How to Create a Decentralized Exchange for Cryptocurrency: A Developer’s Guide to DEX

26 November 2024

26 November 2024🔊 Listen to the Summary of this article in Audio

A decentralized exchange (DEX) is a platform that allows people to trade cryptocurrencies directly with each other without needing a middleman. Unlike traditional, centralized exchanges, DEXs operate on blockchain technology, giving users more control over their funds and privacy.

Building a DEX might seem complicated, but it’s an exciting opportunity for developers who want to create secure, innovative, and transparent platforms for the growing crypto market.

In this guide, we’ll walk you through the basics of decentralized exchanges, their key components, and the steps to create one. By the end, you’ll have a clear understanding of how to start building your own DEX and make your mark in the cryptocurrency world.

Core Components of a DEX

There are mainly three core components of a decentralized exchange.

1. Smart Contracts

Smart contracts are like robots that handle all the trading rules and make sure everything works as it should on the cryptocurrency exchange. They help you trade directly without needing an intermediary like a bank or a company. These contracts are the foundation of any successful exchange development process, as they automatically execute trades and swaps securely.

2. Liquidity Pools or Order Book

Liquidity pools are like shared money jars where people put their crypto so others can easily buy or sell. This helps trades happen smoothly on the exchange platform. Alternatively, some exchanges use an order book, which is like a list showing who wants to buy and who wants to sell. Both methods make the trading process efficient and are key in cryptocurrency exchange development.

3. User Wallets

A crypto wallet is what allows users to connect to the exchange. It’s like a digital keychain that keeps your coins safe and lets you trade. Unlike a centralized app, this type of app development ensures you own your keys and assets. This way, you can trade on an exchange without giving control of your money to someone else.

Our expert developers can help you architect a robust decentralized exchange with cutting-edge blockchain technology.

Steps to Develop a Decentralized Exchange (DEX)

Developing a decentralized exchange involves a structured approach that focuses on technical development, user experience, and regulatory compliance. Here’s a step-by-step guide with actionable insights for developers:

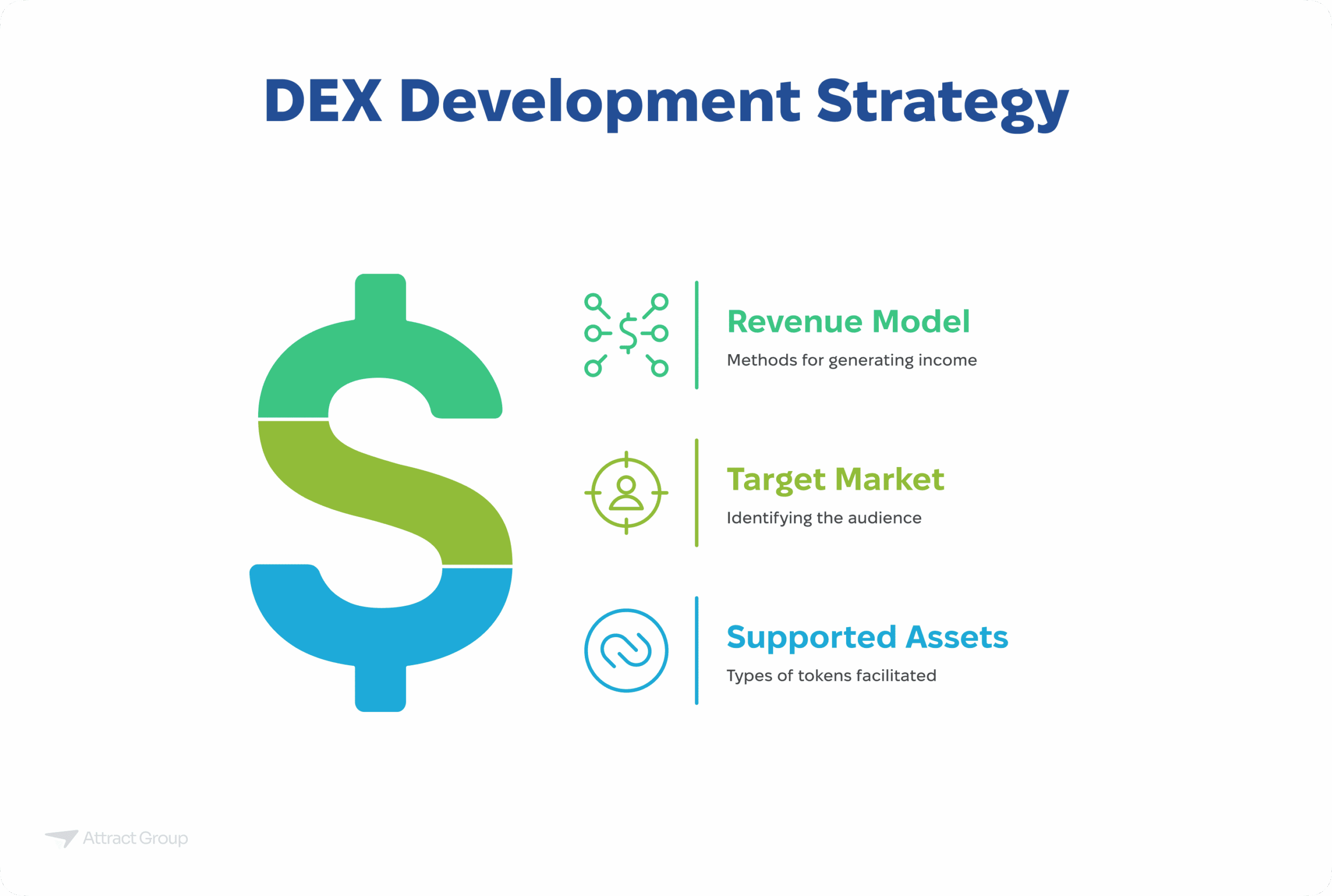

Step 1: Define Your Business Objectives

First things first, let’s figure out why you’re building it.

Once you’ve got a clear vision, it’s time to identify your target audience. Are you catering to seasoned traders, or are you looking to attract newcomers to the crypto world? Knowing your target market will help you tailor your DEX’s features and user experience.

Clearly outline your goals to guide the development process:

- Revenue Model: Decide how your DEX will generate income — trading fees, incentives for market makers, or premium services.

- Target Market: Identify your audience, such as retail traders, institutional users, or niche crypto communities.

- Supported Assets: Choose the types of tokens or cryptocurrencies your platform will facilitate, considering market demand and blockchain compatibility.

