Create a Cryptocurrency in 9 Steps | Your First Cryptocurrency

11 September 2024

11 September 2024🔊 Listen to the Summary of this article in Audio

Did you know that in the bustling world of digital finance, you can create your own cryptocurrency and join the ranks of over 22,000 existing options? Whether you want to create a cryptocurrency using existing blockchain technology or are eager to develop a new blockchain, this comprehensive guide empowers entrepreneurs and tech enthusiasts to launch their very own crypto coin. We cover every necessary step, from tweaking the source code to legal certainties, ensuring your venture into creating a token or a new cryptocurrency is as seamless as it is successful. This guide is your gateway to transforming innovative ideas into a functional digital currency, paving your unique path in the financial ecosystem.

Key Takeaways

- Understanding the purpose and target audience is fundamental when you create a new cryptocurrency, as it directs the foundational strategy of your digital asset.

- Choosing the right consensus mechanism is a crucial way to create enhanced security and efficiency for your coin or token.

- Selecting a reliable blockchain platform is pivotal for your cryptocurrency’s future success, whether you opt to create your own blockchain or utilize an existing one.

- Legal compliance is essential to navigate and abide by various regulations, ensuring your method to create a new blockchain or token adheres to statutory requirements.

- Promoting your digital currency effectively can harness widespread adoption and usage, demanding a blend of technical knowledge and an understanding of the right programming language to connect with potential users.

Our experienced blockchain developers can guide you through every step of creating your digital asset, from concept to launch.

What Is a Cryptocurrency, How Does It Work and Types of Cryptocurrencies

A cryptocurrency is digital money that is secured by cryptography, ensuring transactions are tamper-proof and verifiable. The cornerstone of cryptocurrency is blockchain technology, a decentralized ledger where each transaction is recorded in a “block” and linked to previous transactions, forming a secure and immutable chain. This digital ledger is maintained by a network of computers, which validate and permanently record transactions, preventing any single entity from manipulating the history.

Cryptocurrencies are typically created through mining, a process that involves solving complex mathematical problems to verify transactions and add them to the blockchain. However, for those looking to create their own coin or token, there are other methods such as launching a cryptocurrency on an existing blockchain or employing a blockchain developer to create a new blockchain.

The genesis of cryptocurrency can be traced back to Bitcoin, launched in 2009 by an individual or group using the pseudonym Satoshi Nakamoto. Bitcoin paved the way for a myriad of other cryptocurrencies, each designed with specific functions and market goals. From serving as basic digital money to facilitating sophisticated decentralized applications (DApps) and smart contracts, the applications of cryptocurrencies have expanded significantly. This evolution is supported by advancements in blockchain technology and a growing acceptance among the public and businesses.

Types of Cryptocurrencies:

- Bitcoin (BTC): The pioneer cryptocurrency, renowned for introducing the concept of decentralized digital money.

- Ethereum (ETH): Notable for its flexibility to support smart contracts and decentralized applications, making it a popular platform to create your own token.

- Ripple (XRP): Provides rapid international transaction capabilities, acting as a bridge currency in cross-border payments.

- Litecoin (LTC): Offers faster transaction confirmations than Bitcoin, appealing for those who prioritize speed.

- Cardano (ADA): Distinct for its scientific approach to blockchain architecture, focusing on security and scalability, ideal for those looking to launch robust and sustainable cryptocurrencies.

How to Create Cryptocurrency?

You can create a cryptocurrency in 9 simple steps, the below table discusses each step.

| Step | Description | Key Activities | Considerations |

|---|---|---|---|

| 1. Define Purpose | Determine the core objective and target audience of the cryptocurrency. | Establish the problem it solves or the niche it addresses. | Ensure the purpose aligns with market needs and potential user base. |

| 2. Choose a Consensus Mechanism | Select the appropriate mechanism to validate transactions. | Decide between PoW, PoS, DPoS, PBFT, or hybrid options. | Consider security, energy efficiency, and scalability. |

| 3. Select a Blockchain Platform | Choose the underlying technology for the cryptocurrency. | Evaluate platforms like Ethereum, Binance Smart Chain, Polkadot, etc. | Assess community support, compatibility, and technical features. |

| 4. Design the Nodes | Set up and configure network nodes that will support the blockchain. | Decide between Full nodes and Light nodes, centralized vs decentralized. | Focus on distribution, scalability, and security features. |

