🔊 Listen to the Summary of this article in Audio

The rise of e-commerce has seen a parallel increase in the need for reliable marketplace payment solutions that can effortlessly bridge the gap between convenience and security. As online marketplaces flourish, they require payment solutions that are not only smooth and secure but also adaptable to an ever-globalizing customer base. Among the top contenders in this space, PayPal, Stripe, and Square offer sturdy platforms replete with features tailored to both buyers and sellers. Whether you’re in the nascent stages of launching an online marketplace or looking to upgrade your current payment system, choosing the best payment solution is a pivotal decision. This guide lay the groundwork to navigate the nuances of online marketplace payment solutions and aid in your decision to find the ideal match for your business needs.

Key Takeaways

- Necessity of selecting a secure and user-friendly marketplace payment solution.

- PayPal, Stripe, and Square lead the pack with their specialized features for online transactions.

- Consideration of global reach, currency support, and fees when choosing a payment platform.

- The critical role of payment solutions in facilitating international e-commerce.

- Understanding the balance between comprehensive services and cost-effectiveness in payment solutions.

- The importance of scalability and integration capabilities in marketplace payment systems.

Understanding Marketplace Payment Solutions

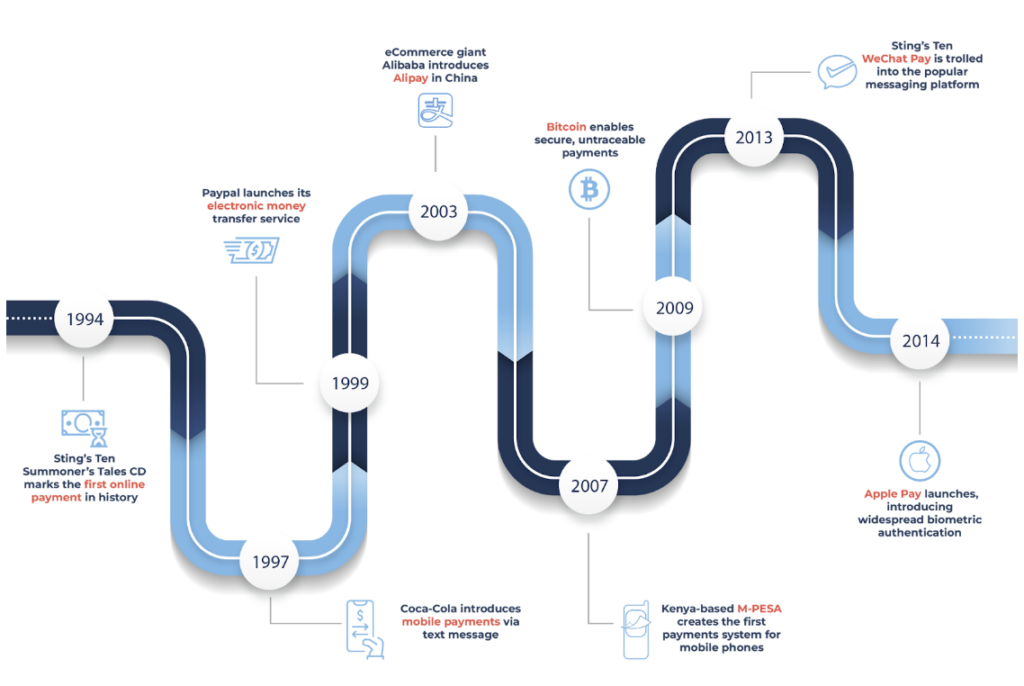

As the digital marketplace continues to expand, the role of efficient and secure payment solutions for marketplace transactions becomes increasingly pivotal. These solutions are the engine room of any e-commerce platform, powering each transaction with reliability and trust. With multiple options at the disposal of marketplace owners, it is crucial to engage a methodical approach how to choose payment method for marketplace operations, considering fees, geographical reach, and customer preferences. A comprehensible introduction to these solutions can be instrumental in propelling a marketplace toward its zenith of user satisfaction and financial success.

