivity features as you choose a payment gateway for the marketplace. For instance, automated tax collection and automatically generated 1099 tax forms simplify tax compliance for the platform’s vendors.

Chargebacks and refunds may end up taking significant time to resolve. The ability to automate chargebacks and chargeback protection may help improve efficiency.

The platform should easily integrate with other payment solutions, accounting software, web plugins, and other services.

8 best marketplace payment solutions

Let’s review the top payment solutions for a marketplace website. See how they compare in the comparison table at the end of this section.

Stripe

Founded in 2010 in the US, Stripe is one of the leading payment infrastructure platforms, serving millions of internet businesses. The company offers Stripe Connect to software platforms and marketplaces.

It includes tailored solutions such as automated onboarding and verification, a smart payout engine, and a unified dashboard that provides full visibility of all user accounts.

Pros

- Automated tax compliance allows marketplace owners and users to save time on tax preparation and filling. With a few clicks, they can automate 1099s and e-filling.

- Easy onboarding enables your marketplace to easily collect user information while fulfilling KYC requirements.

- Stripe’s conversion-optimized UIs promote frictionless sign-ups.

- Rigorous verification and screening reduce risk, and Stripe Connect identifies high-risk accounts.

- Expanding globally is made easier as Stripe already accepts many local methods, with support for over 135 currencies without conversions.

- Stripe has a broad library of ready-to-use integrations targetting accounting software, eCommerce solutions, and business tools. It makes reconciliation easier and improves productivity.

Cons

- The payment gateway serves a limited number of countries, impacting your ability to signup.

- In reviews, users have complained about the UI not being as intuitive. Some have found it difficult to find certain features. Others have struggled with converting manual processes to automatic workflows.

- It offers few customer service options, and there is no website assistant or live chat.

Stripe boasts of a wide user base from startups to Fortune 500 companies. Some marketplaces using Stripe include:

- Bookings.com

- InstaCart

- DoorDash

- Sharetribe

Paypal

PayPal offers a full-stack solution that makes it one of the leading marketplace payment processors. It provides API-driven onboarding, easy monetization with partner fees, full-stack payment processing, and data aggregation.

Pros

- Offer a good selection of methods, from debit cards to local solutions.

- Stores card info to speed up checkout for previous customers.

- Uses a trusted tech stack for end-to-end marketplace management, from onboarding sellers to risk management.

- Thanks to POS support and virtual terminals, PayPal covers all common business types, including in-person sales and online service subscriptions.

- Marketplaces can pay sellers faster with multi-seller and split payment features.

Cons

- PayPal tends to have higher fees for merchants compared to Stripe. It charges 3.49% + fixed fee PayPal Checkout, Pay with Venmo, and invoice transactions. International commercial transactions attract an extra rate of 1.50%. Stripe charges 2.9% + 30¢ for cards and 1%+ for international cards.

- PayPal has a negative reputation for wrongfully shutting accounts down after its algorithms detect suspicious activity.

- It has a finicky relationship with some markets. For instance, in 2021, they announced that they were pulling out of India less than four years after they began operations.

Over 29 million businesses and merchants use PayPal. Famous marketplace employing its solutions include eBay, Eshopex, Groupon, and idea.me (crowdfunding).

Apple Pay

Apple Pay is a payment service offered by Apple since October 2014. It’s faster than using cash or physical cards. The user first adds a credit card to the wallet app. They tap “Pay with Apple” and pay instantly without revealing their card info on the checkout page.

Pros

- Has a huge potential user base as the service is accessible for all iOS users on Apple Watch, Mac, iPad, etc.

- Easy to integrate into an existing checkout process —many payment providers make it available through their API.

- It can detect customers using Apple Pay enabled devices, and recommend Apple Pay as an alternative method, boosting conversions.

- Offers express checkouts. Customers can complete the purchase right from the product page without filling out forms to provide their card details.

Cons

- It’s not exactly tailored as a marketplace payment gateway, as it lacks features such as onboarding or mass payouts. You may add to complement existing methods offered by the main payment solution.

- Apple Pay is one of the most popular mobile payment gateways, hence its support by leading marketplaces such as Amazon, Etsy, and eBay.

Google Pay

As a marketplace payment gateway, Google Pay speeds up the checkout experience with one-click checkouts. Users only need to install the Google Pay app on iOS or Android.

Pros

- Reduces time-to-buy, helping to counter abandoned carts;

- Zero charges for customers and merchants;

- Minimizes risk and fraud by storing payment info on Google’s secure servers;

- Reduces incidents of rejected transactions.

Cons

- Not built as an end-to-end marketplace solution.

Marketplaces and apps supporting Google Pay include Groupon, DoorDash, Airbnb, Postmates, Hotel Tonight, and Wish.

Dwolla

Dwolla is a payment solution for marketplaces that primarily supports account-to-account transfers with ACH payments. Businesses can receive payments and disburse payouts to sellers, contractors, etc. Its strong tech stack supports automated workflows and focuses on a mobile-first approach.

Pros

- Suitable for processing ACH payments at reduced fees

- Free testing environment with a sandbox

- Mass payments support with up to 5000 payments at a go

- Flexible tools help developers build for different use cases, and payment flows

Cons

- There is no support for card payments and many local payment solutions

- ACH payments are slow, taking 3 to 4 business days

- Marketplaces may still require an additional payment processing system for card processing;

Long verification process with many legal requirements for users.

