How to Integrate Cryptocurrency Payments into Your Web App

11 December 2024

11 December 2024🔊 Listen to the Summary of this article in Audio

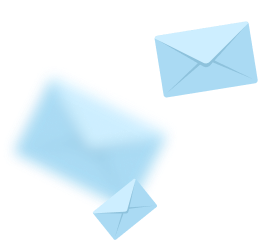

Cryptocurrency is quickly becoming a popular choice for businesses looking to expand their payment options. Integrating cryptocurrency into your web app can open new opportunities, improve speed, and reduce fees.

This guide walks you through the steps to seamlessly add cryptocurrency support, from understanding the basics to staying ahead of future trends.

Step 1: Understand the Benefits and Challenges

Adding crypto payments to your web app has many advantages, but it also comes with a few challenges. It’s important to know both so you can make the best decisions for your business. Here’s a quick look at the pros and cons.

| Benefits | Challenges |

|---|---|

| Lower fees than traditional methods. | Prices can change due to volatility. |

| Instant sending across borders. | You must follow local regulations. |

| No chargebacks to worry about. | Keeping wallets secure takes effort. |

Step 2: Choose a Cryptocurrency Payment Gateway

You need to pick the right gateway to approve digital payout. The gateway you choose will impact how you receive funds, manage fees, and support different methods. Look at your business needs and compare the options carefully.