The Importance of Payment Solutions in Online Marketplaces

Online marketplaces are modern-day agoras where commerce flows ceaselessly thanks to the backbone of marketplace payment solutions. These platforms facilitate transactions across borders with the pressing of a few buttons or the swipe of a screen. The diverse array of payment methods ensures an inclusive environment for global commerce. In selecting the right gateway or processor, marketplace owners must weigh the need for wide-reaching services like PayPal against transaction fees, and the ability to handle mobile payments — a now indispensable facet of online shopping.

Speak to our payment technology specialists for a free consultation on choosing and integrating the right payment solution for your online marketplace.

Different Types of Marketplace Payment Solutions

The e-commerce ecosystem is brimming with diverse payment solutions tailored to enhance the shopping experience. Understanding the variety available helps marketplaces to select systems that align with their unique requirements and customer needs.

Payment Gateways

Payment gateways are the digital checkpoints that securely carry transaction details from the point of sale to the processing network. They’re an essential layer of the marketplace infrastructure, safeguarding customer information and ensuring compliance with financial regulations. Marketplaces often turn to renowned gateways like Braintree or Adyen for their reliability and expansive feature sets.

Merchant Accounts

Essential to any marketplace’s financial framework are merchant accounts. These specialized bank accounts hold funds from sales temporarily, acting as a necessary waypoint between transaction and payout. They provide marketplaces with the ability to manage earnings, refunds, and cash flow with heightened control and oversight.

Integrated Payment Solutions

For marketplaces looking for a comprehensive service package, integrated payment solutions offer a combination of gateway services, merchant accounts, and additional tools under one umbrella. This holistic approach simplifies setup and management, streamlining the path from storefront to financial institution.

Peer-to-Peer (P2P) Payment Systems

Promoting direct financial engagement between users, P2P payment systems are gaining traction within the marketplace domain. They foster a sense of community by facilitating immediate transactions between peers, bypassing traditional banking systems and often minimizing associated fees. These systems have redefined convenience and accessibility in e-commerce.

As marketplaces continue to evolve, the integration of diverse payment methodologies, each with their own set of benefits and considerations, becomes increasingly critical. Merchants must weigh factors such as international currency support, transaction cost, payment speed, and user preference to establish the most suitable, secure, and streamlined payment infrastructure. Choosing the right mix can significantly impact a marketplace’s operability and reputation in the digital space.

Clarifying Misconceptions: Apple Pay and Google Pay in Marketplace Transactions

In tackling the dynamic world of online marketplaces, grasping the role and mechanisms of contemporary payment options like Apple Pay and Google Pay is imperative. These powerful players are not just reshaping consumer experience with their cutting-edge technology but are also offering marketplace operators unparalleled efficiencies in managing financial transactions. Let’s explore the invaluable contributions these mobile wallet pioneers bring to marketplace ecosystems, and how their integration facilitates seamless marketplace transactions.

The Role of Apple Pay and Google Pay as Payment Methods

Adding Apple Pay and Google Pay as viable payment options within your marketplace imparts a level of convenience and sophistication demanded by today’s mobile-centric consumer. With a large swath of customers opting for Apple’s and Google’s ecosystems for their daily digital interactions, the inclusion of these payment pathways can vastly improve transactional experiences on your platform.

How Apple Pay and Google Pay Work with Payment Solutions

Integration of mobile wallets like Apple Pay and Google Pay into marketplace payment systems is facilitated through APIs and software development kits (SDKs) provided by these services. They allow for secure and encrypted transactions, leveraging tokenization to ensure sensitive card information is never directly exposed to the marketplace’s servers, thereby bolstering security while providing a frictionless payment experience.

The Benefits of Including Apple Pay and Google Pay in Your Marketplace

Marketplace operators who include these payment methods can look forward to a raft of benefits. Most notably, they enhance the checkout process, effectively reducing cart abandonment rates with their rapid, one-tap purchase capabilities. Additionally, the inherent security features built into Apple Pay and Google Pay can help reduce instances of fraud, building trust with users and promoting loyalty.