Over 90% of the user base is from the US, in retail, insurance, real estate, and financial services.

Braintree

Braintree became a PayPal service following its acquisition in 2013. It’s an ideal choice for a payment solution for a marketplace as it offers a robust payment mix. Customers can pay with Google, Apple Pay, Venmo, PayPal, and many local options. Its Hyperwallet integration allows marketplaces to settle outbound payments to sellers, contractors, and partners.

Pros

- Supports inbound and outbound payments, making it suited as a standalone solution for multi-vendor marketplaces;

- Reduces time-intensive manual reviews with automated chargebacks and pre-arbitrations;

- Card-vaulting and tokenization make it easier for marketplaces to stay PCI DSS compliant;

- Leverages the power of PayPal and unlocks access to its network of over 300M+ users;

- Maybe cheaper than PayPal as it charges 2.59% + $.49 for the card and digital wallet transactions.

Cons

- Users have complained about long setups;

- Limited geo coverage.

Some marketplaces using Braintree include Open Table (restaurant reservations) and Stubhub (sports tickets).

Authorize.net

Authorize.net, a VISA solution, may be ideal for single marketplace payment processing. It includes support for eChecks, credit cards, and contactless payment methods.

Pros

- Streamline checkouts with VISA checkouts that only require customers to fill out two fields;

- Supports free digital invoicing, allowing businesses to send invoices via email collect payments faster;

- Provides robust fraud protection with an easily configurable rules-based filter;

- Offers certified integrations for popular eCommerce solutions such as Magneto, Foxy.io, and Chargify.

Cons

- Lacks certain features for two-sided platforms such as mass payouts;

- Users have complained about usability, long setup times, and poor customer support.

Over 440,000 businesses count on Authorize.net solutions with popular names such as Shopify, eBay, and Magneto.

Square

Online marketplace payment solutions from Square allow businesses to process credit card payments, ACH payments, POS purchases, and collect contactless and chip payments. Users can expand the tool’s capability to fit marketplace needs by using Square Payroll software to remit salaries to workers.

Pros

- Offers a unified system to run single marketplaces from payment processing to payroll;

- Provides free trials and demos;

- Simple to use and intuitive with convenient features such as customer insights;

- Provides loans for sellers looking to expand, hire, or restock inventory.

Cons

- Solutions mainly target small businesses in the retail sector;

- it may not suit the needs of large multi-vendor marketplaces.

Square’s specialty lies in powering marketplaces that may need POS solutions. It has worked with customers such as Martial Arts on Rails, Jane, Remedly, QuiqMeds, and Seed.

What to choose: Top payment systems compared

We’ve gone over how to choose a payment gateway for an online marketplace with tips such as evaluating the security features, geo-restrictions, etc. Let’s narrow down to the top four options for building complex marketplaces and see how they compare.

*Note. The platforms listed here include mobile support and are PCI DSS compliant.

| Stripe | PayPal | Braintree | Dwolla | |

|---|---|---|---|---|

| Transaction fee for cards | 2.9% + 30¢ | 3.49% + fixed fee | 2.59% + $.49 | – |

| UK Sellers & card fees | 1.4% + 20p | 2.9% + £0.30 | 1.9% + £0.20 | – |

| Available countries | 47 | 200+ | 48 | 25+ |

| Local payment methods | Sofort, SEPA, Giro Pay, iDEAL, Bancontact, WeChat Pay, AliPay, OXXO, China UnionPay, EPS | Sofort, iDEAL, Giropay, Bancontact, OXXO, MyBank, Multibanco, Klarna, Trustly | SoFort, iDEAL, Giropay, MyBank, Trustly, EPS, P24, Blink | Local via wire transfers |

| Accepted Cards | VISA, Mastercard, Maestro, American Express, Discover, Diners Club, JCB | Visa, MasterCard, Discover, American Express, Discover, JCB, Diner’s Club, and EnRoute. | Visa, Mastercard, American Express, Discover, JCB, Diner’s Club, UnionPay | ACH only |

| Apple Pay, Google Pay | Provided | Provided | Provided | No |

| Venmo | No | Yes | Yes | No |

| Supported payment currencies without conversions | 135+ currencies | 25 currencies for payments & balances | 136 currencies | 38 currencies |

| ACH | Yes, 0.80%, capped at $5 | *Users must use Braintree Direct | Yes, at 0.75% | Yes, at 0.5% per transaction |

| Payouts | Yes | Yes | Yes | Yes |

| Advanced fraud protection & 3D secure | Supported | Supported | Supported | Partial support |

| Automated tax collection & reporting | Included | Not provided | Partial support | No |

When to use multiple payment systems

Using multiple payment gateways for your online marketplace may be the right choice in several scenarios:

- Ensuring international coverage during business expansions

- Scaling after using MVP development service

- Building redundancy by having a backup system

- Providing more payment methods to enhance convenience

- Catering to security-conscious customers with a payment gateway marketplace they can easily recognize

- Ensuring local integration – where customers don’t prefer to pay with credit cards

Summary: Payment solution for marketplace

Are you building a marketplace and stuck with payment integration? At Attactgroup, we have worked with all the major payment processing systems and helped integrate them into apps.

We take time to understand your project requirements and provide development support that adheres to rigorous compliance standards for the financial sector.

If you’ve not started on the development, you can also make a p2p marketplace website

So, contact us for expert advice on the best payment solutions for online marketplaces or get a free quote.