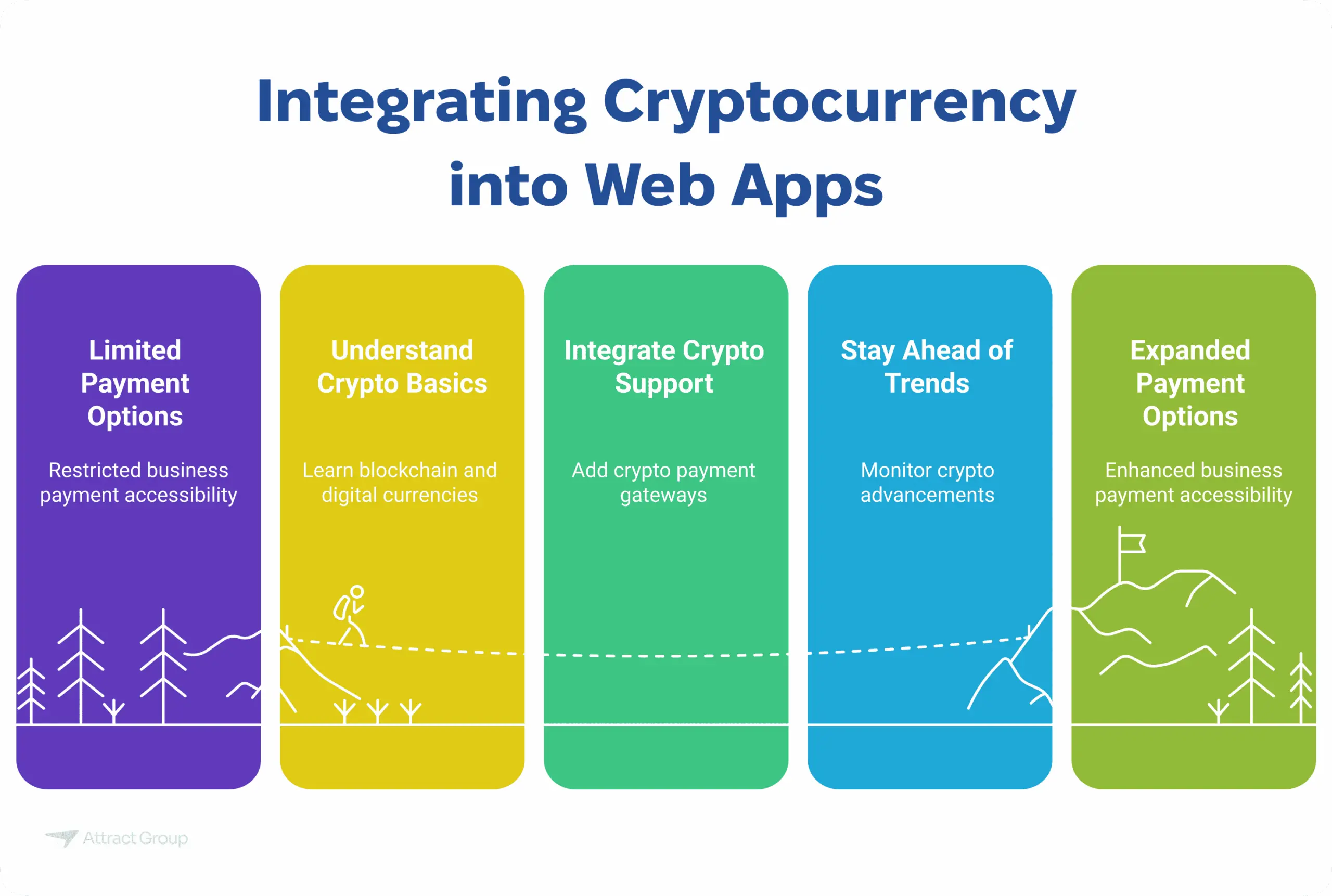

NOWPayments

NOWPayments supports over 300 cryptocurrencies and offers a simple setup for web apps like WooCommerce, Shopify, Magento 2, and more. It also offers a user-friendly interface with easy integration and provides non-custodial methods, ensuring you have full control over your funds.

It charges a 0.5% fee. An additional 0.5% fee applies if currency conversion is needed.

BitPay

BitPay provides instant conversion to fiat, so you needn’t worry about digital currency volatility. It integrates with platforms like Shopify, WooCommerce, and Magento.

BitPay is known for reliability and instant conversion to fiat currencies. Supports multiple cryptocurrencies, including Bitcoin. Provides features like invoicing and transaction buttons.

Charges a 1% fee. Additional fees may apply based on the volume.

Coinbase Commerce

Conibase Commerce makes it easy to approve Bitcoin and other digital currencies with seamless integration with platforms such as Shopify, WooCommerce, and Magento.

It also allows merchants to approve multiple digital currencies and provides features like invoicing and transaction buttons.

Coinbase Commerce charges a 1% fee with no additional fees.

Our expert developers can help you select and implement the most suitable gateway for your specific business needs.

Step 3: Create an Account and Set Up Your Wallet

To start getting digital currency, you need to set up an account and connect a wallet.

Sign Up

You need to start by creating an account with your chosen gateway. Go to their website and click on the sign-up button. Enter your details like email address, password, and business information. Verify your account if the gateway requires it.

Wallet Setup

After signing up, add your cryptocurrency wallet to the platform. Choose whether you want to use a personal or business account. This is where you will store the funds in digital form after you receive them. Make sure your storage method is secure and works well with the blockchain network your gateway supports.

API Key Generation

Log in to your transaction gateway dashboard to generate an API key. This key helps your app communicate securely with the gateway. You will use the API to process transactions and connect decentralized systems, which offer more flexibility than traditional settlement methods like those tied to central bank digital currencies.

Step 4: Integrate the Payment Gateway into Your Web App

There are two main methods to integrate a gateway into your web app: using plugins or extensions and custom integration via API. Here’s a step-by-step guide for both methods.

Using Plugins or Extensions

This method is simple and works well if your web app uses platforms like WooCommerce or Shopify.