Integrating Mobile Wallets Like Apple Pay and Google Pay into Marketplace Payment Systems

The process of integrating these mobile wallets into your marketplace is designed to be streamlined. It requires an understanding of your existing payment infrastructure and the capability to implement changes according to the specific guidelines offered by Apple and Google. Doing so ensures that the end user benefits from a seamless and highly secure payment method that is aligned with their lifestyle and preferences.

- Enhanced security with tokenization technology and biometric authentication

- Increased conversion rates due to simplified checkout processes

- Better user experience, leveraging the widespread popularity of Apple Pay and Google Pay

The strategic implementation of Apple Pay and Google Pay is not simply a matter of keeping up with trends, but a thoughtful advancement towards a more inclusive and robust mobile wallet integration for marketplace transactions.

Assessing Your Marketplace Needs

As online marketplaces scale, the importance of choosing a payment solution that aligns with various operational factors cannot be overstated. Recognizing the critical junctures of customer preferences, transaction security, and the need for adaptability is essential in laying a robust financial foundation for your business’s virtual marketplace. Taking a strategic approach to assess these attributes will be pivotal to your marketplace’s ability to facilitate transactions effectively and grow sustainably.

Evaluating Marketplace Size and Transaction Volume

The selection of a payment solution begins with a clear assessment of your marketplace’s size and typical transaction volume. The ability to handle high volumes without compromising performance is key, especially during peak shopping periods. Scalability should be a defining feature of the chosen platform to ensure it can grow with your marketplace. Solutions that cater to both small businesses and larger enterprises often provide the flexibility needed for dynamic marketplaces.

Supporting Multiple Currencies and Payment Methods

With the globalization of e-commerce, multi-currency support is no longer a luxury — it’s a necessity. Ensuring that your payment solution can handle a variety of currencies and payment methods will cater to an international customer base, providing them with a seamless shopping experience. Crucially, the adaptability of a payment platform to accommodate local payment preferences across regions can make or break the international user experience.

Understanding Your Customers’ Payment Preferences

Customer payment preferences can vary widely, influenced by factors such as geographical location and demographic. Offering a variety of payment methods, from credit cards to digital wallets, can help capture a broader audience and reduce cart abandonment rates. Moreover, paying attention to emerging payment trends ensures that your marketplace remains aligned with consumer demands and expectations.

Security and Fraud Protection Requirements

The backbone of any payment solution is its security infrastructure. As financial fraud continues to evolve, so should the fraud protection capabilities of your payment platform. A payment solution must offer robust protection mechanisms, including encryption and tokenization, to ensure that customer data is handled with maximum security, preserving trust and integrity within your marketplace.

Scalability and Flexibility Needs

An online marketplace must anticipate future growth and changes in e-commerce trends. Selecting a payment solution that offers scalability and flexibility ensures your marketplace can adapt to new market demands without sacrificing performance or user experience. This includes easy integration with other business systems, an ability to manage an increasing number of transactions, and the capability to expand to new markets with minimal disruptions.

Conducting a thorough assessment of these critical areas is not just a preliminary step but a continuous process that requires attention to detail and foresight. The right payment solution not only meets your current marketplace needs but also supports its future trajectory, paving the way for sustained success in the competitive world of e-commerce.

Our development team has extensive experience with integrating various payment solutions. Get a quote for seamless payment integration services.

Research and Analysis of Popular Marketplace Payment Solutions

Selecting the appropriate payment solutions for an online marketplace involves a complex analysis of various providers, each with distinctive advantages and limitations. In this exploration, we delve into the offerings of some of the most reputed solutions including PayPal, Stripe, Adyen, Square, Shopify Payments, and Amazon Pay. An examination of their features, benefits, and costs will illuminate the intricacies behind the choice of an optimal payment partner for marketplaces.