| 5. Establish Internal Architecture | Define the technical infrastructure of the blockchain. | Set permissions, address formats, key management, data storage, and smart contracts. | Ensure robust and secure design to support functionalities and compliance. |

| 6. Integrate APIs | Enhance functionality with appropriate Application Programming Interfaces. | Implement APIs for wallets, exchanges, and payment gateways. | Select APIs that promote security, user-friendliness, and flexibility. |

| 7. Design the Interface | Develop the frontend and backend of the digital platform. | Use appropriate programming languages and focus on UX design. | Ensure the interface is secure, intuitive, and user-friendly. |

| 8. Ensure Legal Compliance | Meet all legal requirements related to cryptocurrency operations. | Adhere to international laws, local regulations, and follow AML/KYC norms. | Stay updated with regulatory changes and ensure transparency. |

| 9. Promote the Cryptocurrency | Market the cryptocurrency to target users and stakeholders. | Engage in online marketing, community engagement, partnerships, and ICOs if applicable. | Build credibility, raise awareness, and encourage adoption. |

Let’s understand each step in more details.

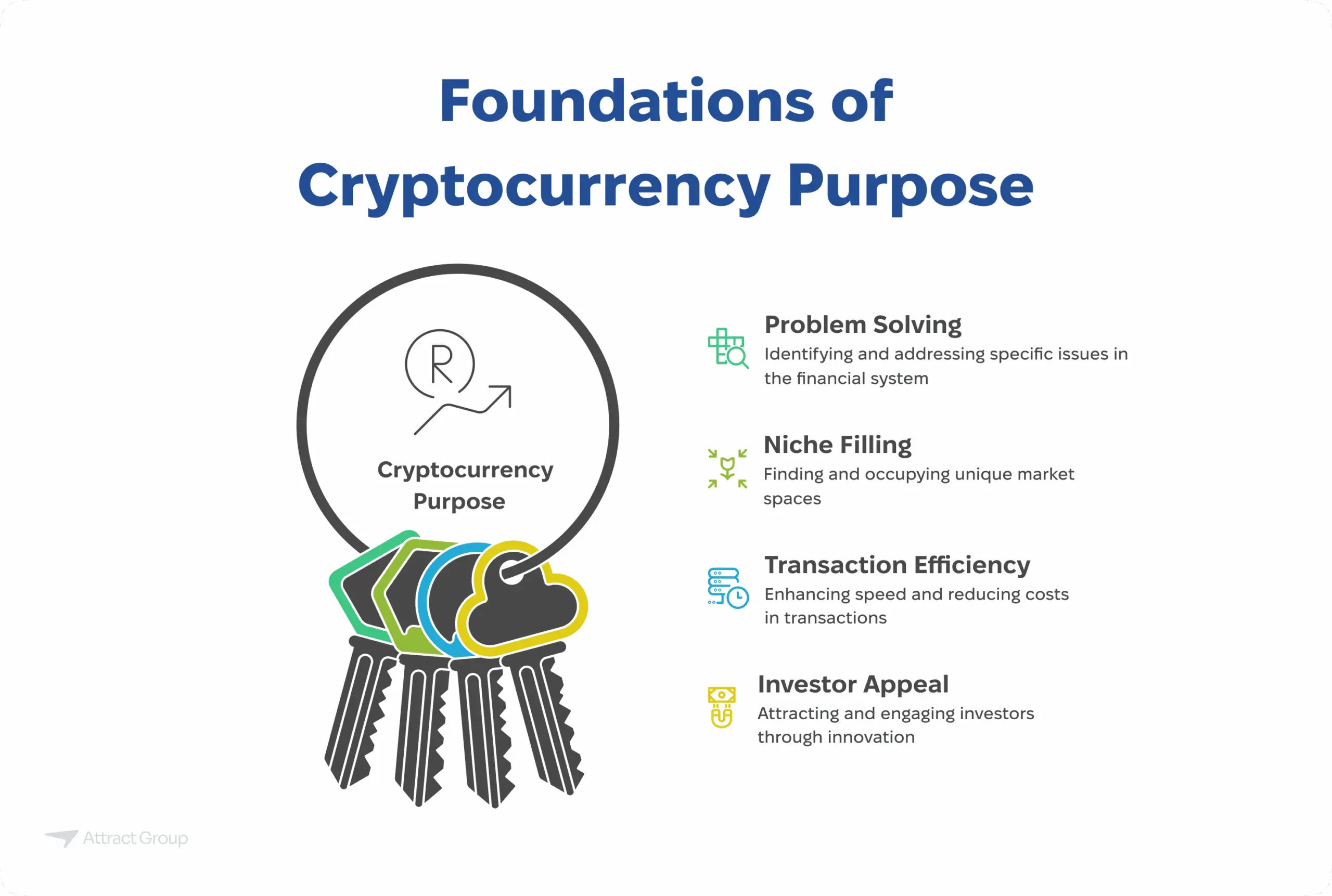

Step 1: Define Your Purpose

The first step in creating a cryptocurrency is to define its purpose. To figure out your cryptocurrency’s goal, you need to know the problem it will solve or the niche it fills. It could be about making transactions faster, cutting fees, or being a new option for investors. A clear goal is vital for steering the development.

Determine the Target Audience

It’s important to know who your cryptocurrency is for. Your target could be tech fans, investors, or a particular industry. Knowing this helps you create the right features and marketing plans.

Use Cases for Your Cryptocurrency

Figuring out how your cryptocurrency will be used is critical. It can range from daily buying and selling to specific industry uses, like finance or supply chain. Showing real-world examples of its use makes its value and place in the market clear.

Economic Model and Tokenomics