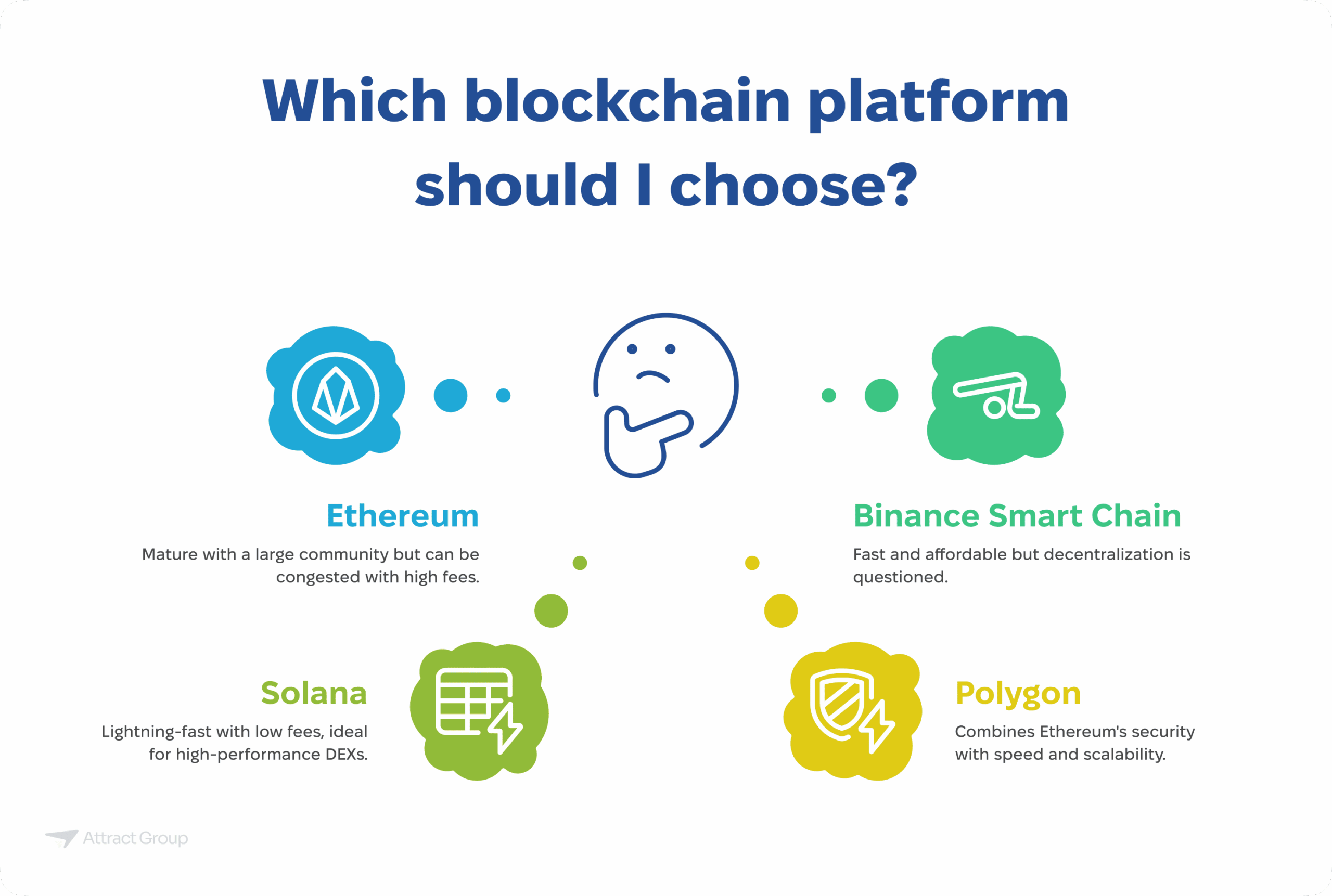

Step 2: Select the Right Blockchain Network

Choosing the right blockchain is like picking the perfect playground for your DEX. You want something fast, secure, and fun to build on.

Let’s break down some of the top contenders:

- Ethereum: The OG of blockchains, ETH is a solid choice for its maturity and vast developer community. But, be warned, it can get a bit congested during peak times, leading to higher fees.

- Binance Smart Chain (BSC): A speedy and affordable alternative to ETH, BSC offers fast transaction times and lower fees. However, its level of decentralization is a topic of debate.

- Solana: Known for its lightning-fast speed and low fees, Solana is a promising platform for high-performance DEXs.

- Polygon: If you want the best of both worlds, Polygon offers the security of Ethereum with the speed and scalability of a layer-2 solution.

Step 3: Design the Order Execution Model

Now that you’ve chosen your blockchain playground, it’s time to design the heart of your DEX: the order execution mechanism.

Here are three primary approaches:

1. Automated Market Makers (AMMs): These are like self-serve vending machines for crypto. Users can swap tokens directly from decentralized pools, eliminating the need for traditional order books. Popular AMMs include Uniswap and PancakeSwap.

| Pros | Cons |

|---|---|

| Eliminates reliance on traditional order books, simplifying the user experience. | Impermanent loss risk for liquidity providers due to price fluctuations. |

| Enables continuous trading, as liquidity is always available through pools. | Relies on high liquidity to minimize slippage, which can be hard to achieve initially. |

| Easier to set up and automate compared to order book models. | Limited trading flexibility; users cannot set custom orders like limit orders. |

| Popular among DeFi users for token swaps and yield farming. | May face high gas fees on congested networks like Ethereum. |

2. Order Book Models: This is the traditional way of matching buyers and sellers. Users place buy and sell orders, and the DEX matches them based on price and quantity.

| Pros | Cons |

|---|---|

| Familiar to traders who use centralized exchanges, making adoption easier. | Requires significant computational resources to maintain and update the order book. |

| Supports advanced trading features like limit orders and stop-loss orders. | Dependent on high trading volume to ensure smooth and efficient order matching. |

| Enables greater precision in executing trades at desired prices. | Can be complex to develop, especially on-chain, due to blockchain performance constraints. |

| Provides transparency in market depth and pricing. | May suffer from low trading volume and a poor user experience if there is insufficient market activity. |

3. Hybrid Model: You can also consider hybrid models that combine the best of both worlds. Ultimately, the right choice depends on your target audience and the specific features you want to offer.

| Pros | Cons |

|---|---|

| Combines the continuous liquidity of AMMs with the flexibility of order books. | Increased development complexity as both systems must be integrated seamlessly. |

| Allows platforms to cater to a broader audience with diverse trading needs. | Higher operational costs due to maintaining dual infrastructures (AMM pools and order books). |

| Offers better trading options, including limit orders and instant swaps. | May require more computational resources, impacting scalability and performance. |

| Reduces reliance on liquidity pools alone, addressing impermanent loss concerns. | Could confuse users unfamiliar with hybrid models or DeFi features. |

Let our blockchain specialists help you select the perfect order execution model for your decentralized exchange platform.

Step 4: Develop Smart Contracts

Smart contracts are the backbone of your DEX. They’re self-executing contracts with the terms of the agreement directly written into code.

When developing your smart contracts, prioritize security, efficiency, and flexibility. Consider using a formal verification tool to ensure the correctness of your code and conduct thorough audits to identify vulnerabilities.

