The Basics of Cryptocurrency Trading: How Developers Can Build Trading Platforms

22 November 2024

22 November 2024🔊 Listen to the Summary of this article in Audio

Cryptocurrency trading might sound like something out of a sci-fi movie, but it’s, in fact, not only easy but also could become a game-changer for you whether you want to invest in cryptocurrency or develop a cryptocurrency trading app, site or platform.

But how does it all work? And what does it take to build a trading site? Let’s break it down in a simple, fun way so you can get started with confidence — whether you’re a trader or a developer!

Understanding How Cryptocurrency Trading Works (For Investors)

Cryptocurrency trading may seem complex at first, but breaking it into simple steps can help you grasp the basics. Here’s cryptocurrency trading explained in easy-to-follow steps:

Open a Trading Account: To get started trading, you’ll need to create a trading account on a cryptocurrency exchange. This account is where you’ll manage your funds, buy and sell cryptocurrencies, and track market prices. Popular exchanges like Binance or Coinbase make this process simple. Choose an exchange with good security features and user-friendly tools.

Buying a Cryptocurrency: Once your account is set up, you can begin buying a cryptocurrency like BTH or Ethereum. This involves depositing money (via credit card, bank transfer, or other methods) into your account and purchasing your chosen digital currency at its current market rate. The process is straightforward and resembles online shopping—add to your cart and confirm the purchase!

How Trading Is Different from Holding: Cryptocurrency trading is different from simply holding onto a cryptocurrency as an investment. While holding means buying and keeping a currency for long-term profit, trading involves actively buying and selling to capitalize on short-term price changes. This dynamic approach requires constant market analysis and quick decision-making.

Understand What Drives Cryptocurrency Prices: The price of the cryptocurrency changes based on supply, demand, and market sentiment. News about regulations, technology updates, or economic trends can cause prices to rise or fall rapidly. Learning what affects prices helps you predict market movements better.

Choose a Cryptocurrency to Trade: Decide whether your chosen cryptocurrency suits your goals. For example, Bitcoin is often seen as a “safer” option with more stable growth, while altcoins like Dogecoin or Solana might offer higher risks and rewards. Research is key here—know the coin’s purpose and market behavior.

Explore Trading Strategies: Effective trading strategies can significantly improve your chances of success. Beginners can start with simple strategies like “buy low, sell high,” while advanced traders might explore techniques like scalping (taking small profits from quick trades) or day trading (making multiple trades within a day). Each strategy comes with its own risk level, so choose one that matches your experience.

Practice Day Trading for Quick Gains: If you prefer fast-paced trading, day trade by making quick, same-day transactions to take advantage of small price fluctuations. This strategy can yield quick gains but also requires a lot of attention and market analysis.

Learn to Manage Risks: Trading isn’t without risk, so set limits to protect your funds. Avoid putting all your money into one coin and always have an exit plan. Diversifying your portfolio and using stop-loss orders can help reduce losses in volatile markets.

Start Trading Today with Small Investments: Don’t jump in with large sums right away. It’s better to start small, learn the process, and gain confidence. As you understand how trading cryptocurrency involves buying and selling effectively, you can gradually increase your investments.

Track Your Performance: Once you buy cryptocurrency and begin trading, keep an eye on your results. Regularly review your trades, successes, and failures to refine your strategy over time.

Understanding How Cryptocurrency Trading Platform Works (For Developers)

Cryptocurrency investing platforms operate as a bridge between traders and the cryptocurrency market. Here’s a breakdown of the mechanism:

Connecting to the Cryptocurrency Market: The platform integrates with various cryptocurrency exchanges to fetch live data on the price of a cryptocurrency, trade volumes, and available pairs. This connection ensures users have real-time information and can react quickly to market moves.

Order Matching System: The core mechanism involves matching buy and sell orders. When a user wants to execute their first trade, the platform’s algorithm pairs their order with a matching counterparty. This can involve another trader on the platform or liquidity from an external exchange.

CFD Trading Integration: Many platforms offer CFD trading to let users speculate on price changes without owning the actual asset. In this setup, the platform acts as a counterparty, calculating profits or losses based on the asset’s price movement. This feature adds flexibility for traders who prefer trading CFDs.