A strong economic model is key to your digital asset’s success. Tokenomics includes how tokens are made, shared, and priced. A balanced approach attracts both users and investors. This creates a thriving environment for your token.

Step 2: Choose a Consensus Mechanism

Choosing the right consensus mechanism is crucial for your cryptocurrency’s success. It makes sure all transactions are securely recorded on the blockchain without a central authority. Here are the main types of consensus mechanisms you should consider:

Proof of Work (PoW)

Proof of Work, used by Bitcoin, lets miners solve complex problems. It needs a lot of computational power, making it secure yet energy-hungry.

Proof of Stake (PoS)

Proof of Stake selects validators to create blocks and check transactions. Validators are picked based on how many coins they stake. It uses less energy than Proof of Work, promoting long-term investment.

Delegated Proof of Stake (DPoS)

Delegated Proof of Stake lets token owners vote for network validators. It aims to be quick and transparent, blending centralization with decentralization.

Practical Byzantine Fault Tolerance (PBFT)

Practical Byzantine Fault Tolerance focuses on being energy-efficient and quickly reaching consensus. All network nodes collaborate to validate transactions, fitting private blockchains best.

Hybrid Consensus Mechanisms

Hybrid mechanisms mix Proof of Work and Proof of Stake. They aim for a good mix of energy use, scalability, and security. These are becoming more popular for their combined strengths.

To help you compare, here’s a table of these consensus mechanisms:

| Consensus Mechanism | Key Features | Pros | Cons |

|---|---|---|---|

| Proof of Work (PoW) | Miners solve complex mathematical problems | Highly secure | High energy consumption |

| Proof of Stake (PoS) | Validators stake cryptocurrency | Energy-efficient | Potential for centralization |

| Delegated Proof of Stake (DPoS) | Token holders vote for delegates | Higher transaction speeds | Relies on trust in delegates |

| Practical Byzantine Fault Tolerance (PBFT) | Nodes jointly validate transactions | Fast consensus | Suitable mainly for private blockchains |

| Hybrid Consensus | Combines PoW and PoS | Balance between security and efficiency | Complex implementation |