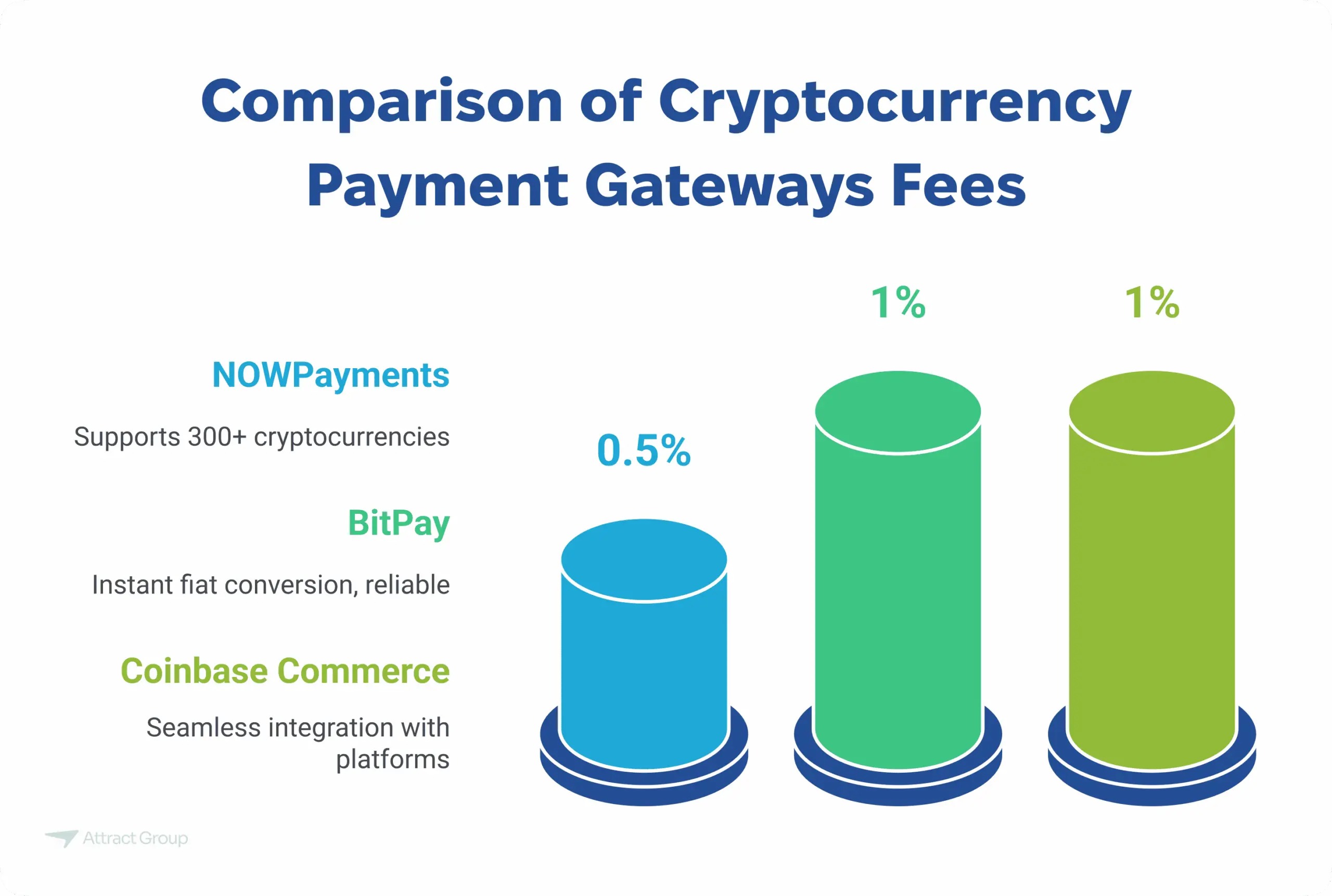

WooCommerce Plugin

- Go to the WooCommerce plugins section in your admin panel.

- Search for a plugin that supports virtual currencies.

- Install and activate the plugin.

- Go to the plugin settings and add your addresses.

- Configure other options like the cryptocurrencies you want to approve and how to display details to users.

- Save your settings, and your gateway will be ready to process transactions.

Shopify Integration

- Log in to your Shopify dashboard and go to the app store.

- Search for a crypto transaction app compatible with Shopify.

- Install the app and follow the setup instructions provided by the app developer.

- Link your cryptocurrency to the app.

- Set up your virtual currencies and other preferences.

- Once done, your Shopify store will support digital transactions.

Custom Integration via API

This method gives you more control but requires programming knowledge. It is useful for custom-built web apps.

1: Read Documentation

Start by reviewing the API documentation from your gateway partner. It explains how to send requests, handle responses, and manage errors.

2: Implement API Calls

- Write code in a language like JavaScript or Python.

- Use the API to send requests for creating transactions, checking their status, and confirming them.

- Store important transaction data securely, like the amount and address.

3: Handle User Permissions

- If you allow users to pay using wallets like MetaMask, integrate the it into your app.

- Request permissions from users to access their peer-to-peer.

- Ensure users can approve transactions without relying on an intermediary or financial institution.

4: Test Your Integration

Run test transactions to check that the system works properly. Confirm that transactions reflect accurately and users get clear notifications.

Whether you need custom API integration or plugin setup, our development team can ensure a smooth, secure implementation of cryptocurrency payments in your web application.

