How to Get Funding for an App Idea

4 May 2022

4 May 2022To develop an application, you often need more than an idea and motivation. But the main question that many young entrepreneurs ask is “how to get funding for my app?” In this article, we will talk about how to find investment for your dream and build the right approach to business.

9 sources to raise funds for a mobile app idea

Start-up capital is required, which is not always easy to get. You can use various sources to help you in this situation, including a loan and crowdfunding. But first, you will need to understand how do apps get funded.

1. Bootstrapping

Consider the main sources of funding for mobile app. First idea — is bootstrapping. Many young startups dream of receiving large funding from venture capital funds or business angels to create their own startup, program or an app. Very few succeed in this, even if the idea itself is very interesting and promising. In this case, bootstrapping can help.

This method can be defined as “a way to finance a company with your own money, without attracting external investments.” Most startups around the world that followed this path were trying to ensure that their idea grows into something more without the use of external investments. The founders of some of the biggest technology companies in the 20th and early 21st centuries used this method at the very beginning. For example — Apple, AppSumo, Craigslist, Facebook, Hewlett-Packard, Microsoft, Oracle and others.

It is challenging to build something like this without external investment, but it can be successful in the long run. It will ensure that you receive all the dividends and income from your startup. In the case of angel investors, you will be required not only to share the income, but also to share the control of your company.

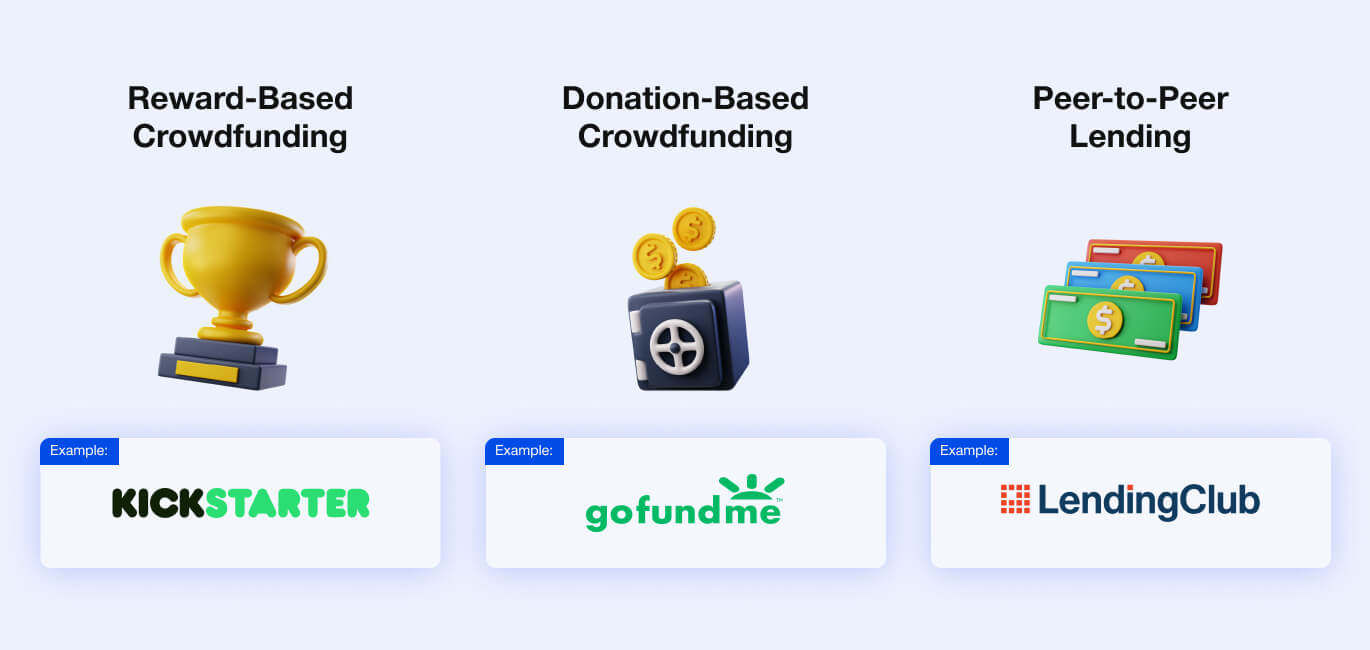

2. Crowdfunding

Crowdfunding is the implementation of the principle “every little bit helps”. The easiest way to describe it is “I have a very cool idea, but I don’t have enough money. Can someone help me?” External funding for mobile app development or any other project is generated by inviting donors with the opportunity to receive dividends from their donations, or on a completely non-reimbursable basis.