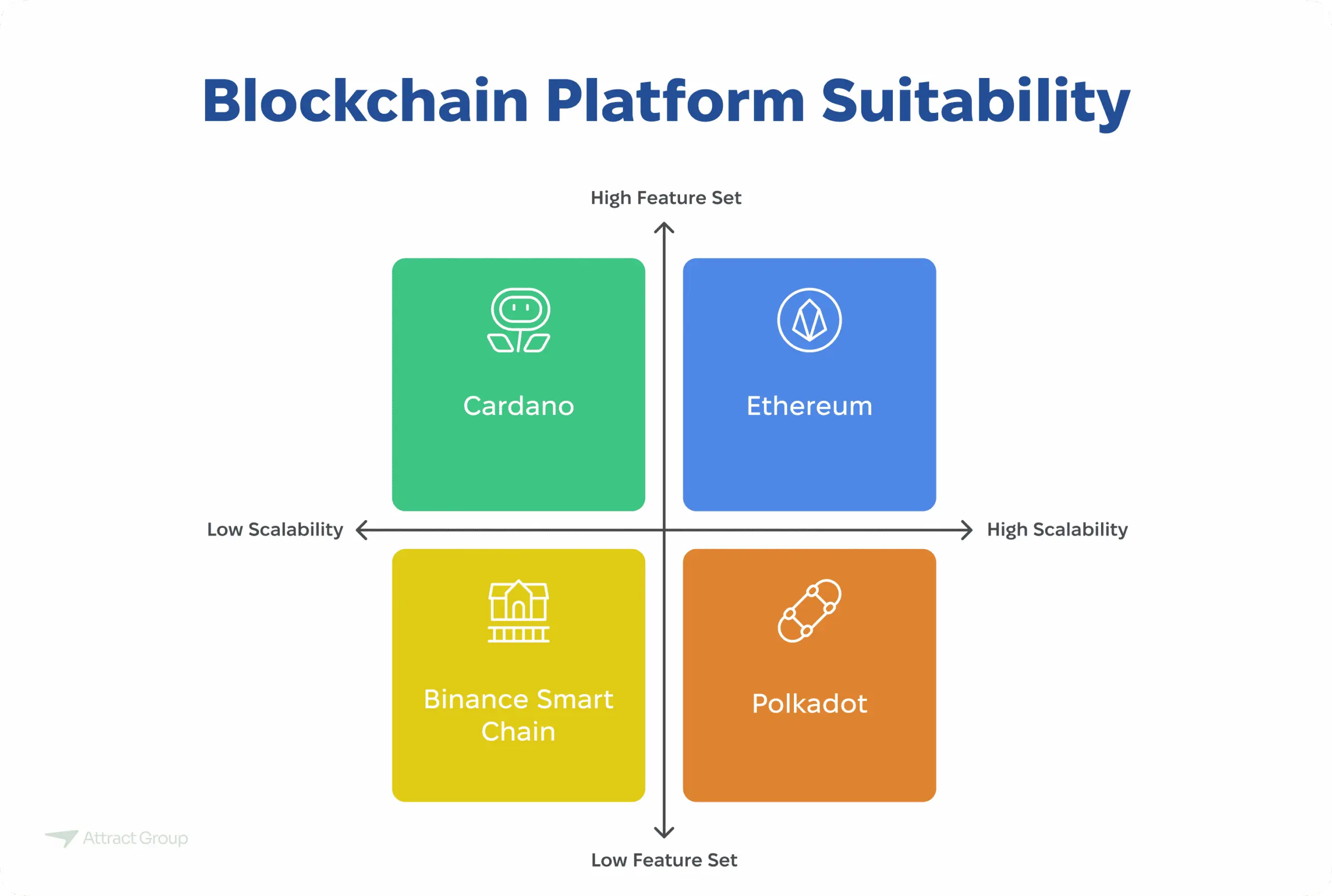

Step 3: Select a Blockchain Platform

Choosing the right blockchain platform is key to your project’s success. Each offers unique features and scalability options. They fit different needs based on what you want to achieve.

Ethereum

Ethereum is top-rated for its strong ecosystem and support for DApps and smart contracts. It’s widely adopted, giving developers many tools. They get community support to efficiently create new cryptocurrencies.

Binance Smart Chain

Binance Smart Chain provides an affordable choice with extra benefits of working across different chains. It’s great for those making DeFi applications. It has lower fees and high performance.

Polkadot

Polkadot is unique for letting different blockchains work together easily. It’s for developers wanting their cryptocurrency to work with many blockchain ecosystems.

Cardano

Cardano stands out with its scientific base and multi-layer structure. It focuses on security and can scale up, ideal for those who want a solid base for their cryptocurrency and smart contracts.

