How to Develop a Cryptocurrency Exchange App: From Concept to Launch

29 November 2024

29 November 2024🔊 Listen to the Summary of this article in Audio

Cryptocurrency exchanges have become essential for trading digital assets like Bitcoin and other cryptocurrencies. As the demand for secure and efficient trading solutions grows, developing a crypto exchange app presents a lucrative opportunity.

This guide explores how exchanges work, the steps to create a secure and user-friendly platform, and the key considerations for launching a successful crypto exchange app.

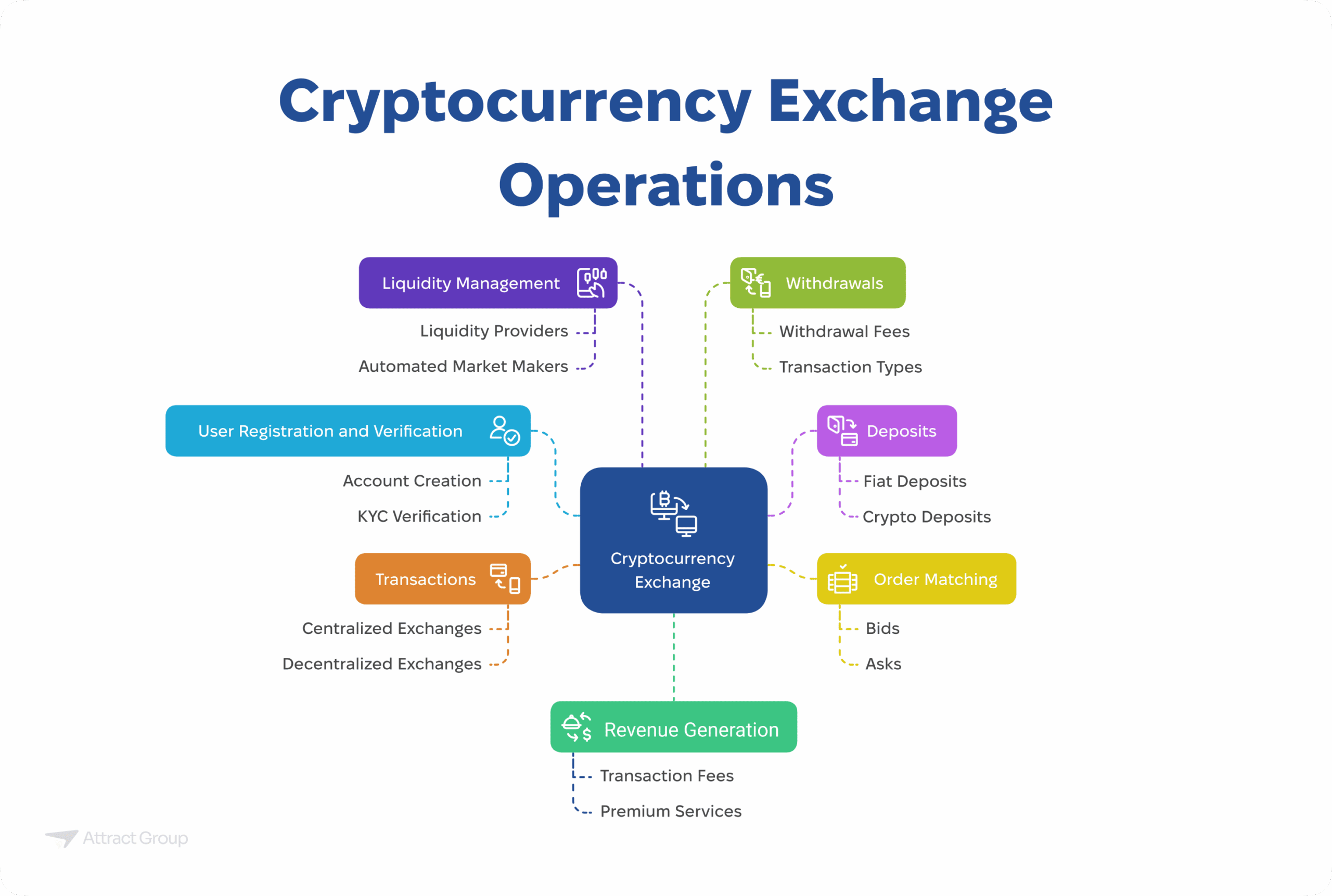

How Does a Cryptocurrency Exchange Work?