Cryptocurrency Transactions and Wallets: Platforms facilitate cryptocurrency transactions like deposits, withdrawals, and transfers. Users’ funds are stored in a cryptocurrency wallet, which could be hot (online) for frequent transactions or cold (offline) for added security. Secure wallet systems are a critical part of the platform’s backend.

Trading Engine: At the heart of the platform is the trading engine, which processes trades in real-time. It handles tasks like order execution, updating balances, and calculating trading fees. This ensures smooth operations, even when users want to trade high volumes or in volatile markets.

Market Analysis and Tools: Platforms provide analytical tools like live price charts, order books, and historical data to help users make informed decisions. These tools enable traders to monitor trends and develop strategies for their trades, whether it’s spot trading or crypto asset speculation.

Security Protocols: Since cryptocurrency is a digital asset, platforms implement high-level security measures like encryption, two-factor authentication (2FA), and multi-signature wallets. These systems safeguard users’ funds and data against hacks and unauthorized access.

User Verification and Compliance: To ensure legality and prevent fraud, platforms follow strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This involves verifying users before they are deemed ready to trade, protecting the platform from misuse.

Liquidity Management: Platforms maintain liquidity by connecting to multiple exchanges or using internal pools. This ensures users can always execute trades at competitive prices, even during times of market volatility.

Automation and Scalability: Advanced platforms use automated processes to handle high transaction volumes efficiently. Automation also allows features like instant notifications, trading bots, and algorithmic trading to enhance user experience.

Transform your cryptocurrency trading app idea into a robust, secure solution with our expert development team.

How to Develop a Crypto Trading Platform?

Step 1: Planning and Architecture Design

Planning and designing the architecture is the foundation for a investing platform. This phase involves defining the platform’s purpose, setting technical requirements, and ensuring scalability and security.