Other Blockchain Platforms

Other platforms like Solana, Tezos, and Avalanche offer various features. They are worth exploring to find the right fit for your project’s specific needs.

| Blockchain Platform | Key Features | Ideal For |

|---|---|---|

| Ethereum | Robust ecosystem, DApps, smart contracts | Developers needing comprehensive tools and community support |

| Binance Smart Chain | Affordable, cross-chain compatibility | Developers focusing on DeFi applications |

| Polkadot | Interoperability between blockchains | Developers seeking a multi-chain ecosystem |

| Cardano | Scientific approach, layered architecture | Developers prioritizing security and scalability |

| Other Platforms (e.g., Solana, Tezos, Avalanche) | Various unique features | Developers with specific technical requirements |

Your blockchain platform choice should match your project goals, technical requirements, and strategic direction.

Our expert team can analyze your project requirements and recommend the most suitable blockchain solution for your cryptocurrency

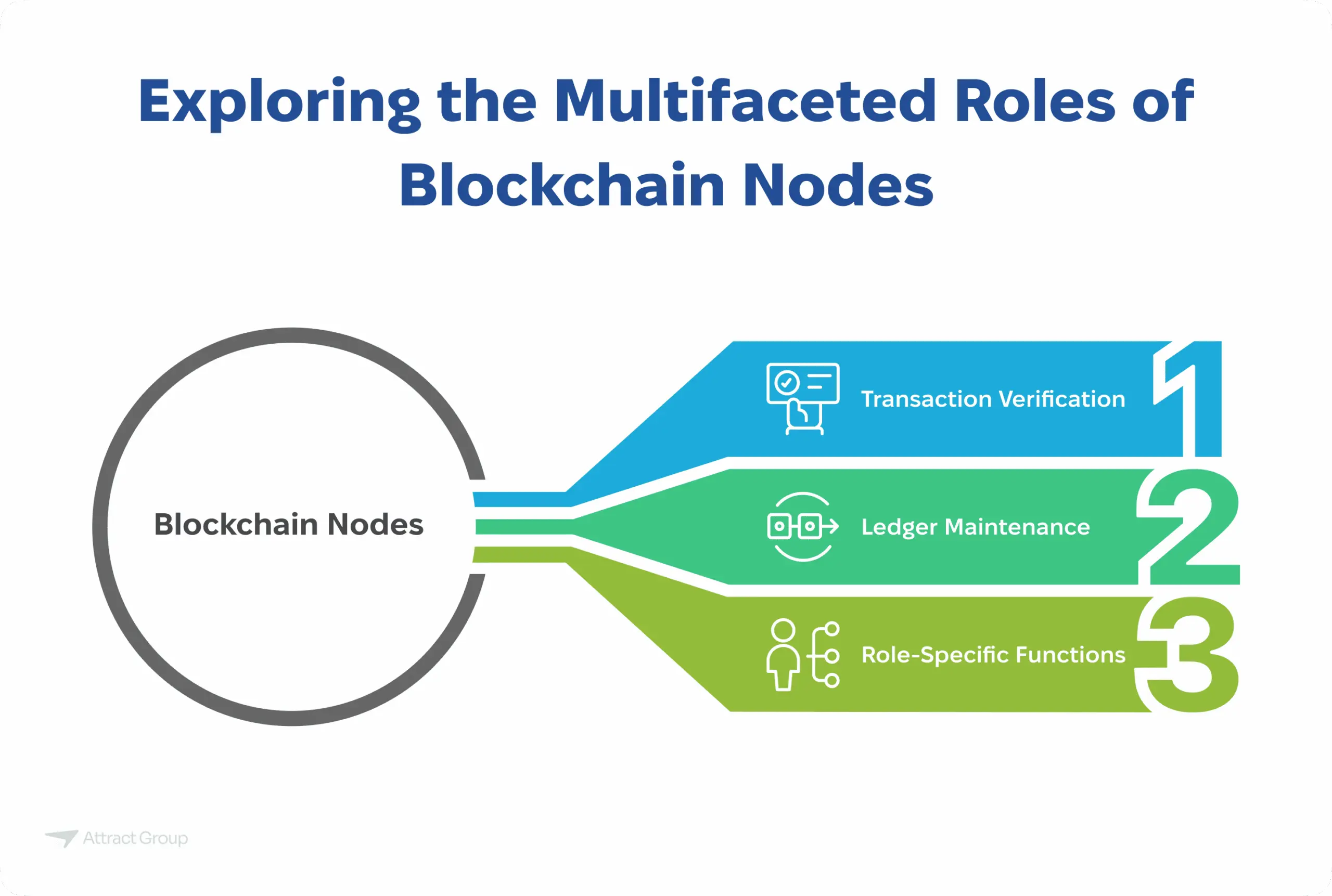

Step 4: Design the Nodes

Nodes are key parts of any blockchain, acting as points that share and hold data. Knowing the different kinds of nodes is key for a strong cryptocurrency network. Each type plays a unique role in making the network effective.