A cryptocurrency exchange is a digital platform that allows users to buy, sell, and trade cryptocurrencies. Here’s how it works:

- User Registration and Verification

Users create an account on the platform, often completing KYC (Know Your Customer) verification to comply with regulatory requirements. - Deposits

Users fund their accounts by depositing fiat currency (like USD or EUR) or cryptocurrencies. For fiat deposits, bank transfers or credit cards are commonly used, while crypto deposits involve transferring funds from an external wallet. - Order Matching

The exchange operates as a marketplace where buyers and sellers place orders. Buyers set bids (maximum price they’re willing to pay), and sellers set asks (minimum price they’re willing to accept). The platform uses order matching algorithms to execute trades when prices align. - Transactions

Once an order is matched, the exchange facilitates the transaction. For centralized exchanges, the platform temporarily holds the cryptocurrency in its own wallets during the trade. Decentralized exchanges, on the other hand, enable peer-to-peer sening directly between users using blockchain technology. - Liquidity Management

Liquidity is crucial to ensure users can trade assets without significant delays or price fluctuations. Exchanges may partner with the providers or use mechanisms like automated market makers (AMMs) to maintain a seamless trading experience. - Withdrawals

After trading, users can withdraw their funds to external wallets or bank accounts. Withdrawals are subject to fees, depending on the type of currency and transaction. - Revenue Generation

Exchanges typically earn revenue through transaction fees, deposit/withdrawal charges, and sometimes through premium services like margin trading or staking.

Types of Cryptocurrency Exchanges

Cryptocurrency exchange platforms can be categorized based on their structure and functionality.

| Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Centralized Exchange | Managed by a single entity that facilitates trading through their platform. | High liquidity, user-friendly interface, fast transactions. | Vulnerable to hacking, requires trust in the operator. |

| Decentralized Exchange | Peer-to-peer platforms that operate without intermediaries, using blockchain for transactions. | Enhanced security, greater privacy, no central authority. | Lower liquidity, slower transactions, complex user experience. |

| Hybrid Exchange | Combines features of centralized and decentralized exchanges, offering more balanced solutions. | Improved security with centralized liquidity management. | Still evolving, may lack full decentralization. |

| P2P Exchange | Allows direct trading between users without intermediaries, often using escrow for safety. | Flexible payment methods, low fees. | Limited trading options, potential fraud risks. |

Steps to Build a Cryptocurrency Exchange App

Creating a cryptocurrency exchange app involves several important steps. Each step plays a key role in ensuring your platform is secure, user-friendly, and effective for cryptocurrency trading.

Step 1: Define Your Business Model

The first step is to clearly define your business model. This involves determining whether you want to establish a centralized or decentralized exchange.

A centralized exchange operates under a traditional model, where a central authority oversees all transactions and holds user funds. This model offers greater security and regulatory compliance but may limit user autonomy. A decentralized exchange, on the other hand, leverages blockchain technology to enable peer-to-peer trading without intermediaries. This model provides greater user control and privacy but can be more complex to implement and secure.

Once you’ve chosen your business model, it’s imperative to conduct thorough research on the regulatory landscape in your target jurisdictions. Cryptocurrency regulations vary widely across countries, and non-compliance can lead to severe legal consequences. Consult with legal experts to ensure that your exchange adheres to KYC (Know Your Customer), AML (Anti-Money Laundering), and other relevant regulations.

Transform your cryptocurrency exchange concept into a robust, secure platform with our specialized development expertise.