Here are the key smart contracts you’ll need:

- Core Trading Logic: This contract handles the core functionality of your DEX, such as placing orders, executing trades, and managing liquidity pools.

- Fee and Reward Distribution: This contract determines how trading fees are distributed and how rewards are allocated to liquidity providers.

- Security Modules: These contracts implement security measures to protect your DEX from attacks, such as reentrancy attacks and flash loan exploits.

Step 5: Create a User-Centric Interface

Design a UI/UX that is intuitive and caters to your target audience’s needs:

- Ease of Use: Ensure even beginners can navigate and trade effortlessly.

- Wallet Integration: Support popular wallets like MetaMask or Trust Wallet for seamless transactions.

- Responsive Design: Optimize for desktop and mobile platforms to reach a wider audience.

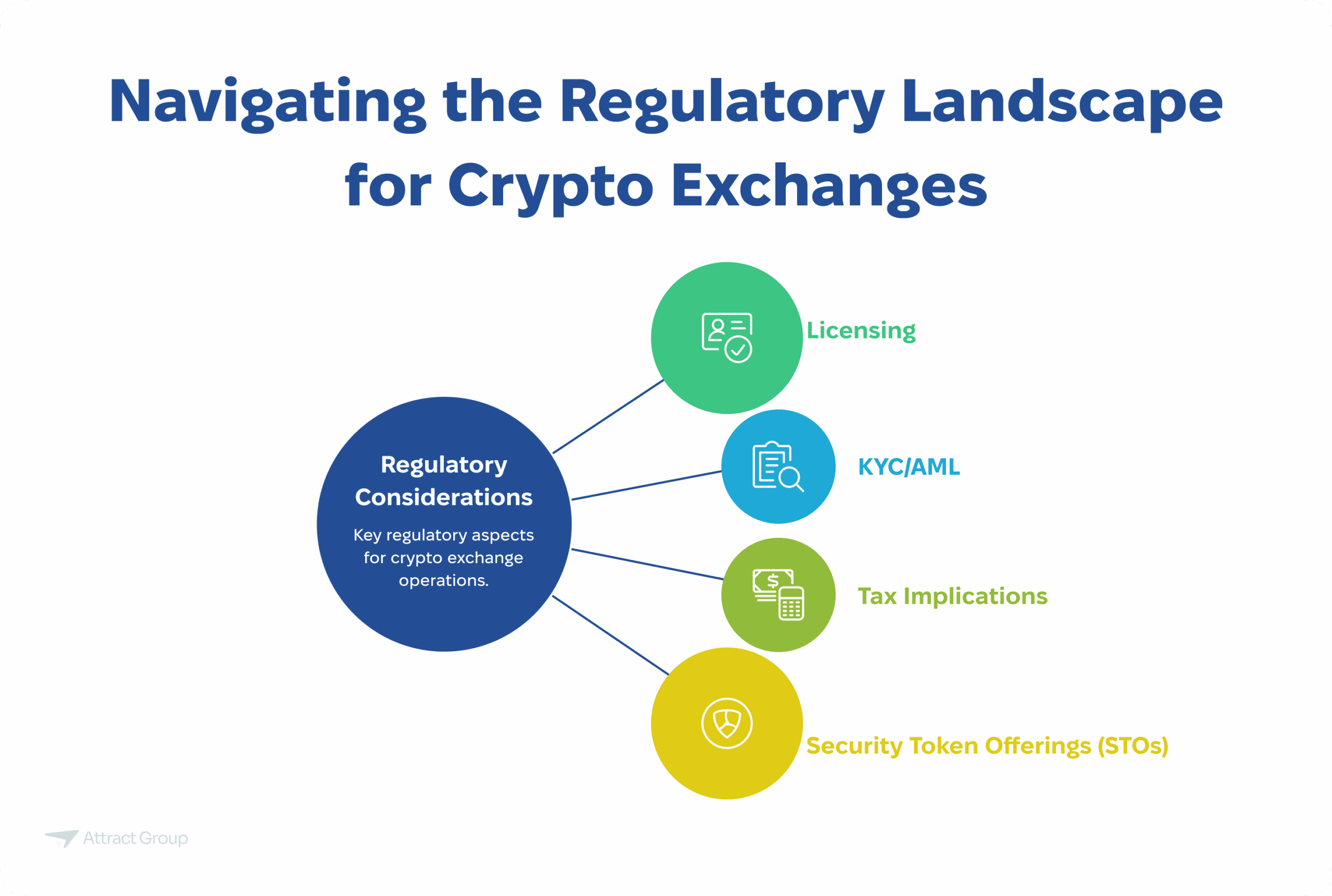

Step 6: Address Legal and Compliance Requirements

Crypto regulations are a complex beast, and it’s crucial to tread carefully. Before you launch your DEX, make sure you’re familiar with the legal landscape in your target jurisdictions.