1. Objective Setting

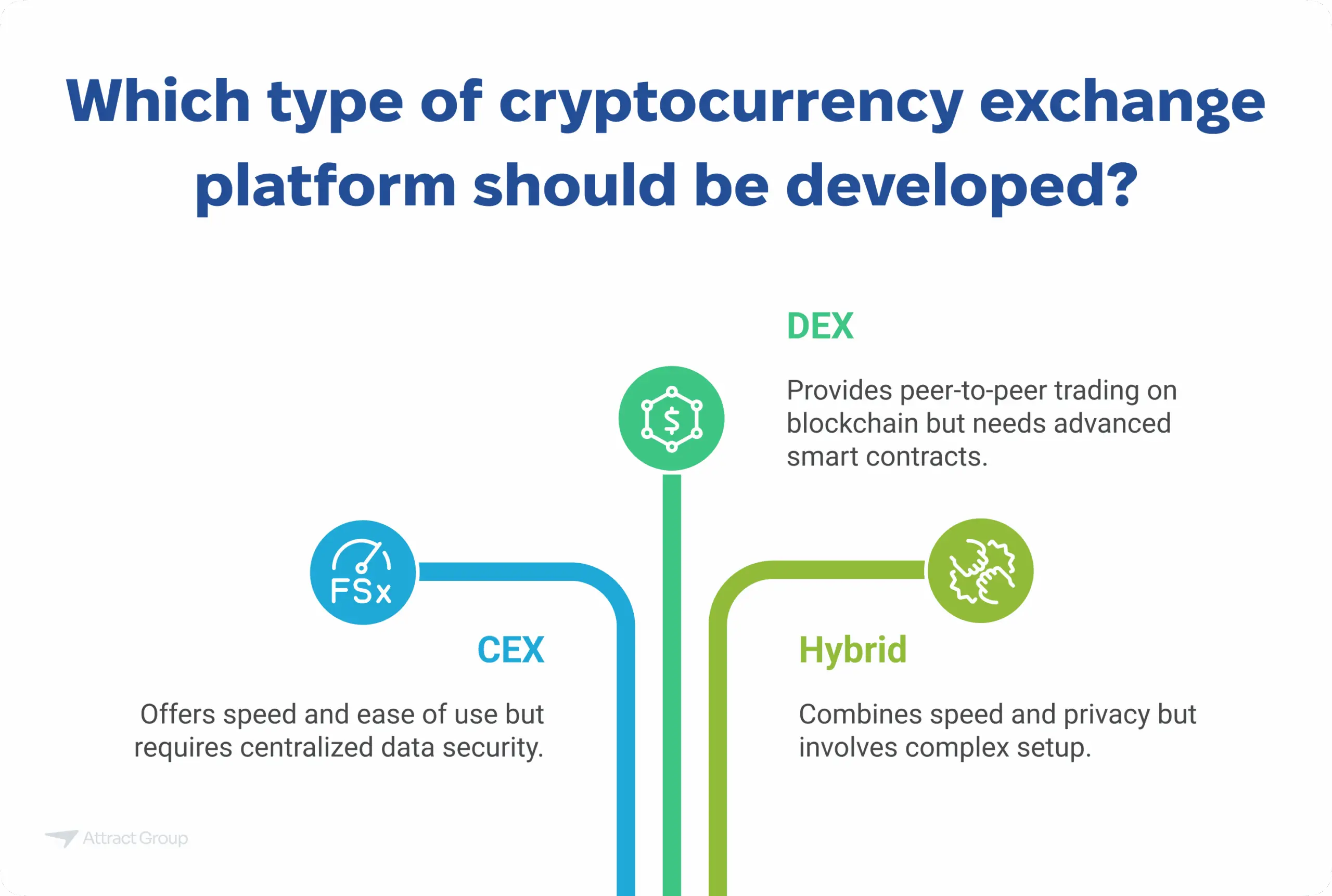

Begin by identifying the type of platform you want to create: a Centralized Exchange (CEX), a Decentralized Exchange (DEX), or a Hybrid Model.

- CEX: Faster and easier to use but requires centralized data security.

- DEX: Operates on blockchain for peer-to-peer trading but demands advanced smart contract capabilities.

- Hybrid: Combines CEX speed and DEX privacy but involves a complex setup.

2. Technical Architecture

The architecture includes several components that work together for seamless operation:

- Front-End: Use frameworks like React or Angular to design an intuitive interface. Include features such as live price charts and trading dashboards.

- Back-End: Develop the core with frameworks like Node.js or Django. The back end manages order matching, user authentication, and wallet services.

- Database: Use PostgreSQL or MongoDB for storing user and transaction data. Implement caching (e.g., Redis) to improve data retrieval speed.

3. Security and Scalability

- Security: Encrypt sensitive data, implement two-factor authentication (2FA), and store funds in cold wallets to reduce hacking risks.

- Scalability: Use horizontal scaling (adding servers as demand grows) and database sharding to manage increasing users and data.