Step 2: Research the Market

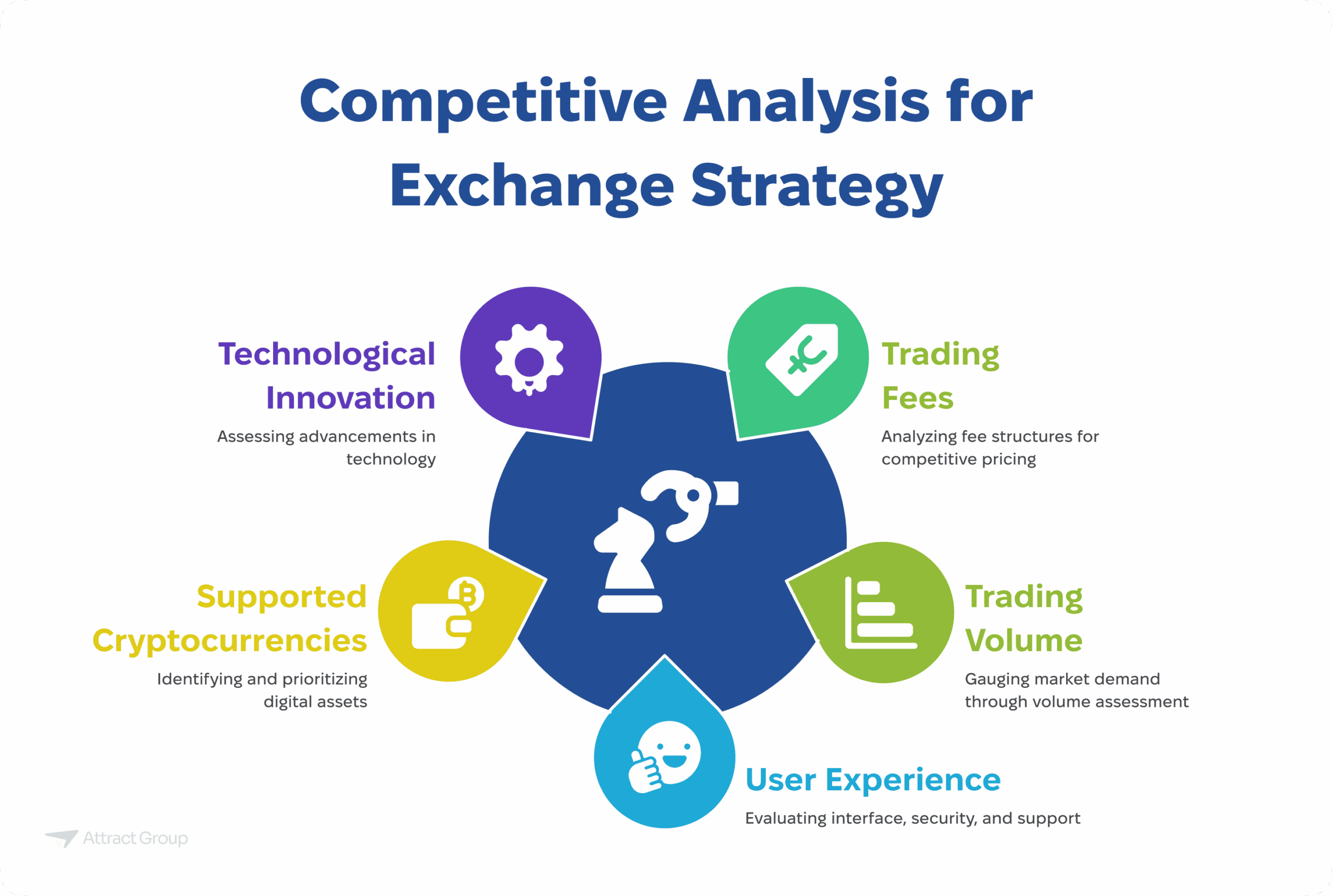

Thorough market research is essential to identify opportunities, understand user needs, and gain a competitive edge. Analyze market trends, user demographics, and emerging technologies to determine the target audience and niche for your exchange.

Conduct a comprehensive competitive analysis to evaluate the strengths and weaknesses of existing exchanges. Consider factors such as:

- Trading Fees: Analyze the fee structures of competitors to determine a competitive pricing strategy.

- Trading Volume: Assess the volume of different exchanges to gauge market demand.

- User Experience: Evaluate the user interface, security features, and customer support of competing platforms.

- Supported Cryptocurrencies: Identify the range of digital assets supported by competitors and determine which ones to prioritize.

- Technological Innovation: Assess the level of innovation and technological advancements of competitors.

For example, you may analyze many exchanges like Binance and Coinbase. You could study their fee structures, the range of cryptocurrencies they support, and their user interface. You might also look at smaller exchanges like Kraken or Bitfinex to identify niche opportunities, such as offering advanced trading features or focusing on specific regions.

Step 3: Plan and Design the App

Make a detailed plan for your app’s features and structure. Some must-have features include:

- User registration to create an exchange account.

- Secure trading to allow users to buy or sell cryptocurrencies.

- Wallet integration to store and manage funds.

- Tools to track market trends and trading volume.

Plan the back-end system for data storage, security, and order matching.