PayPal: Overview, Pros/Cons, Costs, Popular Marketplaces Using It

PayPal stands as one of the most recognizable names in the online payment landscape with a significant presence in over 200 countries. It is lauded for its buyer and seller protection, as well as its ability to handle transactions in 25 currencies. However, it’s not without its downsides, namely higher fees and slower fund transfers compared to some of its competitors.

Stripe: Overview, Pros/Cons, Costs, Popular Marketplaces Using It

Stripe has emerged as a popular payment gateway known for its competitive rates and a strong set of integration options, making it highly attractive for tech-savvy marketplaces. Stripe’s key challenges are its availability in only 42 countries and its support for a limited range of currencies, possibly posing a limitation for marketplaces with a broader geographical user base.

Adyen: Overview, Pros/Cons, Costs, Popular Marketplaces Using It

Adyen offers a seamless payment experience and powerful analytics for businesses desiring a global reach, with support for various payment methods. The platform’s fees and pricing structures are competitive but may be challenging for smaller marketplaces to absorb without significant volume.

Square: Overview, Pros/Cons, Costs, Popular Marketplaces Using It

With a strong emphasis on mobile payments, Square caters to marketplaces with a high mobile user base. However, similar to Stripe, Square’s main drawback is its limited availability in a few countries, potentially hindering its appeal to businesses with an international customer base.

Shopify Payments: Overview, Pros/Cons, Costs, Popular Marketplaces Using It

Shopify Payments integrates seamlessly with the Shopify e-commerce platform, offering convenience and streamlining for merchants. While providing a smooth experience for Shopify users, those on other platforms may find its use limited.

Amazon Pay: Overview, Pros/Cons, Costs, Popular Marketplaces Using It

Amazon Pay leverages the trust and familiarity associated with the Amazon brand, offering a convenient payment solution for consumers. It simplifies transactions by allowing Amazon users to use their stored account details, but its integration and fee structure may not align with all marketplace models.

An analysis of payment solutions indicates that each contender brings unique strengths to the table. Marketplaces must consider their specific needs, weighing the importance of global reach, currency support, fee structures, and integration ease. The selection process should be data-driven and user-focused, ensuring that the final choice not only aligns with the marketplace’s values but also with its user demographics and operational scale.

Still unsure which payment solution best fits your needs? Book a call with our team of payment specialists for tailored advice.

How to Integrate a Payment Solution into Your Marketplace

Integrating a payment solution into your online marketplace is a substantial move towards enhancing its operational efficacy and user experience. With a strategic approach toward payment solution integration, you can streamline the transaction process and fortify the security that is vital for maintaining customer trust. Below we present a step-by-step guide to navigating the complexities of payment integration, addressing common payment integration challenges, and implementing necessary security measures to safeguard your platform and its users.

Step-by-Step Guide to Payment Solution Integration

Embarking on the journey of payment integration begins with a firm plan and a clear set of objectives. We’ve outlined a concise guide to assist you through this critical phase:

- Identify Your Requirements: Assess your marketplace’s specific needs, considering factors such as transaction volume, international sales, and preferred payment methods.

- Select a Suitable Payment Solution: Choose a payment solution that aligns with your needs, emphasizing compatibility, features, and cost-effectiveness.

- Partner With the Payment Provider: Engage in discussions with your chosen provider to understand their integration process and support services.

- Set Up Merchant Accounts: If necessary, set up merchant accounts as required by the payment solution to manage the flow of funds.

- Integrate APIs or SDKs: Work with your development team to implement the payment solution’s APIs or SDKs into your marketplace’s architecture.

- Run Integration Tests: Conduct thorough testing to ensure that the payment solution works correctly within your marketplace.

- Go Live: After successful testing, deploy the payment solution on your live marketplace, and monitor its performance closely.

- Feedback and Optimization: Collect feedback from users and analyze performance metrics to optimize the payment process continually.