Step 2: Choosing the Right Technology Stack

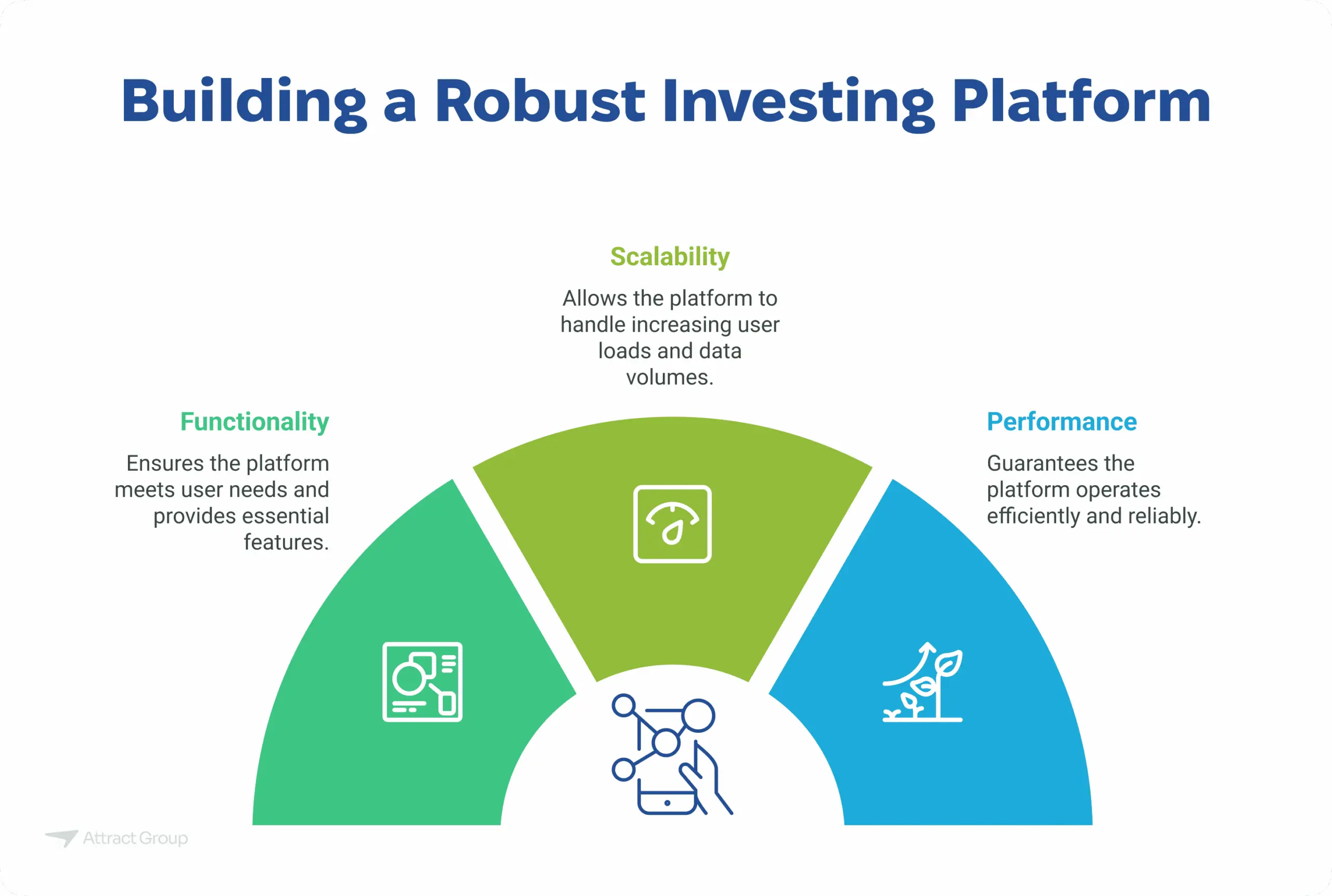

Selecting the appropriate technology stack is a critical step in developing an investing platform. It determines the platform’s functionality, scalability, and overall performance.

Here’s a breakdown of key components and their roles, explained concisely:

Programming Languages

Programming languages form the foundation of your platform. Choosing the right one ensures reliability, flexibility, and ease of integration.

| Programming Language | Purpose |

|---|---|

| Python | Excellent for back-end logic, data processing, and integration tasks. |

| JavaScript | Ideal for both front-end and back-end development, enabling seamless integration. |

| Java | Suitable for scalable and enterprise-grade applications. |

Frameworks

Frameworks streamline development and enhance the platform’s efficiency by providing pre-built libraries and tools.

| Framework | Use Case | Purpose |

|---|---|---|

| Node.js | Back-end | Handles high concurrency and fast execution of tasks. |

| Laravel | Back-end | Offers secure and scalable server-side processing. |

| Django | Back-end | Ideal for rapid development with built-in security. |

| React | Front-end | Enables dynamic and interactive user interfaces. |

| Angular | Front-end | Provides robust tools for creating scalable UIs. |

Databases

Databases store all critical platform data, including user information, trades, and transaction logs. Choose one based on your scalability and data structure needs.

| Database | Purpose |

|---|---|

| PostgreSQL | Best for handling relational data securely and efficiently. |

| MongoDB | Suitable for managing flexible, unstructured, or semi-structured data. |

Blockchain Integration

Blockchain integration is essential for ensuring transparency and security.

| Framework | Purpose |

|---|---|

| Ethereum | Supports smart contracts and ERC-20 token integration. |

| Hyperledger | Focused on enterprise-grade blockchain solutions. |

| Bitcoin Core | Enables seamless Bitcoin transaction handling. |

Our experienced developers can help you choose the optimal technologies for your cryptocurrency platform.

Step 3: User Interface and User Experience (UI/UX) Design

Intuitive Navigation

The interface should provide clear and logical navigation paths to make trading processes straightforward. By using foundational technologies like HTML, CSS, and JavaScript, developers can ensure smooth user interactions. Frameworks such as Bootstrap and Material UI further enhance the layout, creating a responsive design that adapts well to different devices and screen sizes.