What Are Nodes?

Nodes in blockchain talk about devices that join the network. They help by checking transactions and keeping the blockchain working right. Depending on its role, a node might hold all or part of the blockchain’s ledger.

Full Nodes vs. Light Nodes

Full nodes and light nodes have different needs and jobs:

- Full Nodes: These nodes keep the entire blockchain and approve transactions and blocks. They protect the blockchain’s integrity and safety.

- Light Nodes: Known also as lightweight clients, they only keep vital info for checking transactions. They use less resources because they depend on full nodes for full blockchain data.

Centralized vs. Decentralized Nodes

The setup of nodes affects who controls the blockchain and its security:

- Centralized Nodes: These nodes have a single or a few controllers. This means more control but less decentralization.

- Decentralized Nodes: In this setup, nodes are spread out, increasing security and making the network more robust against problems.

Node Configuration and Maintenance

Setting up nodes correctly and keeping them maintained is crucial for a smooth-running cryptocurrency. This means preparing nodes for the workload, keeping software updated to stop security issues, and consistently checking performance. All these steps keep the network safe and efficient:

- Node Configuration: This involves getting the node ready according to network needs like storage and connection settings.

- Maintenance: Regular software updates and checks are needed for nodes to work well and keep the blockchain healthy.

In the end, picking the right node setup and keeping it maintained is very important for a cryptocurrency blockchain to work well.

Step 5: Establish Blockchain’s Internal Architecture

Creating a strong internal architecture for blockchain is vital. It’s the backbone of a secure and effective cryptocurrency. This includes setting up permissions, address formats, managing keys, storing data, and using smart contracts.

Permissions

Permissions decide who gets to be part of the network. In a permissioned blockchain, only selected people can join. This keeps things orderly. On the other hand, a permissionless blockchain welcomes anyone. This openness encourages widespread participation and decentralization.

Address Format

The way addresses are formatted is crucial. It keeps transactions safe and accurate. Each blockchain has its own rules on how addresses should look to meet its standards and work smoothly.

Key Management

Managing cryptographic keys safely is key. These keys safeguard transaction security and protect the users’ assets in the blockchain world.

Data Storage and Retrieval

For a blockchain to work well and grow, it must store and access data efficiently. The goal is to balance speed, security, and efficiency in handling data. This ensures it can manage more transactions without hiccups.

Smart Contracts and Automation

Smart contracts are critical for automating and applying rules in blockchain transactions. They make agreements run smoothly without needing trust in others, boosting the network’s reliability and features.

| Component | Description | Example |

|---|---|---|

| Permissions | Defines who can participate in the blockchain network. | Public vs. Private Blockchains |

| Address Format | Ensures transaction accuracy and protocol compliance. | Ethereum Address Format |

| Key Management | Handles the creation and protection of cryptographic keys. | Hardware Security Modules (HSM) |

| Data Storage | Manages how data is stored and accessed on the blockchain. | Decentralized Storage Solutions |

| Smart Contracts | Automates and enforces transaction rules. | Ethereum Smart Contracts |

Step 6: Integrate APIs

Application Programming Interfaces (APIs) are key for a cohesive cryptocurrency world. They allow developers to improve their projects. This leads to efficient and safe digital currency transactions.

Public and Private APIs

With public APIs, outside developers can tap into your platform’s data or features. This fosters sharing and working together. On the other hand, private APIs are kept for in-house use. They secure sensitive parts of your platform, ensuring safety for important tasks.

Cryptocurrency Wallet API

Adding a cryptocurrency wallet API is crucial for user financial interactions. It lays the foundation for secure, easy-to-use wallets. Users can thus manage their digital funds better.

Exchange APIs

Exchange APIs are vital for including trading options on your platform. They offer live trading data. This means users can quickly make trades, buy, or sell without hassle.