Common Challenges During Payment Integration and How to Overcome Them

During the integration process, you may encounter hurdles that can impede progress. It’s crucial to anticipate these challenges and prepare to address them effectively:

- Compatibility Issues: Ensure that your marketplace’s existing infrastructure is compatible with the payment solution. Engage with technical support from the provider to navigate any challenges.

- Regulatory Compliance: Stay informed about the regulatory requirements related to payments in all active markets to avoid legal pitfalls.

- Security Concerns: Prioritize the implementation of security protocols, such as encryption and tokenization, to protect sensitive data.

- User Experience: Design the integration with the user’s convenience in mind, maintaining simplicity and ease of use throughout the transaction process.

- Technical Glitches: Allocate resources for troubleshooting potential technical issues, such as bugs or downtime, during and after integration.

Testing and Ensuring the Security of Your Payment Integration

Before unveiling the payment solution to your user base, a rigorous testing phase is imperative. This assures the functional robustness of the system and upholds security standards:

- Unit Testing: Verify that individual payment components perform as expected in isolation.

- Integration Testing: Check the interoperability of the payment solution with other marketplace systems, ensuring seamless interactions.

- Security Audits: Conduct comprehensive security checks to detect vulnerabilities, with a focus on data protection and fraud prevention mechanisms.

- Performance Testing: Evaluate the payment system under varying loads to ensure it can handle peak transaction volumes without degradation.

- User Acceptance Testing (UAT): Obtain feedback from a representative user group to confirm that the payment process meets their expectations.

Employing these steps diligently paves the way for a secure and efficient payment integration into your online marketplace. It’s a strategic investment that can significantly elevate the checkout experience and foster long-term loyalty among users.

Legal Considerations and Compliance in Marketplace Payments

In the sprawling digital marketplace, legal considerations and compliance are cornerstones of sustainable e-commerce practices. Paramount among these are matters such as PCI compliance, international payment laws, and data protection. Ensuring rigor in these areas is less about mandatory adherence and more about solidifying the integrity and trustworthiness of the marketplace. It’s about choosing to uphold not just the letter, but the spirit of the law, thereby providing a safe harbor for commerce in an often turbulent digital sea.

Understanding Payment Card Industry (PCI) Compliance

PCI compliance is not just a set of guidelines but a fundamental part of a marketplace’s blueprint for secure transactions. It involves a robust framework designed to protect cardholder information and stave off data breaches. This compliance is a continuous process, involving regular audits and updates to safety protocols in alignment with the Payment Card Industry Data Security Standard (PCI DSS). As such, marketplaces must ensure encryption, access control, and firewall protections are robust and up-to-date.

Navigating International Payment Laws and Regulations

The international stage is a mosaic of payment laws, each region with its own set of rules governing transactions. Marketplaces must therefore remain agile, attuning their operations to the unique regulatory environments of each country they serve. This agility involves understanding and implementing measures to comply with international payment laws, from anti-money laundering statutes to consumer protection regulations. Consistent vigilance and adaptation to these laws ensure that marketplaces operate without legal friction across borders.

Data Protection and Privacy Laws

With data breaches making headlines and privacy concerns on the rise, adhering to data protection laws is more than a legal formality — it’s a commitment to the marketplace community. These laws govern how personal information is collected, stored, and shared. Privacy regulations such as GDPR in Europe have set a high standard for data handling, compelling marketplaces worldwide to elevate their data protection practices. In the US, the California Consumer Privacy Act (CCPA) provides a similar framework. Earnest adherence to these laws is tantamount to earning and maintaining consumer trust.

User Experience and the Impact of Payment Solutions on Marketplace Success

Online marketplaces that prioritize user experience orchestrate the customer’s journey from browsing to purchasing with seamless integration of payment solutions. It is the finesse in execution of a streamlined checkout process that augments conversions and fosters enduring customer trust and retention. In the realm of digital transactions, mobile payments act as a catalyst in upholding the efficacy and convenience necessary for the flourishing mobile commerce sector, attracting a customer base that is ever-evolving and technologically discerning.