A prime example is a few years ago, Zack Brown, being a fan of potato salad, really wanted to make his own salad. He planned to raise about $10 to prepare this dish. As a result, he raised almost 50 thousand dollars. The most popular fundraising platform is Kickstarter. Here everyone can raise money to realize their crazy idea, create a video game or get funding for app development.

3. Personal network (friends and family)

Another option on how to get funding for an app is an investment from a close group of people. But it only works if your project is not too big and does not require a multi-million dollar investment.

You can raise money for any mobile app startup with the help of your friends or family members. In other words, borrow some money. Friends and family, unlike banks, will probably not set creditors on you.

4. Private investors

There are three main categories of private investment:

- Funded buyout — the company is bought out with borrowed funds

- Venture capital — investing in a project at an early stage. Typically, private investors are commonly referred to as “business angels”. Such investments can bring huge profits but are very risky.

- Growth capital — investing in established companies and start-ups, further growth and development.

Private investment is one of the ways to invest your own capital in order to make a profit. Private investors usually act only in their own interests and on their own behalf. Both citizens and legal entities interested in the project can invest.

5. Angel investor

Angel investors or business angels are wealthy individuals with extensive investment experience. It is a way to get funding for your app. Many people invest in the business ideas of newcomers, especially if such ideas are innovative. According to Investopedia, these investments are unpredictable and risky as upcoming markets lack risk statistics.

Business angels invest in many projects at the same time. Since most of them will fail and only one of the few will be able to make a profit that will pay off all the losses. So, Andy Bechtolsheim, one of the first angels of Google is now a billionaire.

Business angels usually invest their own money. The number of angels in the world is growing. They often unite in groups or networks in order to jointly participate in the search for promising projects. You can find such groups and sites where you can get funding for an app.

8. Venture capital investors

Venture investments are investments in growing businesses or start-ups, usually when the prospects and success of the companies are unknown. The main difference between such investments and conventional ones is the high risk. If a startup can find the right business model and does not make critical mistakes, it can become a major player in the market.

If successful, the venture capital for app development investment can pay off thousands of times. In the case of traditional investments, the investor receives a stable, but not super-high income, but the risks are much less.

Many start-ups cannot get a loan from a bank because they do not have sufficient assets for collateral. In this case, one of the very few ways to raise a lot of money for the startup is through venture capital funds.

7. Bank loans

Startup loans are characterized by uncertainty. It is impossible to prove one’s own income and future profits with certainty. Generally, banks do not agree to finance startups since it is a risky deal with a high probability of non-return on investment. Borrowers are often required to meet strict requirements, complexity and duration to obtain a loan. So, for most developers it is not an easy way to get funding for apps.

Small and medium-sized businesses that exist for at least 3-6 months have more chances. In this scenario, the money usually contributes to an already identified goal, there is evidence of profitability, and there are income reports. You can get such a loan in almost any bank, but you should take into account all the risks and problems of this method.

8. ICO and IEO

One of the ways to attract funding is cryptocurrency. Methods of raising capital through cryptocurrency are ICO (Initial Coin Offerings) and IEO (Initial Exchange Offerings).

Let’s look at one by one and compare them with each other:

- ICO — issuance by a project or company of its own money (tokens) in order to attract investment. Simply put, a company that raises money for its project through an ICO borrows money from the blockchain community. In a sense, the initial placement of tokens is similar to the launch of a project on the Kickstarter crowdfunding service. Almost any promising project can attract investments with an ICO. In the meantime, it is necessary to gain the trust of the blockchain community. It is important to publicly and factually prove the viability and prospects of the project.

- IEO — the initial exchange offer, as its name implies, is carried out on the platform of the exchange. Unlike ICO, IEO is managed by the exchange on behalf of a startup that is trying to attract investments through the issued tokens. Since the sale of tokens is carried out on the platform of the exchange, token issuers must pay a listing fee along with the percentage of tokens sold during the IEO.