Payment Gateway APIs

Payment gateway APIs are important for digital currency’s wider use. They let businesses accept cryptocurrencies easily. This brings digital money into the mainstream. Developers can add various payment options, making platforms more user-friendly.

| API Type | Use Case | Advantages |

|---|---|---|

| Public API | External access and collaboration | Promotes openness and integration |

| Private API | Internal security and control | Maintains security and control over sensitive data |

| Cryptocurrency Wallet API | Wallet creation and management | Secure and user-friendly fund management |

| Exchange APIs | Enabling trading functionalities | Real-time trading data and swift order execution |

| Payment Gateway APIs | Accepting cryptocurrency payments | Broadens digital currency adoption |

Integrating APIs wisely is crucial for a top-notch crypto platform. By using different types of APIs, developers can make a system that covers various needs. This supports smooth digital money use for everyone.

Step 7: Design the Interface

Making a good interface is key for a cryptocurrency’s success. It involves both front and back-end programming. This ensures users have a great experience and top-notch security. Let’s take a closer look at these parts.

Front-End Programming

Front-end programming makes the interface look good and work well. Developers use HTML, CSS, and JavaScript. They aim to make using the site easy and fun, keeping users interested.

Back-End Programming

Back-end programming is about the behind-the-scenes work. It makes sure data and transactions are handled right. Developers might use languages like Python, Java, or C++ for strong back-end systems. Good back-end work helps the interface run smoothly.

User Experience (UX) Design

UX design focuses on making the interface user-friendly. It involves studying users and testing designs. The aim is to meet users’ needs well, making them happy and likely to stay.

Security Features and Best Practices

Adding security features is a must nowadays. Key steps include using encryption, requiring multiple checks for access, and following safe coding rules. These actions protect the platform and make users feel safe.

| Aspect | Key Elements | Impact |

|---|---|---|

| Front-End Programming | HTML, CSS, JavaScript | Enhances User Interfaces |

| Back-End Programming | Python, Java, C++ | Robust Data Management |

| UX Design | User Research, Testing | Improves User Satisfaction |

| Security Features | Encryption, MFA, Secure Coding | Protects User Data |

Step 8: Make Your Cryptocurrency Legal

Making your cryptocurrency legal is essential. It builds trust with your users. You’ll need to know and follow many laws and regulations. These include global and local laws, AML and KYC protocols, and tax rules.

Compliance with International Laws

It’s key to follow international laws to make sure your cryptocurrency is accepted worldwide. Each country has its own rules for digital currencies. By complying, you make your offering more credible and avoid legal issues.

Local Legislation

Local laws are just as crucial. Each place has its own demands for crypto business. Knowing and following these rules prevents legal problems and includes registering with regulators. It also means making sure your business practices are above board.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

For a safe and legal cryptocurrency, you must implement strong AML and KYC policies. These rules require checking who your users are and watching for suspicious transactions. Following these rules protects your business and builds a safe environment for everyone.

Tax Implications and Reporting

Understanding taxes and reporting correctly is vital. Know how taxes work for your crypto in different places. This ensures you fulfill all financial responsibilities and avoid fines. Being open and correct with reports also builds trust with users and authorities.

| Aspect | Description |

|---|---|

| International Laws | Adherence to global regulations for widespread acceptance. |

| Local Legislation | Compliance with specific regional requirements and jurisdictions. |

| AML and KYC | Measures to combat illegal activities and ensure security. |

| Tax Implications | Understanding and addressing taxation in different regions. |

| Reporting | Accurate and transparent reporting to maintain compliance and trust. |

Step 9: Promote Your Cryptocurrency

In the world of cryptocurrency, standing out is key. A good marketing plan helps. It makes your crypto project seen and trusted. Activities like online marketing, engaging with communities, partnerships, and bounty programs are important. They help build a strong community, draw in investors, and collect funds for growth.

Being open and communicating well is vital for a good start. Keep people updated with the latest news and plans. Be active on forums and social media. Using crowdfunding, like Initial Coin Offerings (ICOs), is smart. It shows what you’re doing and why it matters to investors.