Step 5: Configure Payment Settings

Once you’ve integrated the gateway, you need to configure the settings to ensure smooth transactions.

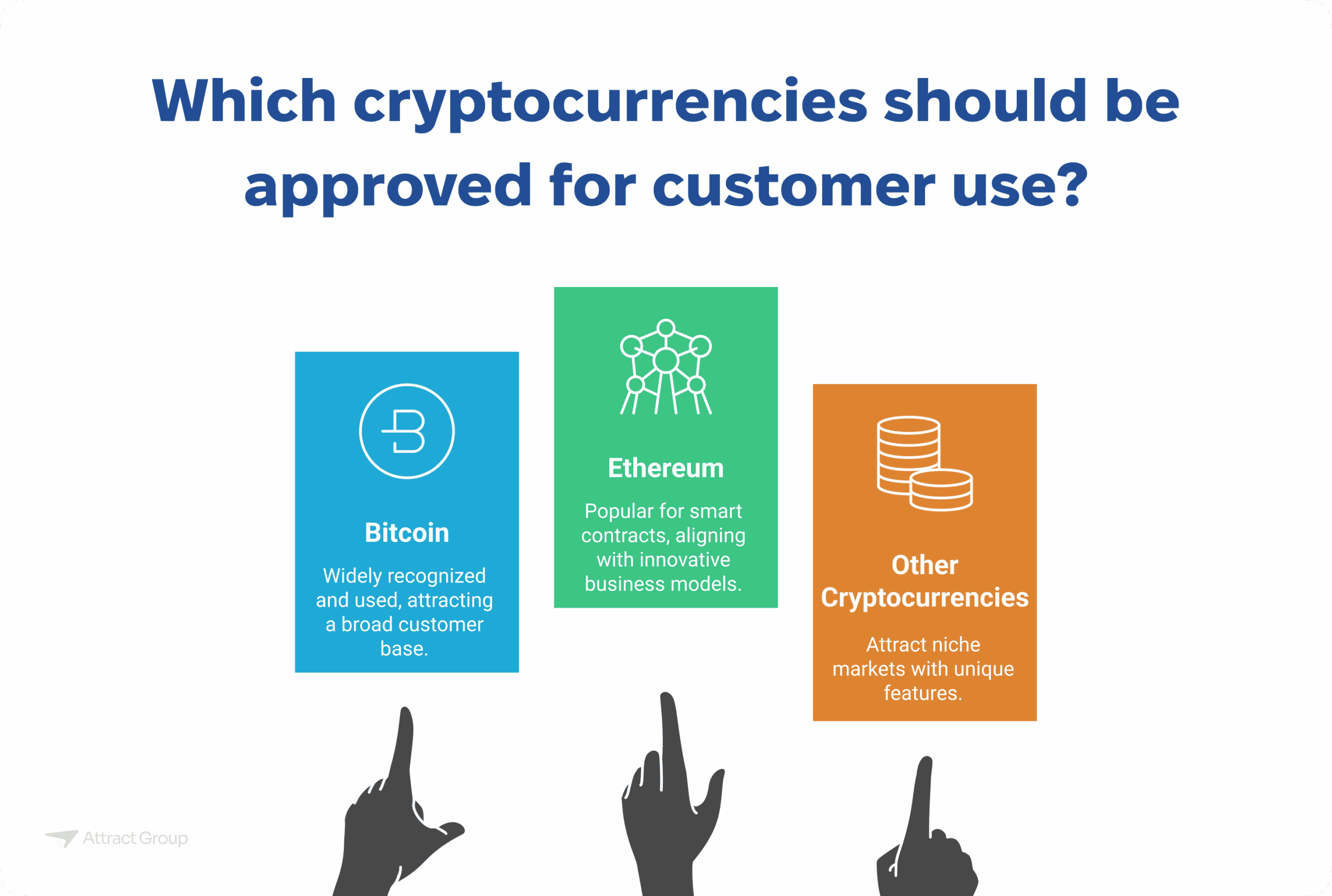

Accepted Cryptocurrencies

Decide which cryptocurrencies to approve. Choose options that your customers are likely to use, like Bitcoin or Ethereum. You can also add other popular cryptocurrencies to attract more users. If cryptocurrencies use features that align with your business model, include them in the list.