Here are some key considerations:

- Licensing: Research the specific licensing requirements for operating a crypto exchange in your region.

- KYC/AML: Decide whether you’ll need to implement Know Your Customer (KYC) and Anti-Money Laudering (AML) procedures. These can involve verifying user identities and tracking transactions.

- Tax Implications: Understand the tax implications for both you and your users.

- Security Token Offerings (STOs): If you plan to offer security tokens, you’ll need to comply with securities laws.

Pro Tip: Consult with legal experts to ensure your DEX is compliant with all relevant regulations. Ignorance is not bliss when it comes to the law.

Our legal and technical experts can navigate the complex regulatory landscape of cryptocurrency exchanges.

Step 7: Rigorous Testing

Before launching, conduct thorough testing in a controlled environment to ensure stability and security:

- Smart Contract Audits: Hire third-party auditors to review your contracts for vulnerabilities.

- Functional Testing: Test all features, including trading, deposits, withdrawals, and UI responsiveness.

- Load Testing: Simulate high traffic to evaluate performance under stress.

Step 8: Deploy and Launch Your DEX

Transition your DEX from testnet to mainnet with a well-planned deployment:

- Final Validation: Reconfirm that all components, from smart contracts to UI, are functioning correctly.

- Marketing Strategy: Announce your launch through crypto communities, social media, and press releases. Offer incentives like trading fee discounts rewards to attract early users.

Step 9: Ongoing Support and Optimization

A successful DEX requires continuous improvement:

- Customer Support: Provide prompt assistance to users via chat, email, or community channels.

- Platform Monitoring: Use analytics tools to track performance, user behavior, and trading volumes.

- Upgrades and Security Patches: Regularly update the platform to address bugs, optimize performance, and implement new features based on user feedback.

Cost and Time Considerations to Build a Decentralized Exchange (DEX)

Building a decentralized exchange (DEX) is a significant investment of time and resources, requiring careful consideration of various factors that influence both cost and development timelines. The overall expense depends on the complexity of the project, the technology stack used, the expertise of the development team, and the security measures implemented to ensure user safety. Similarly, the timeframe for creating a DEX varies based on the scope of the platform, with simpler designs taking a few months and more advanced features requiring extended development. Understanding these aspects is crucial for planning and executing a successful DEX project, balancing budget constraints, and meeting launch deadlines. Below is a detailed breakdown of cost and time considerations to guide your efforts.

Estimated Cost Breakdown

| Component | Estimated Cost |

|---|---|

| Market Research | $3,000 |

| UI/UX Design | $8,000 |

| Back-end Development | $10,000 |

| Front-end Development | $8,000 |

| QA Testing | $5,000 |

| Project Management | $5,000 |

| Post-Launch Support | $6,000 |

| Total Estimate | $45,000 |

Time Considerations

| Aspect | Details | Estimated Time |

|---|---|---|

| Project Scope | Simple DEX requires less time; feature-rich platforms with advanced functionalities take longer due to extensive coding and testing. | 4–6 months |

| Development Methodology | Agile methodologies with iterative feedback can speed up development while ensuring quality. | Varies based on methodology. |

| Team Efficiency | Experienced teams handle challenges effectively, reducing development time. | 4–6 months or less |

Partner with our seasoned blockchain development team to create a secure, innovative decentralized exchange platform.

Conclusion

Building a decentralized crypto exchange is a transformative journey that combines cutting-edge technology, user-centric design, and robust security. By following this guide, you now understand the essential components — smart contracts, liquidity pools or order books, and crypto wallets—and the step-by-step process to create a DEX that aligns with your business goals. Whether you’re aiming to launch a decentralized exchange for seasoned traders or a beginner-friendly decentralized exchange platform, this project offers immense potential to innovate and grow in the cryptocurrency space.

Creating a successful exchange website or a feature-rich mobile app is not just about technical development; it’s about crafting a seamless experience that allows users to trade with confidence and autonomy. Whether you’re looking to start a cryptocurrency exchange or build a crypto exchange that redefines the trading landscape, a clear vision and expert execution are vital.

If you’re ready to turn your ideas into reality, The Attract Group is here to help. With years of experience in exchange business and cryptocurrency exchange development, we specialize in delivering top-notch solutions tailored to your needs. Whether you need a secure decentralized exchange platform or a user-friendly app, we bring expertise, innovation, and commitment to every project.

Let’s make your vision a reality — contact us today to build the best in the industry!