Step 4: Choose the Right Technology

Selecting the right technologies is crucial for developing a reliable, secure, and scalable cryptocurrency exchange app. Below are key technologies that are widely used in exchange development.

| Technology | Usage | Pros | Cons | Why It’s Used |

|---|---|---|---|---|

| Python | Back-end development, logic implementation | Easy to learn, rich libraries, scalable | Slower execution compared to compiled languages | Ideal for rapid development and integrating blockchain frameworks like Web3.py. |

| JavaScript (Node.js) | Back-end and API development | High performance, non-blocking I/O, flexible | Requires experienced developers for scalability | Powers trading APIs and real-time features like live trading updates. |

| React | Front-end development | Fast, reusable components, user-friendly UI | Limited to the view layer; needs other tools for full-stack development | Creates an intuitive and engaging interface for seamless user interaction. |

| PostgreSQL | Database for structured data storage | Highly reliable, ACID-compliant, scalable | Complex configuration for high loads | Ideal for storing user data, transaction history, and ensuring data consistency. |

| MongoDB | Database for unstructured data storage | Flexible, fast for large datasets | Less suitable for highly relational data | Handles unstructured or semi-structured data like user logs or wallet details. |

| Ethereum | Blockchain integration | Decentralized, supports smart contracts | High gas fees and slower transactions | Powers decentralized exchanges and facilitates crypto wallets and smart contracts. |

| Hyperledger | Private blockchain integration | Permissioned, high scalability, secure | Requires significant setup and maintenance | Suitable for enterprise-level, permissioned exchange platforms. |

Step 5: Design the User Interface

Create a simple and clean interface that’s easy for users to navigate. Users should be able to quickly find options to buy and sell cryptocurrencies. Use tools like React to make the app look modern and work smoothly on all devices.

Our experienced developers can help you select and implement the perfect technology stack for your cryptocurrency exchange.

Step 6: Develop the Back-End System

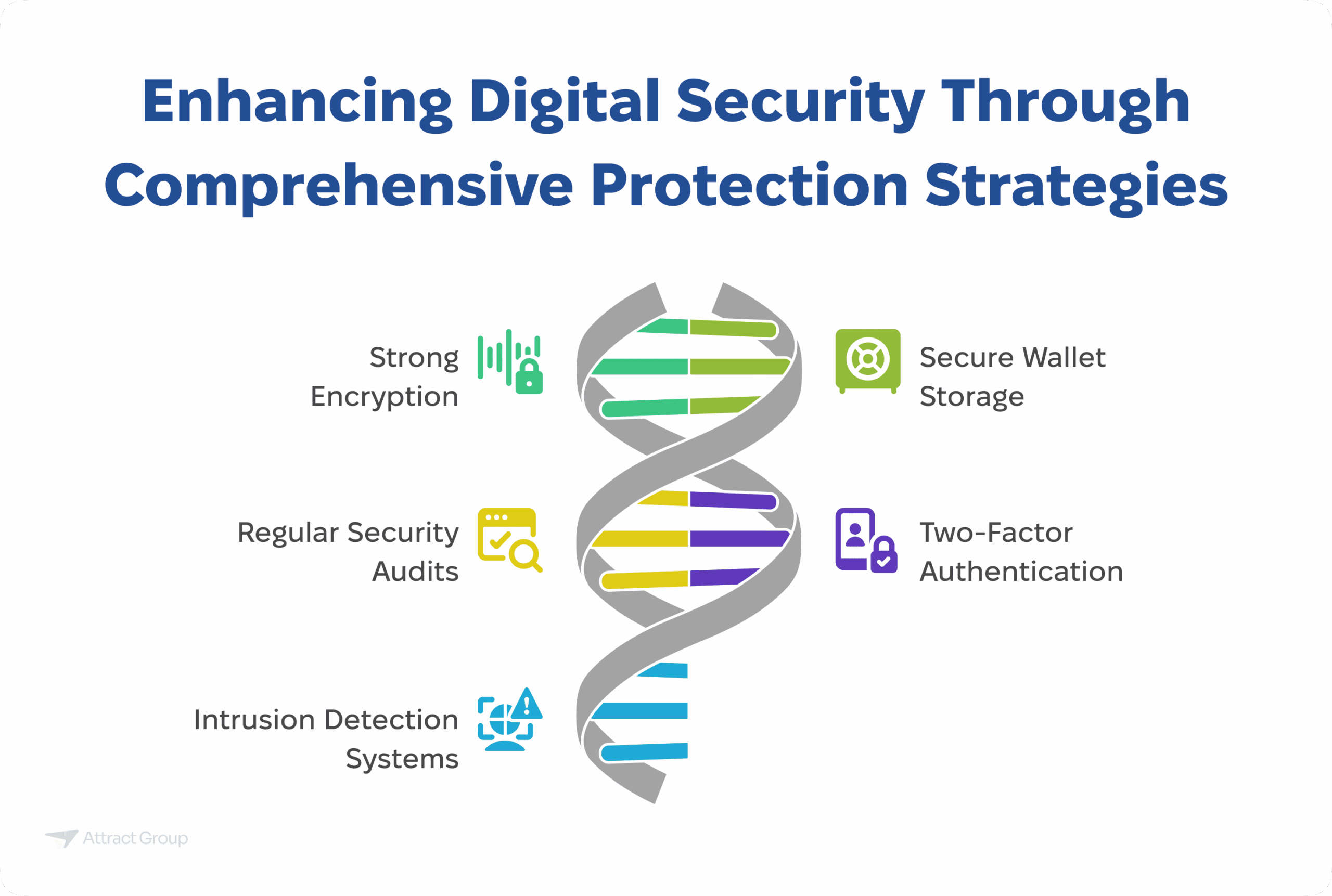

To protect user funds and sensitive information, implement the following security measures:

- Strong Encryption: Employ advanced encryption techniques to safeguard user data, including personal information, transaction history, and API keys.

- Secure Wallet Storage: Utilize secure, offline storage for cold wallets to minimize the risk of hacking attacks.

- Regular Security Audits: Conduct regular security audits to identify and address potential vulnerabilities.

- Two-Factor Authentication (2FA): Require users to provide an additional layer of security by using 2FA for login and withdrawal processes.

- Intrusion Detection Systems (IDS): Implement IDS to monitor network traffic and detect any suspicious activity.

- Regular Software Updates: Keep all software and hardware components up-to-date with the latest security patches.

- Incident Response Plan: Develop a comprehensive incident response plan to effectively handle security breaches and minimize damage.

Step 7: Integrate Payment Gateways and Wallet Solutions

To ensure seamless and secure transactions, focus on the following:

- Partner with Reliable Payment Gateways: Collaborate with reputable payment providers to enable users to deposit and withdraw funds using various methods, including credit/debit cards, bank transfers, and digital payment systems. Ensure these gateways comply with relevant regulations and security standards.

- Integrate Popular Digital Wallets: Allow users to store, send, and receive cryptocurrencies directly within the exchange platform by integrating with popular digital wallet providers. Consider offering both custodial and non-custodial wallet options to cater to diverse user preferences.

- Prioritize Security: Implement robust security measures, such as encryption, strong authentication, and regular security audits, to protect user funds and prevent unauthorized access.

- User Verification: Implement robust user verification processes, including KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, to comply with regulatory requirements and mitigate risks.

Leverage our cybersecurity expertise to build a robust, hack-resistant cryptocurrency exchange platform.

Step 8: Prioritize Security

Security is vital for your exchange. Add features like two-factor authentication, SSL encryption, and cold storage for user funds. Protect users’ private keys and make sure their assets are safe.

Step 9: Test Your App

Thorough testing is crucial to ensure a seamless user experience and prevent potential issues. Conduct a comprehensive range of tests, including:

- Functional Testing: Verify that all features, from account creation to complex trading strategies, work as expected.

- Performance Testing: Assess the app’s performance under heavy load to identify bottlenecks and optimize its scalability.

- Security Testing: Conduct regular security audits and penetration testing to identify and address vulnerabilities.

- User Acceptance Testing (UAT): Involve a group of users to test the app in real-world scenarios and provide feedback.

- Stress Testing: Simulate high-traffic conditions to evaluate the app’s ability to handle peak loads.

- Bug Fixing and Optimization: Continuously monitor the app’s performance and address any bugs or issues that arise.

Step 10: Launch the App

Once your exchange is fully developed and tested, it’s time to launch and market it:

- Soft Launch: Consider a soft launch to test the platform’s performance and identify any issues before a full-scale launch.

- Marketing Strategy: Develop a comprehensive marketing strategy to attract users and build brand awareness. Utilize social media, content marketing, email campaigns, and partnerships with influencers to reach your target audience.

- Listings and Partnerships: List your exchange on popular cryptocurrency listing platforms and partner with other exchanges to expand your user base.

Step 11: Maintain and Improve

After launch, monitor your app’s performance and listen to user feedback. Regularly update it to fix bugs, improve security, and add new features. Keep up with market trends to stay competitive.

This structured process ensures your cryptocurrency exchange app meets user needs while staying secure and reliable.

Partner with our seasoned development team to bring your cryptocurrency exchange vision to life, from concept to market.

Conclusion

Developing a cryptocurrency exchange app is a dynamic and rewarding journey, requiring a clear vision, thoughtful planning, and the right technologies. From choosing your business model to implementing robust security features, every step plays a critical role in delivering an exchange that meets user expectations and stands out in the competitive crypto market.

If you’re ready to turn your concept into a reality and need expert guidance in developing a secure and scalable crypto exchange, consider partnering with Attract Group. With a proven track record in innovative app development, we’re here to bring your vision to life.