Payment Notifications

Set up webhooks or Instant Transaction Notifications (ITNs) to get real-time updates. These alerts help you track transactions as they happen. Use your transaction gateway dashboard to configure these notifications. This step ensures you stay informed without needing a centralize monitoring system, keeping the process flawless.

Security Measures

Enable two-factor authentication (2FA) for your account. This adds an extra layer of security to protect your funds. Regularly monitor transactions to detect any suspicious activity. The decentralized nature of cryptocurrencies provides security, but you still need to regulate access to your account. Even though cryptocurrencies differ from traditional fiat currency or CBDC systems, maintaining strong security practices is essential.

Step 6: Test Your Integration

Testing your integration is a crucial step to ensure everything works correctly before you go live.

Use Testnets

Most gateways offer test networks. These let you simulate transactions without the need for real funds. Use these tests to check how transactions flow through your app.

Simulate Real Transactions

Create sample transactions to see if users can complete transfers smoothly. Ensure that funds reflect correctly in your wallet and on your gateway dashboard. This step is essential since cryptocurrencies may function differently compared to traditional settlement systems.

Check Notifications

Verify that notifications are working as expected. Real-time updates should reach you whenever a transaction is completed. This helps you identify any delays or errors in the process.

Review Security Features

Ensure your system blocks fraudulent activities during testing. Confirm that two-factor authentication and other security measures are working. Decentralization reduces risks, but thorough checks are still necessary.

Test User Experience

Ask a team member or friend to make payments as a user. They can help you spot any issues or confusion during the process. Make sure the interface is clear and easy to follow.

Test Multiple Cryptocurrencies

If you accept several cryptocurrencies, test each one. Ensure that payments work regardless of the digital currency used. Check how your app handles the issuance of payment confirmations for every currency.

Step 7: Ensure Compliance with Regulations

Following regulations is essential to avoid legal issues when handling cryptocurrency transactions.

Research Local and International Regulations

Learn about the rules for cryptocurrency and digital currency in your country. Check how they regulate digital transactions. Look at international laws if you plan to accept payments from other countries.

Implement KYC and AML Policies

Add Know Your Customer (KYC) processes to verify user identities. Use Anti-Money Laundering (AML) tools to monitor for suspicious activity. These steps help you ensure that your crypto transactions are legitimate and comply with regulations.

Consult Legal Experts

Talk to a lawyer who specializes in cryptocurrency and digital currency laws. They can guide you on setting up your business legally. This ensures your use of digital wallets and cryptocurrency transactions meets all required standards.

Stay Updated on Evolving Laws

Keep track of changes in laws as the future of digital currencies develops. Regulations often change as governments learn more about crypto. This helps you stay compliant and avoid unexpected issues.

Worried about the legal complexities of cryptocurrency integration? Our team provides comprehensive support to ensure your digital payment solution meets all regulatory requirements.

Step 8: Stay Ahead with Future Trends

Staying updated on trends in cryptocurrency and digital money helps you keep your payment system competitive.

- Central Bank Digital Currencies (CBDCs): Governments are exploring CBDCs as a secure alternative to traditional cash. As CBDCs roll out, they may coexist with cryptocurrencies, offering new payment options. Prepare by staying informed about CBDC developments and ensuring your systems can adapt to hybrid digital money solutions.

- Advancements in Blockchain Technology: Blockchain is becoming more efficient and scalable, making digital currency transactions faster and cheaper. Expect improvements in decentralized systems, enabling businesses to offer seamless peer-to-peer payments. Keep your app updated to integrate these innovations.

- Mainstream Adoption of Cryptocurrencies: More businesses and customers will use cryptocurrencies, similar to cash transactions today. As this adoption grows, focus on supporting diverse currencies and optimizing your system for high transaction volumes.

As cryptocurrency continues to evolve, partner with a development team that stays ahead of the latest trends and technologies in digital payments.

Conclusion

Integrating digital currencies into your web app opens doors to new opportunities and broader audiences. By following these steps, you can confidently embrace the future of digital commerce and enhance your business capabilities.

At Attract Group, we pride ourselves on delivering innovative solutions and unmatched expertise. Our dedicated team works tirelessly to help businesses like yours succeed in the digital economy. Partner with us today to unlock your potential and lead your industry forward!