IEO participants do not send money to a smart contract, as with ICOs. Instead, they must create an account on the platform of the exchange hosting the IEO. Members then deposit funds into their exchange wallets using coins, and use those funds to purchase the fundraising company’s tokens.

If we draw analogies with classic stocks, then investing in an IEO is like buying shares in a company on the New York Stock Exchange. Investing in an ICO compared to this is like buying a stake in a business through an ad in a newspaper for cash on receipt.

9. App Funding Contests

The last idea for funding for an app is the App Funding Contest. A large number of different organizations (universities, technology companies, networks of angel investors and others) hold similar competitions. They conduct them to implement their business ideas on the principle “I have an idea and money, I only need a performer.”

There are a large number of Internet resources where you can find lists of all ongoing competitions and take part in any of them.

Contact us today and let’s discuss securing funding for your innovative venture!

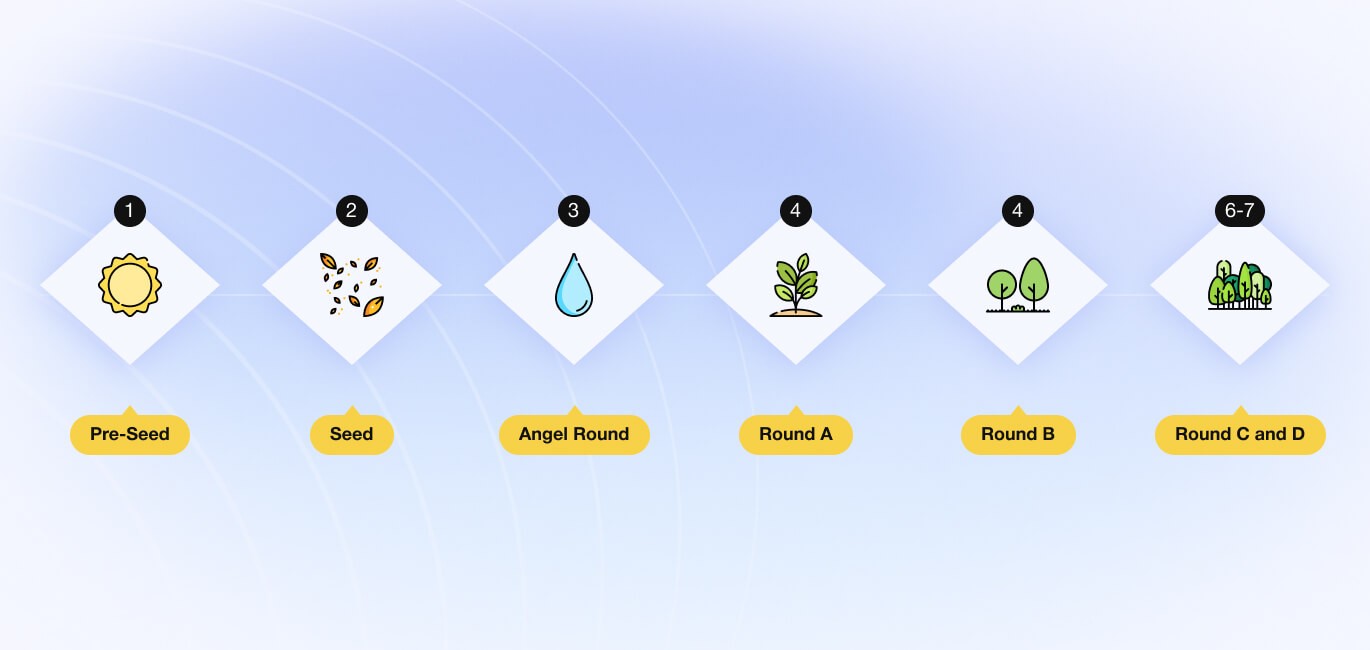

Startup Funding Stages

Investment rounds are called stages of project financing by investors. Each stage is characterized by certain criteria, tasks, type of investor, and amount of financing.

Rounds are divided into:

- early — pre-seed, seed, Round A, optionally, this may include angel funding;

- late — Round B, C, D and others.