Streamlining the Checkout Process

In the current competitive landscape, the online marketplace’s checkout process is a critical facet of the overall user experience, frequently determining the success of conversions. A streamlined checkout process not only minimizes friction but also reduces the steps and time required to complete a purchase, directly influencing customer satisfaction and retention rates.

The Role of Payment Solutions in Customer Trust and Retention

Cultivating customer trust is a central objective for marketplaces, and a responsive, secure payment solution is fundamental in achieving it. Payment solutions that incorporate advanced fraud protection and encryption build a layer of credibility essential for retaining customers, who will return to a platform that upholds their financial security with unwavering diligence.

Mobile Payments and the Rise of Mobile Commerce

As mobile commerce emerges as a dominant force in the e-commerce arena, the need for marketplaces to support mobile payments has never been more paramount. Offering convenient and mobile payment options that integrate smoothly with user interfaces caters to the mobile-savvy consumer, assuring them of agile and secure transactions from virtually any location.

The imperative for online marketplaces to not just implement but continually enhance their payment solutions remains clear. In doing so, they ensure an ever-improving shopping experience, encompassing a gamut of modern conveniences that today’s discerning customers have come to expect.

Future Trends in Marketplace Payment Solutions

As we stand on the cusp of a new era in marketplace payment solutions, the horizon is alight with innovative trends. These advances are poised to redefine the mechanisms of online transactions and elevate the level of trust and efficiency within the digital marketplace ecosystem. In this segment, we explore how the incorporation of cutting-edge technology is shaping the future of payments in online marketplaces.

The Growth of Cryptocurrency Payments

The advent of cryptocurrencies heralds a new age in the scope of digital transactions, offering decentralized, borderless, and sometimes anonymous payment options. Cryptocurrency payments are increasingly gaining traction in online marketplaces, providing users an alternative that promotes transactional freedom and privacy. This growth reflects a broader shift towards diversified financial mechanisms, responding to modern consumers’ desire for greater autonomy in how they manage their online spending.

AI and Machine Learning in Fraud Detection and Payment Processing

With the relentless evolution of fraudulent schemes, AI and machine learning are becoming indispensable allies in the perpetual fight against such activities. These technologies offer unparalleled proficiency in fraud detection through dynamic risk assessment. Sophisticated algorithms analyze patterns and anomalies in payment behaviors, enabling real-time decision-making that keeps marketplaces several steps ahead of potential threats, making payment processing smarter and more secure.

The Emergence of Blockchain Technology in Marketplace Payments

Blockchain technology is emerging as a pivotal innovation in marketplace payment solutions. Its inherent characteristics — transparency, security, and immutability — have the potential to enhance trust between buyers and sellers in online transactions. As blockchain continues to mature and integrate with existing payment infrastructures, it promises to introduce a new standard of verifiability and efficiency in marketplace operations.

- Blockchain for enhanced security and transparent record-keeping

- Cryptocurrencies facilitate low-cost, high-speed transactions globally

- AI-driven systems for monitoring and real-time decision-making in payment processing

The embracement of these transformative trends signifies an important shift in the functionality and expectations of online marketplaces. As marketplace operators look ahead, staying abreast of and integrating these technologies will not be merely advantageous — it may become essential for remaining competitive and meeting the evolving demands of the global digital economy.

Conclusion: Making the Right Choice for Your Marketplace

As we conclude our exploration into the myriad of marketplace payment solutions available, one truth remains evident: the success of any online marketplace hinges greatly on choosing a payment solution that is reliable, agile, and conducive to growth. Factors such as availability, fees, integration capabilities, mobile-friendliness, and robust security are not mere attributes but the cornerstones that will uphold your marketplace’s reputation and operational efficiency. The journey of selection does not end with a choice made; it continues with meticulous implementation and an unwavering commitment to adaptation and improvement.