For example, a user logging into trade crypto should easily locate options for buying, selling, or viewing price charts. Features like quick access to wallet balances, trading pairs, and portfolio performance allow users to focus on key aspects like supply and demand trends without unnecessary complexity.

User Features

To remain competitive in the market, a crypto exchange must provide robust features that support both basic and advanced trading. Customizable dashboards are essential, allowing users to personalize their experience based on their trading style. Real-time price charts and trading indicators help users analyze market trends effectively, whether they’re trading cryptocurrencies or comparing them to traditional assets like stocks.

Accessibility is key. The platform should simplify the trading experience for first-time users while providing advanced tools like candlestick charts, order books, and market depth for seasoned traders. This dual approach ensures the platform appeals to a broad user base.

Key Elements of UI/UX Design

| UI/UX Aspect | Technology | Purpose |

|---|---|---|

| Navigation Design | HTML, CSS, JavaScript | Enables intuitive access to platform features and functions. |

| Frameworks | Bootstrap, Material UI | Ensures responsive and visually appealing layouts across devices. |

| Dashboards | Customizable widgets, data visualization | Allows users to personalize their trading environment. |

| Real-Time Charts | Chart.js, D3.js | Helps users monitor supply and demand and price fluctuations effectively. |

| Accessibility | Responsive design, user-friendly tools | Ensures ease of use for beginners while offering advanced tools for experienced traders. |

Step 4: Backend Development

Backend development is the foundation of how an invesing platform operates. It handles crucial processes such as user authentication, trade execution, and data security, ensuring a smooth experience for users.

Core Components

The backend manages key features that allow users to trade and securely interact with their digital assets.

- User Authentication: Ensures secure login and access by verifying user credentials.

- Order Matching Engine: Matches buy and sell orders in real-time, facilitating trades efficiently between users handling both traditional currencies and cryptocurrencies.

- Trading APIs: Provides integration points for third-party tools, expanding the platform’s functionality.

- Transaction Processing: Ensures that the platform can verify transactions quickly and accurately while maintaining transparency.

- Wallet Management: Manages user funds through a crypto wallet, allowing users to store cryptocurrency securely.