The most risky are the early stages of startup development, as the risk of failure is very high and the prospects are unclear. Let’s look at each stage in a little more detail.

Pre-seed

The first stage of mobile app funding, which includes the development of your concept, hypothesis testing, and launch of your MVP. At this stage, the source of financing is usually developers’ own savings, as well as the so-called FFF triad — Friends, Fools, Family. For large projects, this is not enough, so we have to look for sources of external financing.

Seed

From this stage, the generally accepted classification of investment rounds begins. Seed funding for apps is considered the most challenging because it involves testing the business model, analyzing forecasts and results. At this stage, investors are usually business angels, startup studios, venture capital funds. This stage is also risky. The main reasons for failure include:

- wrong business model

- high competition

- consumer dissatisfaction with the product

- lack of funds

By investing in this round, the business lays the “seeds” for explosive growth in the future.

Angel round

This round is not always singled out separately as part of the previous round. This stage involves financing from a private investor — a business angel. In addition to financial assistance, angels often provide other support — useful links, mentoring, acting as mentors for founders.

Round A

Since there are only a few projects ready for this round, investors compete for attention from companies and developers. There is a business model in place with deep and proven sales channels, a strategy, and development plans in place.

At this stage, difficult negotiations are typical. The duration of the conclusion of the transaction can drag on for months. The average amount of funding is $1 million. For instance, Cloudflare closed this stage with $2.1 million. This stage is designed to continue rapid development, to take over a large portion of the target market.

Round B

Most startups approach this round with several trusted investors. The amount of financing at this stage differs, usually from 10 to 30 million dollars, which are spent on further scaling of the company. For example, the electronic payment system Square at this stage attracted 27.5 million. When evaluating a company at this stage, investors are guided by the dynamics of the project, business strategy, compliance with trends, and management efficiency.

Rounds C and D

It is worth noting that all letter investment rounds (A, D, C, D, and so on) have similar functions, structure, and tasks. The main difference between these stages is the type of securities offered. Series A offers Series A preferred papers, Series B offers B shares, and so on.

In the late stages C and D the company is actually preparing for an IPO (Initial Public Offering) or for selling itself to a strategic investor. As a rule, the amount of funding increases with each stage, but at later stages this rule may not be respected. The amount of funding as such at any stage depends on the scope and objectives of the project.