Recap of Key Factors in Choosing a Payment Solution

In the realm of marketplace success, identifying the optimal payment solution requires a thorough consideration of several pivotal factors. Availability across markets ensures your reach is not confined, while competitive fee structures facilitate cost-effectiveness. Integration capabilities allow for seamless synergy with other marketplace components, essential for a frictionless user experience. Mobile-friendliness answers the demands of the growing number of consumers who shop on handheld devices. Foremost, security instills trust and guards your marketplace against the ever-present threat of fraud. Balancing these essential elements can significantly influence your ability to meet customer needs and retain a competitive edge.

Next Steps After Selecting a Payment Solution

Once a payment solution is chosen, the focus should shift towards its strategic implementation. This includes establishing seamless integration with your marketplace’s infrastructure, enabling reliable and secure transaction processes, and attending to user feedback for continual refinement. Moreover, implementing a procedure for frequent reassessment ensures that your marketplace remains aligned with the latest technological advancements and regulatory requirements. The pursuit of magnifying marketplace success is dynamic and requires ongoing dedication to payment solutions developments to maintain relevance and efficiency in an ever-adapting e-commerce landscape.

Encouragement to Continue Researching and Staying Informed on Payment Solutions Developments

In an industry driven by swift technological progression, the quest for the perfect payment solution is perpetual. Staying abreast of emerging payment solutions developments is essential for ensuring your marketplace remains at the forefront of innovation. Regularly revisiting your strategic approach to choosing a payment solution, armed with fresh insights and keeping a finger on the pulse of new payment technologies, will fortify your marketplace’s position in the market. Embrace the evolution of these financial mechanisms with a spirit of discovery, and let your marketplace be a haven where the latest in payment solutions not only enhance user experience but also drive growth and success.

Our seasoned developers can design and implement a secure, scalable payment solution tailored for your marketplace’s needs.

FAQ

What are the crucial features to look for in marketplace payment solutions?

Key features include a secure transaction environment, user convenience, support for multiple currencies and payment methods, scalability, and seamless integration with your online marketplace.

How do I choose the best payment solution for my online marketplace?

Consider your marketplace’s operational scale, target audience, and specific payment needs. Evaluate factors like transaction volume, preferred payment methods, security requirements, and the ability to handle multiple currencies. Compare the costs and benefits of different payment solutions, including PayPal, Stripe, and Square to find the best fit for your marketplace.

What are the differences between payment gateways, merchant accounts, and integrated payment solutions?

Payment gateways provide a secure path for transaction data and facilitate processing. Merchant accounts act as holding places for funds before they are transferred to your bank. Integrated payment solutions offer a complete package that often includes a gateway and merchant account, aiming for a simpler setup and management process.

Can Apple Pay and Google Pay be integrated into marketplace payment systems?

Yes, Apple Pay and Google Pay are mobile wallets that can be integrated into marketplace payment systems, offering additional convenient and secure payment options for users.

What are the benefits of including mobile wallets like Apple Pay and Google Pay in my marketplace?

Including mobile wallets can enhance user experience by offering faster checkouts, increased security through tokenization, and the convenience of one-tap payments. They cater to the growing segment of users who prefer mobile commerce.

Are there any legal considerations I should be aware of when implementing a payment solution in my marketplace?

Yes, legal considerations include Payment Card Industry (PCI) compliance for securely handling credit card information, adhering to international payment regulations that vary by country, and complying with data protection and privacy laws to maintain user trust.

How does integrating a payment solution impact the user experience on an online marketplace?

A well-integrated payment solution can streamline the checkout process, reduce friction, improve conversion rates, and foster customer trust and retention. Offering multiple payment methods, including mobile payments, also enhances the customer experience.

What future trends in payment solutions should online marketplace owners keep an eye on?

Owners should monitor the growth of cryptocurrency payments, the application of AI and machine learning in fraud detection, and the use of blockchain technology for enhanced payment security and transparency.

What should I do after selecting a payment solution for my marketplace?

After choosing a payment solution, proceed with integration, ensure comprehensive testing for security and functionality, and plan for ongoing optimization. Stay informed about payment solution developments to continue meeting your users’ needs.