Security Features

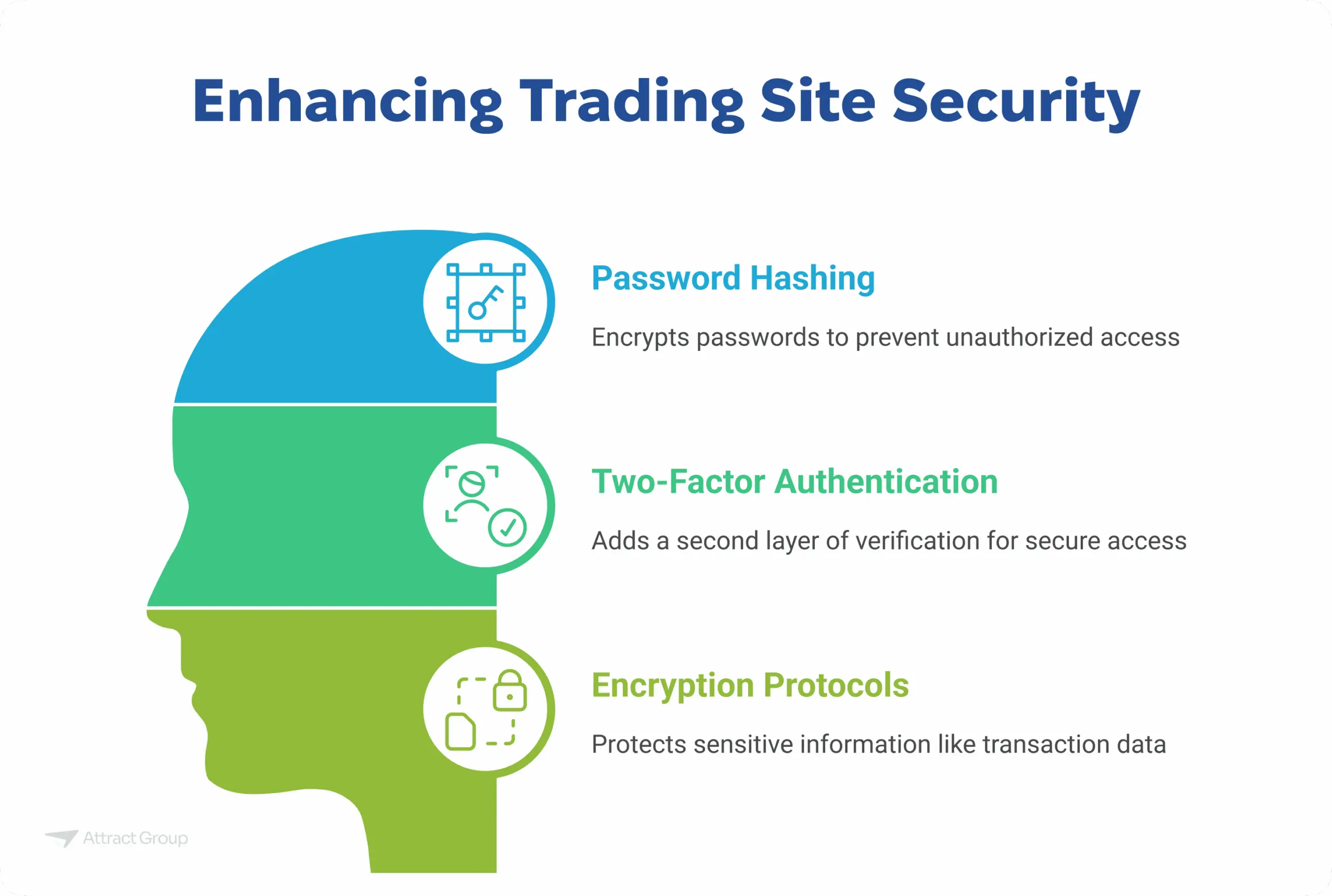

The security of a trading site is critical to protecting both users and the system. The backend must implement advanced measures to safeguard data and funds.

- Password Hashing: Encrypts user passwords to prevent unauthorized access.

- Two-Factor Authentication (2FA): Adds a second layer of verification for secure user access.

- Encryption Protocols: Protects sensitive information, including transaction data and API keys.

Step 5: Wallet Integration

Wallet integration is a critical part of developing an investing platform. It allows users to securely store cryptocurrency, process deposits and withdrawals, and manage balances. A well-designed wallet system ensures the smooth flow of funds while maintaining security and accessibility.

Wallets on an investing platform serve as the bridge between users and the blockchain, handling everything from generating wallet addresses to processing transactions. They also play a crucial role in safeguarding assets by protecting private keys, which are essential for authorizing transfers and verifying ownership.

Types of Wallets

There are two primary types of wallets integrated into cryptocurrency platforms: hot wallets and cold wallets. Each serves a unique purpose, balancing convenience and security.

Hot Wallets:

- These are connected to the internet and designed for frequent transactions.

- Ideal for day-to-day trading, allowing users to deposit, withdraw, and transfer cryptocurrencies instantly.

- While convenient, they are more vulnerable to hacking due to their online nature.

Cold Wallets:

- Offline wallets used to securely store the majority of user funds.

- Provide enhanced security by keeping assets away from online threats.

- Suitable for long-term storage and large reserves of cryptocurrency.

Comparison Table: Hot Wallets vs. Cold Wallets

| Feature | Hot Wallets | Cold Wallets |

|---|---|---|

| Connectivity | Always connected to the internet | Completely offline |

| Usage | For frequent transactions | For long-term storage |

| Security | More vulnerable to hacking | Highly secure against cyber threats |

| Speed | Instant access to funds | Requires additional steps to access funds |

| Examples | Exchange wallets, mobile wallets | Hardware wallets, paper wallets |

Step 6: Implementing Security Measures

Security is the backbone of any investing platform. The dynamic nature of cryptocurrencies, with their decentralized design and cryptocurrency volatility, makes robust security measures crucial for protecting user funds and maintaining trust. Security is essential not just for platform operations but also for compliance with global and regional regulations.

Cryptocurrency platforms must safeguard users’ funds and data using advanced technical solutions. Since cryptocurrency work relies on complex systems like proof of work for blockchain verification, ensuring the integrity of these processes is vital. Additionally, integrating regulatory practices like KYC (Know Your Customer) and AML (Anti-Money Laundering) ensures that the platform adheres to standards for currencies such as the US dollar and global financial systems.