Steps to prepare an App to Become a Fund-Magnet

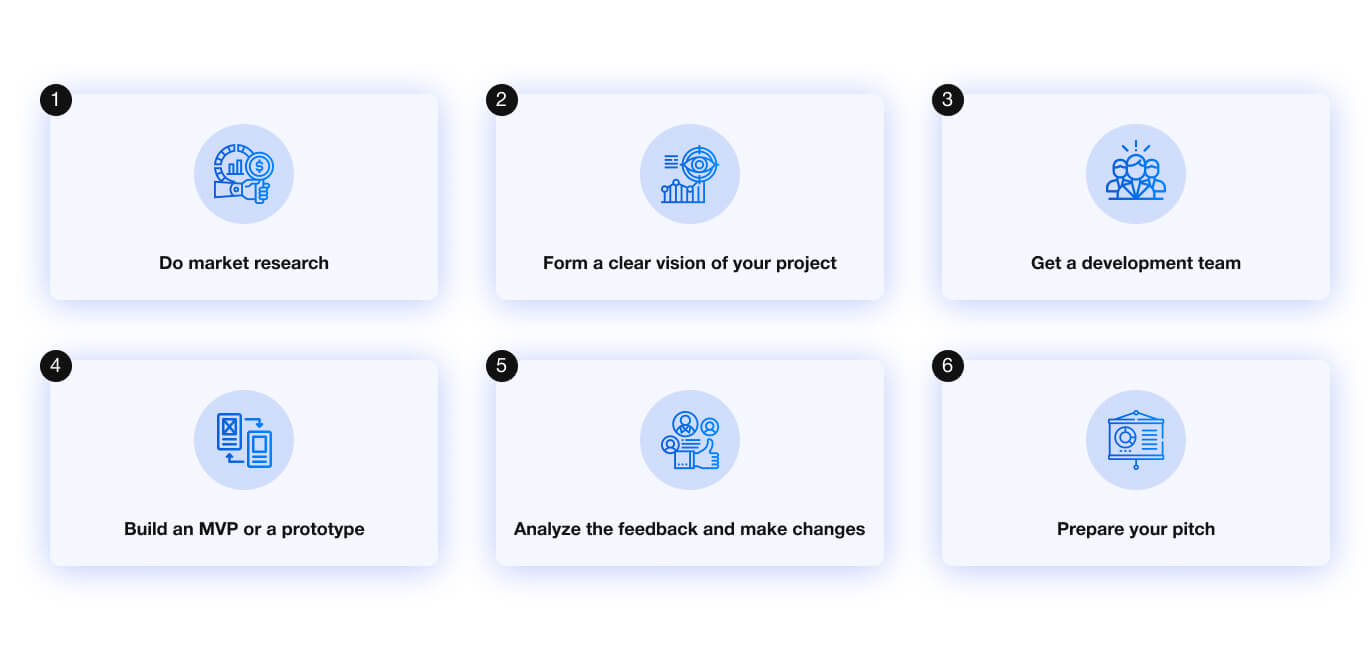

Looking at many apps today, such as Snapchat, Twitter or Instagram, many users get the feeling that it is not possible for an average person with no useful links or vast amounts of income to create something similar. Although there are certain difficulties in this field, a person who knows the right approach and prepares beforehand can succeed. First, we need to understand what steps you should take before launching an app:

- Do market research.

Market research — is an exploration of users’ behavior. What drives the customer to use or purchase the product? How do they act while using it and how can I gain their trust? Find out what people search for and how many of them are concerned about one problem. Come up with a solution for their issues by reading stories and comments on different apps. There are two types of research: primary and secondary. The first step involves determining needs and creating a working business model. The second — analyzing the weaknesses, opportunities and threats of your app. Secondary research also includes adaptation and development of working strategies. - Form a clear vision of your project.

After the research, take notes and analyze the needs of customers. Decide what exactly you want to build and how your project will be beneficial to similar ones. If you hesitate — take a management class or find a Product Manager. Hiring a specialist will prevent you from wasting time and money on failed projects. A specialist can also explain how to raise money for your mobile app startup. - Get a development team.

Before hiring a development team, determine what you want from them. What are they planning to focus on? Back or front end? Insights into UI or UX design? Who’s in charge of the team of programmers? Everyone in your dev team should clearly understand what their job is. You can hire people in your area or overseas. The only thing to remember is that with the second choice you will also need to take into account language barriers and time zones. - Build an MVP or a prototype.

Interactive digital prototype for an app — is a sketch, an idea, which will help to visualize future products. You can present your prototype to investors or stakeholders, so they can understand your vision and inform you whether this project has potential. MVP (Minimum Viable Product) — is a basic version of your digital product prepared specifically to collect feedback from users. With MVP development you can take notes on certain issues with your project, understand the needs of your target audience and steer your app in the right direction. With a prototype you can only fix technical issues, design flaws and present ideas to the public. On the other hand, MVPs are built to inform your team about the needs and preferences of the target audience. - Analyze the feedback and make changes (if needed).

Collect feedback from users. It can be made by clicking on the widget in the app itself or a website with a feedback form. - Prepare your pitch.

Pitch deck is a presentation of your project. It needs to be done in order to make users and investors understand the main goal of your project. It is an easy way to find investors for an app. In contrast to sitting alone trying to reach any contacts to promote your app, you can attract investors from big companies with the right pitch.

How to Calculate Investments for an App Startup

Valuation is important for founders and investors, because they expect that each side will get a fair deal. Calculating investments for an app startup is a tricky thing, and the result will never be 100% accurate. Here is the simplest way to calculate the costs for your project to start getting funding for an app:

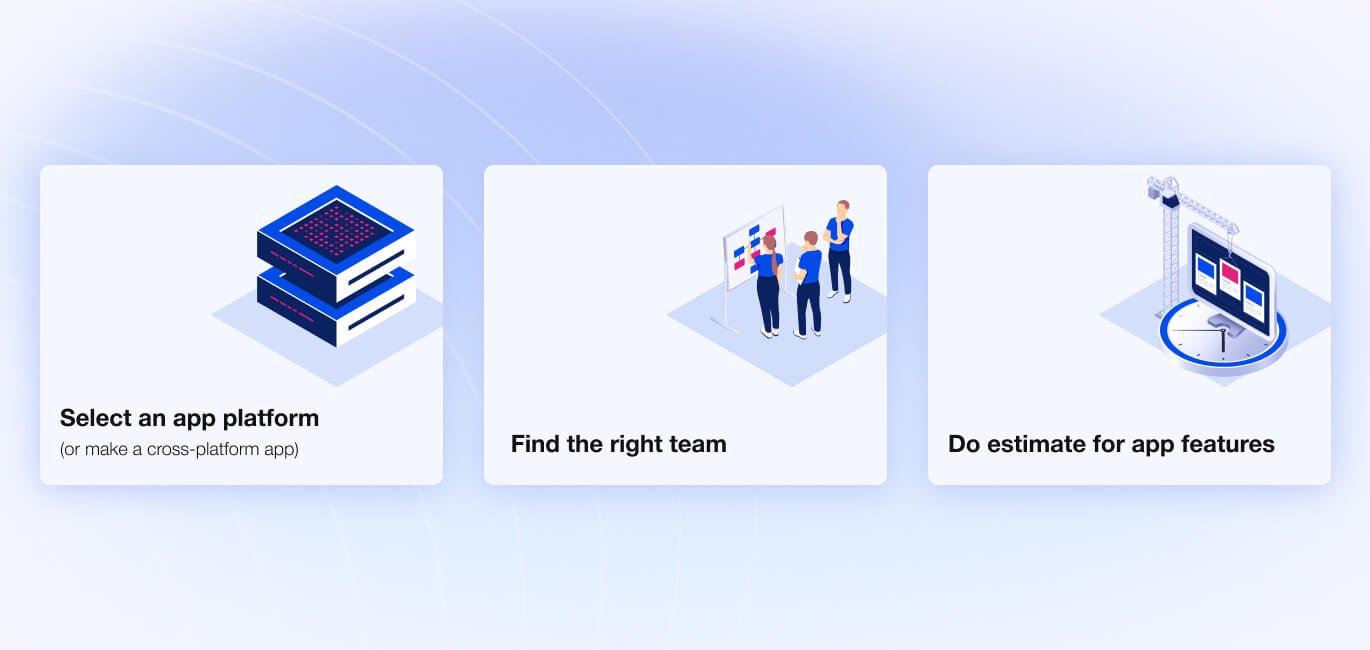

- Select an app platform (or make a cross-platform app).

You will have to decide what is best for your app: native development or cross-platform development. Native development is the creation of software that runs on only one platform (Android or iOS). So, for each platform you will have to build two separate apps. The main benefit of native development is that it can take full advantage of internal features of the device — camera, storage, compass, etc. The UI adapts to the user’s operating system, creating an app design that matches the device’s operating system.Cross-platform development running on one code base. It means that you don’t need to create two apps for different platforms. It is a universal tool with less time required for development.The cost of the second choice will be lower, requiring only one developer.

- Find the right team.

To build an app you will need more than one engineer in your team. Although it can be costly, the software development team will cover these costs in the future. According to Forbes, here’s how you can find people for your project: Understand the main goal behind your startup. Do you want to make more money, gain authority, or something else? With a clear purpose, you can find entrepreneurs online. By helping them to overcome their challenges, they can get interested in your project.If you don’t want to waste your time and money — hire a mentor who will take care of everything.

In searching for professionals for your startup, you can turn to several resources:- clutch

- dribbble

- upwork

- behance etc.

Search for freelancers — a simple post on social media or a website can sooner bring the right people to your team.

- Do estimate for app features.

The final cost of an app varies depending on different features. To estimate them, you will need to consider a variety of app development services. Here you can read about all necessary elements that will play a crucial role in the estimation of your startup: cost to design an app.

App funding: conclusion

Making the right business approach can make sure that the project of your dreams will not only remain in your dreams. First, to get app development funding, you will have to find a perfect idea for an app and get some reviews for your project. Even though you can do it yourself, the process may take years. It is unknown whether your idea will remain trendy and relevant as it is now. To eliminate the risk of failure, many aspiring entrepreneurs are getting help from a trusted collective of professionals.