Conclusion

In the dynamic world of digital finance, the burgeoning interest in how to create a cryptocurrency has become more accessible than ever. Whether you are looking to launch your first cryptocurrency or develop a new token on an existing blockchain like Ethereum, the options are vast. From leveraging token development services to deploying code to create a new token, each step in creating a cryptocurrency is pivotal. The journey begins with understanding the cryptocurrency creation process, ensuring every step, from cryptocurrency development to making sure your cryptocurrency complies with all relevant legal regulations, is meticulously planned. For those eager to make their own cryptocurrency, it’s not just about the technical know-how but also about ensuring their cryptocurrency or token complies with the evolving legal frameworks in the cryptocurrency market. Moreover, considering options such as hosting your token on another blockchain to create a robust cryptocurrency project, or perhaps using blockchains on platforms like GitHub for developing a crypto coin, can open up new avenues for innovation. Whether it’s to raise money through an Initial Coin Offering (ICO) or to enhance cryptocurrency transactions, creating a successful cryptocurrency involves a comprehensive understanding of both blockchain and cryptocurrency dynamics. Ultimately, anyone can venture into cryptocurrency creation, but it takes a well-rounded knowledge of blockchain technology and strategic planning to create and launch a successful cryptocurrency that resonates with users and stands the test of time in the competitive crypto trading arena.

From smart contract development to ensuring legal compliance, our comprehensive cryptocurrency development services cover all aspects of your project

FAQs

What are the initial costs involved in cryptocurrency development?

The costs can vary widely depending on whether you choose to create a token on an existing blockchain or develop a new blockchain from scratch. Utilizing platforms like Ethereum to host your token can be cost-effective as it eliminates the need for extensive infrastructure development. However, if you opt for creating a new blockchain, expenses for technical expertise, security measures, and network setup could be significant. Don’t forget ongoing costs such as legal compliance and promotion.

Can I create a cryptocurrency without extensive programming knowledge?

Yes, it is possible to create a cryptocurrency without being a programmer yourself. Many platforms offer user-friendly environments where you can create tokens with little to no coding. Additionally, there are numerous cryptocurrency developers and token development services available that can help you create your crypto, ensuring it complies with all relevant technical and legal requirements.

What are the legal considerations one must be aware of before launching a cryptocurrency?

Ensuring your cryptocurrency complies with laws is critical. This includes international regulations concerning anti-money laundering (AML), Know Your Customer (KYC) protocols, securities law, and tax obligations. It is advisable to consult with legal experts in the cryptocurrency domain to ensure all legal bases are covered.

How can blockchain technology enhance the efficiency of cryptocurrency transactions?

Blockchain technology offers a decentralized ledger that records all transactions transparently and immutably, significantly reducing the risk of fraud and eliminating the need for intermediaries. This not only speeds up transactions but also lowers transaction costs, enhancing overall efficiency.

In what ways can a new token raise money for business ventures?

Launching a new token can raise funds through mechanisms like Initial Coin Offerings (ICO), Security Token Offerings (STO), or Initial Exchange Offerings (IEO). These methods allow investors to purchase tokens before they are publicly traded, providing the necessary capital to fund the development and expansion of blockchain projects.

What is the best strategy to ensure a new cryptocurrency project gains traction and is successfully adopted?

Successful cryptocurrency adoption often hinges on strategic partnerships with established financial and tech companies, comprehensive user education, and aggressive marketing campaigns. Additionally, ensuring that the cryptocurrency offers tangible benefits over existing digital currencies, such as improved transaction speeds or reduced costs, can help attract users.

How does one ensure a cryptocurrency project remains sustainable in the long run?

Sustainability comes from continuous development, maintaining legal compliance, and fostering a strong community. Regular updates to the network to introduce new features and improve security, as well as transparent communication channels with users, can help sustain user interest and trust in the project.

Is it necessary to host a cryptocurrency on a blockchain like Ethereum, or are there alternatives?

While Ethereum is one of the most popular choices due to its robust development tools and active community, there are alternatives like Binance Smart Chain, Polkadot, or Solana, each offering unique features like increased transaction speeds or lower costs. The choice depends on the specific needs and goals of your cryptocurrency project.

What are the critical steps to ensure that every cryptocurrency transaction within my network is secure?

Ensuring transaction security involves multiple layers of defense, including the use of secure code practices during development, regular audits by reputable security firms, implementation of consensus mechanisms like PoS or DPoS that deter attacks, and educating users on securing their wallet keys.

How can I differentiate my cryptocurrency from many others in the market?

Differentiation can stem from unique value propositions such as specializing in micro-transactions with extremely low fees, providing solutions for specific industries, or integrating advanced privacy features. Moreover, building a strong brand story and community support can set your cryptocurrency apart in a crowded market.