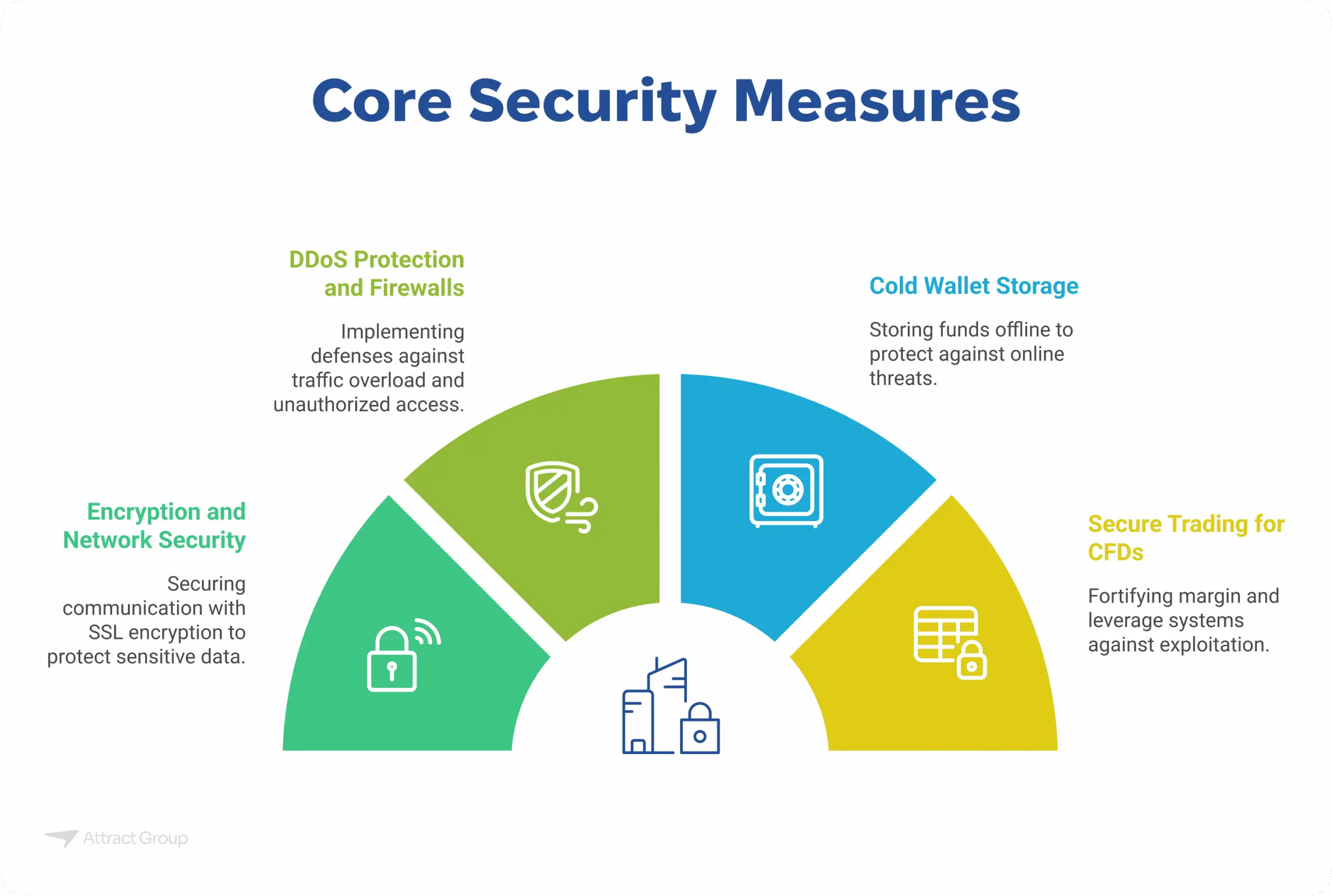

Core Security Features

- Encryption and Network Security: Use SSL encryption to secure communication between users and the platform, protecting sensitive data like passwords and API keys.

- DDoS Protection and Firewalls: Implement DDoS protection to guard against traffic overload attacks, ensuring the platform remains operational. Firewalls add an extra layer of defense against unauthorized access.

- Cold Wallet Storage: Store the majority of funds in cold wallets, away from online threats. This is particularly important for securing high-value assets like BTH and ethereum.

- Secure Trading for Cryptocurrency CFDs: For platforms offering cryptocurrency CFDs, ensure that margin and leverage systems are fortified against exploitation.

Regulatory Compliance

- KYC and AML Integration: Implement identity verification processes to validate users’ identities and detect suspicious activities. This ensures the platform meets legal requirements while protecting against fraud.

- Legal Partnerships: Work with legal advisors to align with regulations for handling digital assets and fiat currencies such as the US dollar. This is especially crucial for platforms that support fiat-to-crypto transactions.

- Proof of Work Audits: For platforms involving proves of work cryptocurrencies like Bitcoin, perform regular audits to ensure compliance with energy usage and environmental regulations.

Protect your users and platform with our comprehensive security implementation and compliance solutions.

Step 7: Liquidity Management

Liquidity management is vital for ensuring smooth operations on an investment platform. It refers to the platform’s ability to handle transactions efficiently, allowing users to buy or sell assets without significant delays or price changes. Since trading involves buying and selling assets, liquidity ensures that users can execute trades at competitive prices.

A platform can establish initial liquidity by connecting to external exchanges or market makers, creating a seamless trading environment. For example, whether a user wants to trade the first cryptocurrency like Bitcoin or open a CFD trading account to speculate on cryptocurrency price movements, liquidity is crucial for stable operations. Simulating trading volumes in the early stages also helps attract users and stabilize the market, ensuring they trust the platform for all trading activities.

Step 8: Testing and Quality Assurance

Testing and quality assurance are essential steps to ensure that an investment site is reliable, secure, and capable of handling real-world trading scenarios. Functional testing validates critical features like order matching, wallet integration, and payment gateways, ensuring that the core components work seamlessly. Stress tests simulate high user loads and transaction volumes to verify the platform’s scalability and stability under peak conditions.

Security audits play a crucial role in safeguarding user funds and data. Penetration testing identifies potential vulnerabilities, while compliance with industry security certifications ensures the platform meets global security standards. This process is critical, as crypto platforms handle sensitive user information and high-value transactions, making reliability and security paramount to building user trust and platform credibility.

Step 9: Launch and Marketing

The launch and marketing phase is where an investment platform transitions from development to real-world use. A soft launch, where a beta version is released, allows developers to gather valuable user feedback and address any remaining issues before a full-scale rollout. This step ensures the platform is refined and user-ready.

An effective marketing strategy is crucial to attract users and build trust. Digital marketing campaigns, strategic partnerships, and active community engagement are key tactics to create awareness. Highlighting features such as robust security, ease of use, and support for popular cryptocurrencies appeals to both beginners and experienced traders. This combination of a thoughtful launch and targeted marketing helps establish a solid user base and positions the platform for long-term success.

Step 10: Post-Launch Support and Maintenance

Post-launch support ensures that a crypto investment platform remains secure, efficient, and user-friendly over time. Ongoing improvements are essential to keep up with market trends and user expectations. This involves regularly rolling out new features, applying security patches to address vulnerabilities, and optimizing performance to handle increasing user loads.

Equally important is customer support, which builds user trust and loyalty. Offering 24/7 support through FAQs, chatbots, and live assistance ensures that users can resolve issues quickly. Actively monitoring user feedback allows developers to identify pain points and refine the platform continuously, creating a seamless trading experience that adapts to evolving needs. These efforts are vital for sustaining platform growth and maintaining a competitive edge in the crypto market.

Partner with our expert development team to create a cutting-edge cryptocurrency trading solution.

Conclusion

Building a crypto trading or investment platform is a complex but rewarding endeavor. From understanding the basics of crypto trading to implementing robust security measures and integrating user-friendly features, each step plays a vital role in creating a platform that traders can trust. Whether you’re interested in developing a crypto exchange, enabling cryptocurrency CFDs, or facilitating seamless trading experiences, this guide provides a roadmap to success.

At Attract Group, we specialize in helping developers and businesses bring their cryptocurrency platform ideas to life. With expertise in cutting-edge technologies, market integration, and regulatory compliance, we deliver tailored solutions that meet the unique needs of your project. Whether you’re targeting traders new to Bitcoin or seasoned investors managing diverse portfolios, we’re here to ensure your platform stands out in the competitive market.